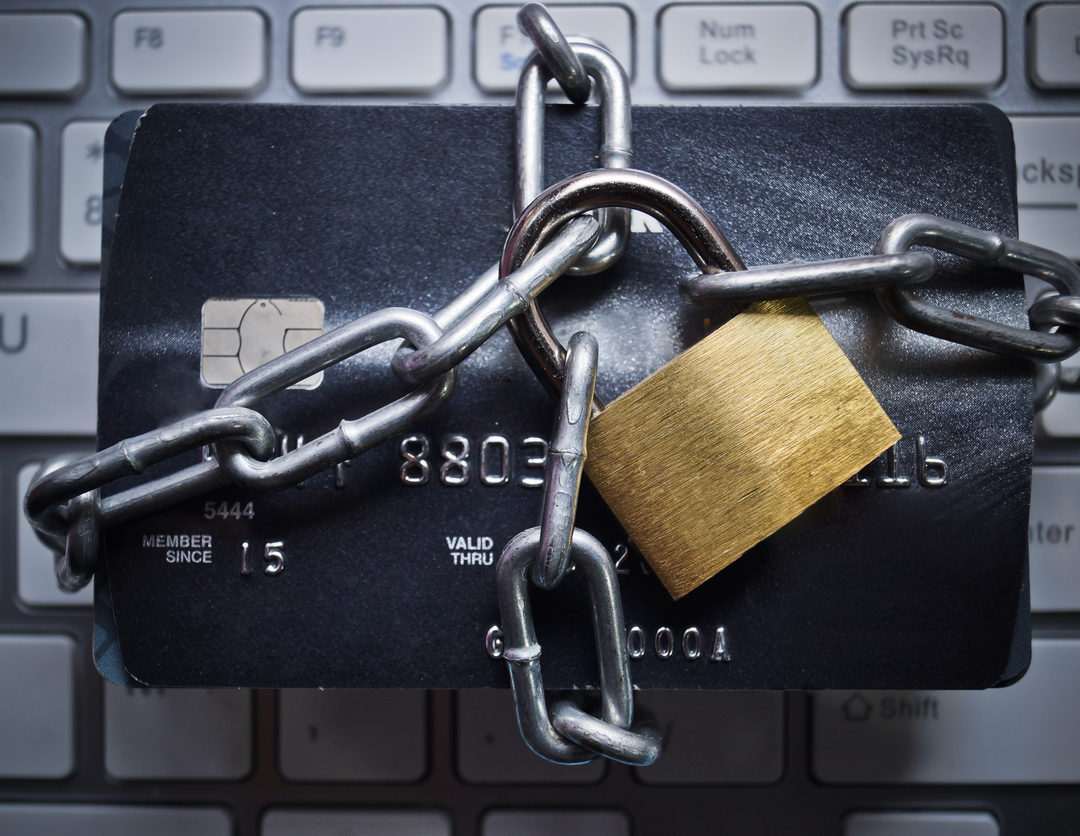

Every click, swipe, or tap could be an invite to thieves eager to crack into your bank account. That’s why the importance of data security for digital payments cannot be understated. As you enjoy the quick tap-to-pay, know that risks are always lurking. I’m here to shed light on how your hard-earned cash stays safe and what’s being done to keep it that way. Let’s unpack the risks and dive into the digital trenches of financial cybersecurity. From encryption to cutting-edge authentication, your peace of mind matters just as much as your money.

Understanding the Risks: Why Data Security is Vital in Digital Payments

The Consequences of Financial Data Breaches

When a data breach hits, it spreads trouble fast. Imagine someone swiping your card details. They could buy stuff using your money! A breach can hurt your bank’s trust and make your private info public. Banks might face fines, lose customers, and spend loads to fix the damage. They work hard to keep your money safe. When they slip up, it’s a big deal for everyone.

The Spectrum of Cybersecurity Threats in Fintech

Bad guys use many tricks to mess with digital payments. They might try to scam you or sneak into systems to take data. Some even create fake sites to trick you into giving your card info. Smart folks in cybersecurity work to block these attacks. They check every corner for possible risks and set up solid walls to keep the bad guys out. Cybersecurity in fintech is like having a superhero guard your wallet.

Digital payment protection is key to fighting off these threats. Strong cyber security in fintech keeps your cash and cards safe while you shop or bank online. Think about a sturdy lock on your door; that’s what encryption for payment safety is like. It scrambles your data so only the right folks can read it.

The folks in charge of secure online transactions know this well. Payment gateways security is a top job for them. They use tools like risk analysis in e-payments to spot dangers early. And they ensure that secure checkout processes are in place for when you’re ready to buy.

Tokenization in banking is another smart trick. It turns your card details into secret codes. Hackers can’t do much with these codes. Credit card security measures like this keep those sneaky thieves away from your money.

Financial data breach prevention is a team effort, with everyone from banks to shoppers playing a part. Consumer fraud protection is like a shield that guards you against tricks and theft. Two-factor authentication in payments adds an extra check. It makes sure it’s really you using your card.

Mobile payment vulnerabilities get a lot of focus, too. Phones are handy for paying but can be risky if not guarded right. That’s why big brains are working on biometric verification for payments. It uses parts of you, like your face or fingerprint, to check your identity. Super cool and clever!

There are also rules to follow, like regulations for payment security. They are there to make sure everyone plays fair and safe. Data encryption standards are part of these rules. They make sure everyone scrambles data the strong way. SSL certificates for web payments are like secret handshakes for websites. They tell your browser a website is safe to pay on.

So, next time you tap or click to pay, remember: there’s a whole world of protection working for you. This stuff might sound like a spy movie, but it’s real, and it’s there to keep your money safe as houses. Your job? Keep an eye on your info, use secure passwords, and always be a bit cautious online. Together, we can keep the cyber bad guys at bay and enjoy the ease of digital payments without worry.

Key Security Measures for Protecting Digital Transactions

Encryption Techniques and Their Role in Transaction Safety

Protecting our money online is key. In digital payments, cyber crooks can’t touch your money thanks to encryption. This is like secret code for your data. Only the right person can decrypt this. So, when you buy stuff online, encryption keeps your card details safe.

Encryption scrambles your sensitive info. It turns it into code that hackers can’t read. When your data reaches the seller, it gets unscrambled. This way, only you and the seller know what’s in it. Simple, yet powerful.

Encryption is a guard for your online shopping. It makes sure no one steals your card number. It’s a shield for your money and personal details. We need it for safe buying and selling on the internet.

The Significance of Tokenization and PCI DSS Compliance

Tokenization is another hero in keeping your digital money safe. It replaces your real payment info with a unique series of symbols. This token then represents your info without exposing the real details. Even if someone evil gets this token, they can’t do anything with it. It’s like having a secret agent stand in for your credit card.

PCI DSS stands for Payment Card Industry Data Security Standard. It’s a big deal for anyone handling card info. All businesses must follow these rules to protect card data. If they don’t, they risk heavy fines or worse, your trust.

This is how stores keep your card safe. They show they care about keeping your card details hidden. When they stick to these rules, your info stays in a virtual lockbox.

PCI DSS makes sure businesses handle your card safely. It requires firewalls, good passwords, and regular checks for safety holes. It’s all for keeping your card data away from bad guys.

Together, tokenization and PCI DSS form a strong team. They stop hackers and ensure your trust in digital payments. It’s like having a top-notch security system in your house. You can sleep easy knowing your money is safe.

Always keep an eye out for these defenses when paying online. They mean your purchase is secure. Next time you click ‘pay’, remember, encryption and tokenization are your allies. They’re your caped crusaders, keeping your financial info safe from the dark forces on the web.

Innovations in Authentication: Enhancing Consumer Protection

Biometric Verification Systems and Two-Factor Authentication

We live in a world full of smart tech. Our phones, laptops, even doors, use nifty tools like biometric systems. They know us by our fingerprints or how we look! Now, think of using this cool stuff for buying things online or in stores. Sounds neat, right?

Biometric verification is just that. It uses parts of you, like your thumbprint, to make sure it’s really you spending your cash. This is super safe because no one else has a thumb like yours. Shops and banks are using this to help protect your money.

Can I make digital payments safer with biometric verification? Yes, you can! By linking your unique traits, like fingerprints or facial patterns, with your accounts, you make it much harder for bad guys to trick the system. It’s a game-changer for digital payment protection.

But wait, there’s more! Ever heard of two-factor authentication, or 2FA for short? It’s like a double door for your online safety. You need two keys to get in – something you know, like a password, and something you have, like a code sent to your phone. So even if someone steals your password, they can’t get to your money without that second key.

Together, these smart tools make a huge shield around your hard-earned cash. Thanks to them, shopping online or sending money over your phone is getting safer every day.

Tackling Mobile Payment Vulnerabilities with Cutting-Edge Technologies

What about when you pay with your phone? That’s super handy, but there are risks. Bad people are always trying to find weak spots. But don’t worry, we’re fighting back with awesome tech!

Today’s mobile payments have to be really secure to keep your details safe. We’re always on the move, tapping phones on card readers, and sending money with a click. This means we need top-notch security 24/7.

To do this, we look at all the risks. We check everything that could go wrong when you pay with your phone. Then we use the latest tools and tricks to stop problems before they start. We’re talking encryption, fancy codes that scramble your card details so only the right folks can read them.

There’s this thing called tokenization too. It turns your payment info into secret codes that are useless to thieves. This keeps your card safe, even if bad guys get their hands on these tokens.

It’s like giving a guard dog your card, and only you can tell it to sit! With these cool tricks, you can trust your phone to handle your cash without fear.

And remember, always keep your phone’s software up to date. This helps close gaps that crooks might want to sneak through. Stay sharp with your tech, and it’ll take good care of you.

These cyber security super moves are all about staying one step ahead. They’re built to outsmart bad guys and keep your money safe, no matter where you shop or how you pay. So next time you tap, swipe, or click to buy something, you can smile, knowing you’re the boss of your bucks.

Creating a Culture of Cybersecurity in Financial Operations

Best Practices and Regulatory Standards for Secure E-Commerce

In fintech, we keep digital payment protection top of mind. Safe online buy and sell starts with strong cyber security. We use encryption to shield each payment. This locks out folks who shouldn’t see your money moves.

But it’s not just about one tech trick. We follow PCI DSS rules close. It’s like a checklist to make sure we miss no steps in guarding your cash online. It says we must use things like tokenization. This swaps out real card details for fake ones. That way, if bad people get in, they find nothing to steal.

A big part of staying secure is testing for risks. We look hard at e-payment systems. Finding weak spots lets us fix them before trouble hits. We work hard so when you check out, it’s smooth and safe. That safety builds trust, and trust keeps you coming back.

Staying Ahead: The Importance of Financial Cybersecurity Awareness and Training

Think about all the news on data leaks and fraud. It’s more important than ever to keep up with training in financial cyber safety. We train our teams about the newest tricks thieves use. And we teach them to be ready to act if something goes wrong.

We show our folks how to spot fishy emails and odd account actions. That way, if someone tries a scam, we’re on it fast. We also help customers learn how to stay safe. When you know what looks wrong, you can help stop fraud too.

New rules for payment safety come out all the time. We’ve got to stick with these laws to keep your info locked down tight. We see it as our job to know every word so we can do it right. Also, we need to keep up with new ways bad guys try to get your cash.

But here’s the thing. Even the best plans can’t promise a zero chance of problems. When bad stuff happens, we have to handle it quick and smart. That means having a team that knows just what to do. So we practice a lot, and we learn from mistakes to make sure we’re always getting better.

In all, it’s key to make cyber safety a daily part of our work life. We need to think cyber smart every step of the way. When we share this with everyone, we make a shield that’s hard to break. It’s not just good for us—it’s good for you too. Because when we’re safe, you can click, tap, and swipe without a single worry.

In this post, we dug into the need for tight data security in digital payments. From risks like data breaches to fintech threats, we can’t ignore these dangers. We learned key steps to protect online transactions, highlighting encryption and tokenization. Safety doesn’t stop there; innovations like biometric checks and two-factor auth are key.

Finally, a strong security culture, with best practices and training, is vital. Always keep ahead, stay aware, and take action to guard your financial data. Remember, smart moves in security make all the difference. Stay safe!

Q&A :

Why is data security crucial for digital payments?

Data security is vital for digital payments because it helps protect sensitive information such as bank account details, credit card numbers, and personal identification from unauthorized access, fraud, and theft. With the increasing volume of online transactions, a single data breach can lead to substantial financial loss and damage to the reputation of the involved parties. Ensuring robust data security measures are in place helps maintain customer trust and promotes the reliability and adoption of digital payment systems.

How can consumers ensure their data is secure when making digital payments?

Consumers can enhance the security of their data during digital payments by taking several precautions. Firstly, they should only use secure and reputable payment platforms and applications. Additionally, it’s advisable to use strong, unique passwords for each service and enable two-factor authentication where available. Consumers should also keep their software up to date to protect against the latest security vulnerabilities and be wary of phishing attacks by confirming the authenticity of requests for sensitive information. Regularly monitoring bank statements for unauthorized transactions is another essential practice.

What are the common threats to data security in digital payments?

Common threats to data security in digital payments include hacking and cyber-attacks aimed at intercepting sensitive information during transactions. Phishing scams are also prevalent, where fraudsters trick individuals into providing login credentials and payment details. Other threats include malware, such as viruses and ransomware, which can steal data directly from users’ devices. Additionally, weak authentication processes can allow unauthorized users to gain access to accounts.

What role does encryption play in securing digital payments?

Encryption is a fundamental security measure in the realm of digital payments. It works by transforming sensitive data into a coded format that is unreadable to anyone without a specific decryption key. This means that even if payment data is intercepted during transmission, it remains inaccessible and useless to the unauthorized party. Encryption is applied not only during the payment transaction process but also when storing sensitive data, providing a robust defense against data breaches and cyber threats.

Can adopting digital payment methods increase overall data security?

Yes, adopting digital payment methods can potentially increase overall data security when compared to traditional payment methods. Digital payments often incorporate advanced security features such as encryption, tokenization, and fraud detection algorithms that are not present in cash or check transactions. These technologies help safeguard consumer data during both transit and storage. However, the increased security is contingent upon the use of good cybersecurity practices by both consumers and payment service providers.