In the digital age, your money’s on the front line. Crackdown on fraudsters and keep your hard-earned cash safe. Protecting yourself from digital payment fraud isn’t just smart; it’s essential. Tap into the power of knowledge and tactics to shield your finances. Join me, and let’s build your defense together.

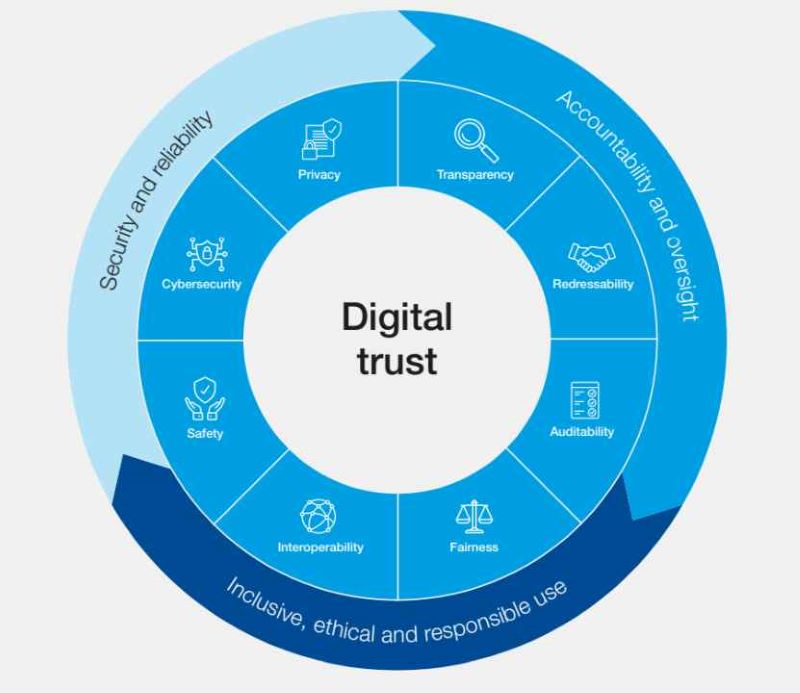

Understanding the Landscape of Digital Payment Fraud

The Basics of Financial Cybersecurity

We all buy stuff online today. But do you know how to keep your money safe? Cyber payment security measures are your smart moves to stop thieves. Think of them as your online money bodyguards. Now, the first thing is to understand why secure online payments matter. Each time you pay online, your card details can get stolen if not protected. You must make sure your payments are secure like a locked door.

Let’s talk about those bodyguards. One strong guard is encryption. It scrambles your payment info so that only the right seller can see it. Just like a secret code. Two-factor authentication is like checking your ID twice. It makes sure it’s really you using your card. Always look for websites with these bodyguards in place.

Recognizing the Red Flags of Payment Scams

Now, avoiding payment scams is like dodging a tricky dodge ball. Scammers trick you into giving them your money or info. To spot these scams, look for weird emails or text messages that ask for your details. They can look real but have signs like misspelled words or strange links. Think twice before you click.

Another thing to watch for is too-good-to-be-true offers. Big promises can hide big rip-offs. Protecting yourself online also means paying attention to these red flags. If a site or message seems off, it just might be.

When you use e-wallets or mobile payment, keep your app updated. Think of updates as new moves in your defense game. They fix holes where thieves could get in. Also, keep an eye on your bank statements. This way, you can catch any sketchy charges quick.

Last tips: Stay away from unsafe Wi-Fi like at coffee shops when you’re buying stuff. Hackers can often break in there easily. And pick strong, tough passwords to keep your accounts locked tight.

In this digital world, your safety comes first. By keeping these tips in mind, you’ll not only outsmart the bad guys but shop with peace of mind knowing your digital treasure is guarded. Keep your eyes open, use the tools you’ve got, and always shop with a shield up.

Fortifying Your Personal Cybersecurity Shields

Implementing Two-Factor Authentication & Strong Passwords

To shield your money, always use two-factor authentication for transactions. What is two-factor authentication? It’s a security step. It doubles checks your identity. You might get a text with a code after you put in your password. This protects you. Hackers have a tough time getting both your password and your phone.

For passwords, mix it up. Use letters, numbers, and symbols. Make each password unique. Never use easy ones like “1234” or “password.” This stops hackers from guessing right. Change your passwords often. Think of it as a lock on your digital door. More than just a twist, it needs a key too.

The Importance of Secure Payment Gateways and Encryption

When you buy online, pick shops that use secure payment gateways. This means your info travels safe, scrambled so only the right place can read it. How can you tell? Look for “https” in the web address. That “s” stands for “secure.” No “s,” no shopping.

Encryption is another big word but simple idea. It scrambles your card numbers. Like a secret code, only you and the store can crack. This keeps your money info safe from sneaky eyes. It’s like sending a note in class that no one else can read.

When using mobile payment apps or e-wallets, look for ones that value your privacy. They should have strong security settings. These work like a shield, guarding your money as it moves. Better safe than sorry. Be sure to check app settings. And always get your apps from known stores, not from random places on the web.

In short, every step here builds a wall around your cash. Follow them like a personal safety drill. Order right, pay safe, and keep sharp. If you do, you’ll be the champion of your own money, not a hacker’s prize.

Maintaining Vigilance During Transactions

Monitoring Bank Statements and Transaction Alerts

Checking bank statements often helps catch fraud fast. Set up alerts to get quick news about activity in your accounts. This lets you act fast if something seems off. If you see charges you don’t know, contact your bank right away. They can look into it and keep your money safe.

Errors can slip in, so always check each detail. Even a small charge can be a sign of bigger trouble. Keep your eyes peeled for repeat charges too. Sometimes, sneaky charges come in small amounts but often. Get alerts by email or text so you know about each and every transaction.

Identifying and Avoiding Phishing Tactics

Phishing is a trick where scammers try to steal your details. They fake emails or websites to look like the real thing. To stay safe, don’t click on links from people you don’t know. Also, be wary of emails asking for personal info. Even if they look legit, it’s best to go straight to the source. Check the actual website by typing it in yourself, not by clicking on a link.

When in doubt, toss it out. That’s the safe way to treat suspicious emails. These tips aren’t just useful. They are a shield against tricks and traps online. By staying sharp, you can shop with peace of mind knowing you’re doing your part to keep your money safe.

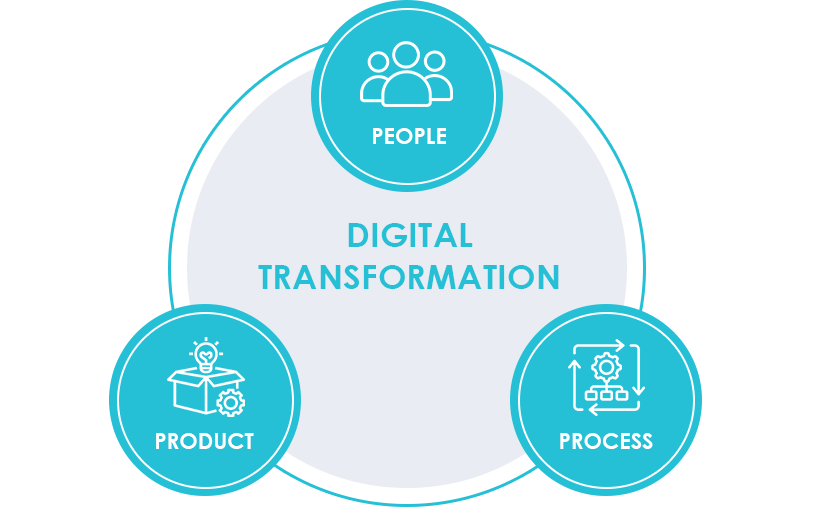

Adopting Safe Digital Payment Habits

Selecting Reputable Online Merchants and Secure Payment Platforms

When you shop online, try to buy from well-known sellers. Look for secure sites that start with “https” – the “s” means it’s more secure. It’s like finding a safe playground for your money to have fun. These shops and websites use special tech to keep your card safe. This tech is like a secret code that only you and the shop can read. Always double-check the website’s address. Sometimes bad guys make fake sites that look real. They do this to trick you and steal your card info. So if you spot a spelling error or something looks off, leave that site right away.

Utilizing Antifraud Software and Keeping Systems Up-to-Date

Think of your computer or phone like your house. Just like you lock your doors, you need to protect your tech. This is where antifraud software comes in. It’s like having a superhero guard your stuff. This software looks out for scams and warns you before you click on something bad. And remember to keep your software fresh and updated. Old software can have holes that let thieves sneak in and grab your info. By updating, you’re fixing those holes and keeping your guards up.

It’s really important to update your phone and computer often. Make sure you download the newest software. The updates are like new moves to stay ahead of the sneaky thieves. Plus, don’t use public Wi-Fi when you’re doing money stuff like shopping or banking. Public Wi-Fi is not always safe, and bad folks can watch what you’re doing. It’s best to use your own internet that has a password. That way, you know it’s safe.

Another good move is to check your bank stuff a lot. Look at your bank statements to catch any strange charges early. If you see something weird, call your bank fast. They can help stop the bad guys and protect your money.

When you’re shopping or banking online, don’t forget to be smart and stay safe. Use these tips to keep your money from getting taken by tricky thieves. They’re always out there, trying to find ways to grab what’s yours. But with care and smart moves, you can keep your money safe.

In this post, we explored how to protect yourself from digital payment fraud. We started by covering the basics of financial cybersecurity and the red flags of payment scams. I shared tips on how to strengthen your cyber defenses with two-factor authentication and solid passwords, plus the need for secure payment gateways and encryption.

We then discussed the importance of staying alert during transactions by checking bank statements and watching for phishing tricks. Lastly, I talked about choosing trustworthy online shops and safe payment methods, as well as using antifraud tools and updates.

Stay safe out there! Always be sharp and keep your online payment practices tight. That’s my final nugget of advice. By following these steps, you’ll guard your hard-earned cash against sneaky fraudsters. Keep your eyes open and your info secure!

Q&A :

What steps can I take to prevent digital payment fraud?

Taking precautions is key when it comes to digital payments. You can protect yourself by using strong, unique passwords for your accounts and changing them regularly. Be cautious of phishing scams and only enter payment information on secure websites (look for HTTPS and a padlock icon in the address bar). Enable two-factor authentication (2FA) whenever possible, and regularly monitor your bank statements and payment history for any unfamiliar transactions. Remember, sharing sensitive information like PINs or passwords increases your risk of fraud, so keep them to yourself.

How do I recognize digital payment fraud?

Recognizing digital payment fraud involves being aware of unexpected requests for personal or financial information, unsolicited contacts or messages prompting you to click on suspicious links, payments you don’t remember making appearing on your transaction history, or any unusual activity on your digital payment platforms. If something seems off, trust your instincts and verify the legitimacy of the request by contacting the company through official channels.

What should I do if I suspect I’m a target of digital payment fraud?

If you suspect you’ve become a target of digital payment fraud, act quickly. Contact your bank or the payment service provider immediately to report the suspected fraud and discuss the next steps, which might include freezing your accounts or cards. Change all related passwords and remove any payment methods from potentially compromised sites. It’s also wise to monitor your credit reports for any unauthorized new accounts or credit inquiries.

Are certain digital payment methods safer than others?

Some digital payment methods are considered safer due to the security measures in place. Credit cards often have strong fraud protection policies, limiting your liability in case of fraud. Mobile payment apps that use encryption and tokenization can also be secure, as they don’t directly use your card number. Research the security features of any payment method you choose and ensure you’re comfortable with the level of risk before using it.

How can I secure my mobile device to prevent digital payment fraud?

Securing your mobile device plays a crucial role in preventing digital payment fraud. Always lock your device with a strong password, PIN, biometric scan, or pattern. Keep your device’s operating system and all apps, especially payment apps, up to date with the latest security patches. Avoid downloading apps from unofficial sources and be mindful of the permissions you grant to apps. Install reputable security software that can help detect and block malware or fraudulent applications. Additionally, avoid making transactions over unsecured public Wi-Fi networks and consider using a VPN for an added layer of security.