In a world where tapping a screen can move your money, knowing how to protect your data when using digital payments is a must. I’ll cut through the tech jargon to show you simple steps to keep your finances safe. From encryption secrets to sly scammers, I’ve mastered the techniques that will arm you against data thieves. Keep reading to transform into a digital payment defender.

Ensuring Robust Protection through Modern Technology

The Role of Encryption in Securing Digital Payments

To keep your cash safe online, think of encryption as a secret code. It scrambles your payment info, turning it into a code hackers can’t read. Want to send money to a friend? Encryption locks your card numbers tight. This happens each time you click “pay”. Even if bad guys steal the data, they can’t use it. It’s like giving them a safe without the combo.

Now, you might ask, “What is data encryption for payments?” It’s a tech tool that jumbles up your financial details. This keeps them hidden from thieves when you pay online. Every time you check out, the details twist into a secret form. By doing this, your sensitive info stays under wraps.

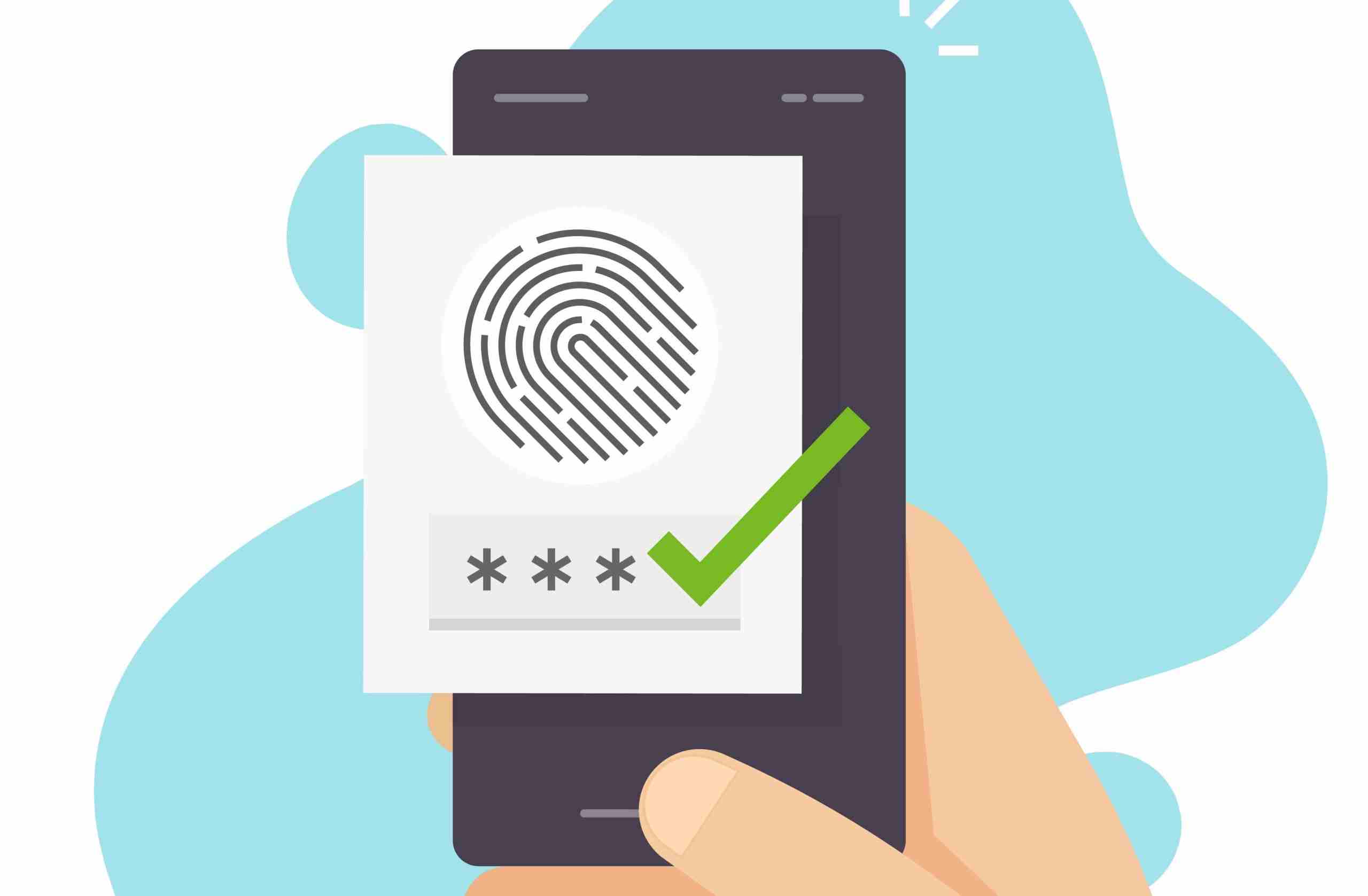

The Advancement of Biometric and Two-Factor Authentication Methods

Your face and fingerprints can now guard your money. It’s real! Biometric security uses parts of you that nobody else has. Like your thumbprint. It’s a special password that’s always with you. When your phone asks for a thumb tap to approve a buy, that’s biometrics in action.

Two-factor authentication is another shield. Imagine a guard asking for two passwords before letting anyone in. That’s what your phone does. First, it may ask for your password. Next, it’ll send a code to your phone or email. Without both, no one can sneak into your account. This double-check makes it way harder for bad folks to get in.

Together, these methods are like having superhero-sidekicks for your money. They team up to stop bad guys from getting to your cash. Biometric tools lock down your accounts with something unique to you. Two-factor requires an extra step, proving you’re really you. This one-two punch keeps your money safe.

In short, by encrypting your data and using two-factor and biometric checks, you’re putting up a fortress around your finances. So, next time you tap to pay with your phone or log in to your bank account, remember these silent, but super-powerful protectors keeping your green safe!

The First Line of Defense: Privacy and Authentication Settings

Optimizing Privacy Settings for E-wallets and Mobile Payments

To keep money safe, we must set up e-wallets right. First, know where privacy settings are. They’re usually in the app’s ‘Settings’. Change them to the highest security. This locks out hackers.

Updating the app helps too. App updates often fix security holes. Check for updates and download them right away. No delays!

Next, turn on alerts. Get a message for every transaction. It’s a fast way to spot trouble. Also, review permissions. Don’t let the app access what it doesn’t need.

Remember, using strong passwords is crucial. They’re the key to mobile payment security. Here’s how to make a strong one:

- Mix letters, numbers, and symbols.

- Avoid easy words like “password”.

- Make it long; at least 8 characters.

- Never use personal info like your name.

One more thing: use different passwords. Don’t repeat them for different accounts.

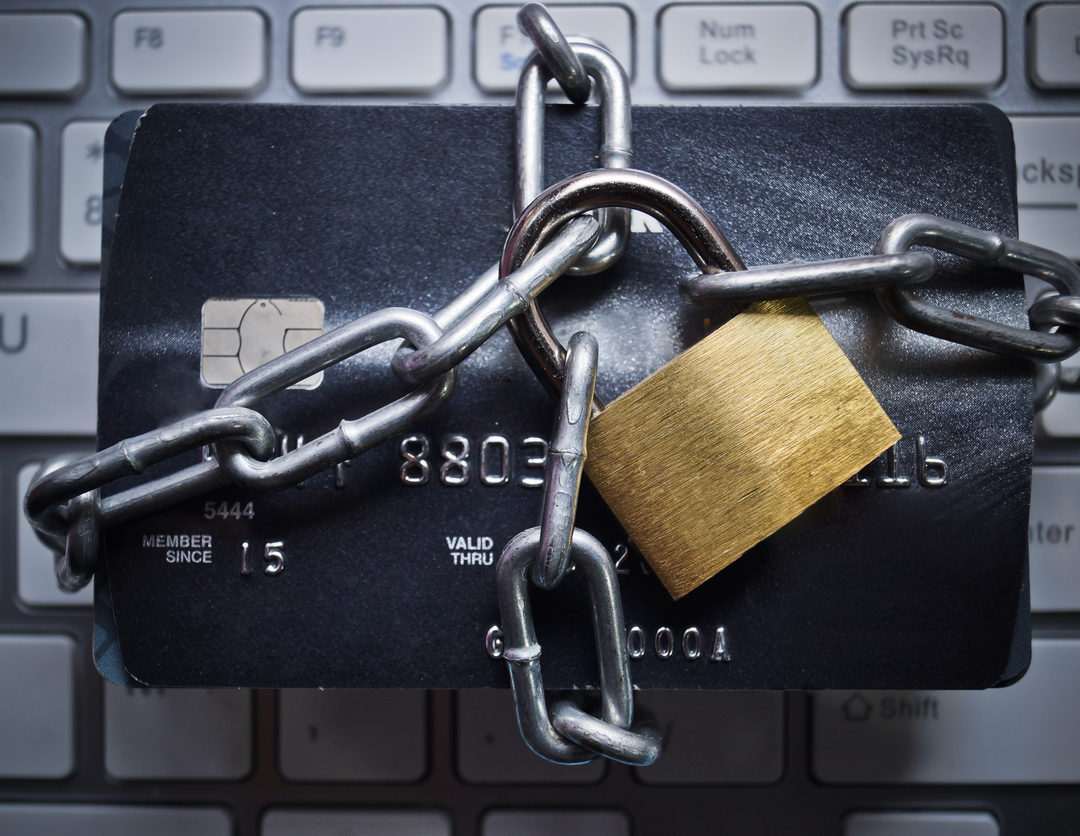

Implementing and Managing Strong Password Protection Strategies

Now, let’s speak about passwords. I can’t stress enough: use unique ones! Think of it like keys. You wouldn’t use one key for your house, car, and office, right?

Passwords protect financial information. Password managers can help here. They store and create strong passwords for you. Just remember one main password to access them.

Adding an extra layer is wise. This is two-factor authentication (2FA). You enter a password and then prove who you are. This could be a fingerprint or a code sent to your phone. It’s like having a double-locked door.

Lastly, consider biometric authentication. It uses your body to prove it’s you. This could be a fingerprint or face scan. It’s getting popular because it’s easy and secure.

Secure your digital life like you would your home. Use strong locks (passwords), update security systems (apps), and keep a watchful eye (alerts). That’s how you master data security in digital transactions.

Remaining Vigilant: Detection and Prevention Tactics

Strategies for Monitoring Account Activity and Responding to Fraud Alerts

Always check your account. Daily if you can. This way, you spot fraud fast. Use apps that send alerts for unusual activity. Banks and e-wallets offer these. Turn on notifications and get instant updates on your phone. This keeps you one step ahead.

If you get a fraud alert, act quickly. Check your account. See if the alert is true. If it is, call your bank or card issuer right away. They can help stop more fraud. They will guide you on what to do next.

Two-factor authentication adds a strong layer of security. It uses something you know, like a password. It also uses something you have, like a phone or fingerprint. This makes it harder for hackers to get into your account.

Mobile payment security is key. Use only trustworthy payment apps. Make sure they have the best security, like encryption. This scrambles your data so only the right person can read it.

Identifying and Avoiding Common Payment Scams and Phishing Attacks

Learn the signs of scams and phishing attacks. They can trick you into sharing personal info. This can lead to stolen money or identity theft. Don’t click on fishy links in emails or messages. If an offer seems too good to be true, it probably is. Watch out for misspelled messages and odd email addresses.

Use only secure payment gateways when shopping online. Look for the padlock icon in your web browser. This means the site uses SSL certificates. They keep your data safe as it moves from place to place.

When using a digital wallet, set strong privacy settings. Use a unique, hard-to-guess password. Change it often. Don’t use the same password for different accounts. Password protection is a simple yet effective tool against fraud.

Remember, public Wi-Fi is not safe for transactions. Use a VPN for online payments instead. This hides your data from others on the network.

Credit card security is important, too. Check your statements for any charges you don’t recognize. Contact your bank if you see something wrong. They’re there to help you keep your money safe.

Cyber security for online banking can protect your finances. Enable alerts for every transaction. This way, you get notified when money leaves your account. Monitoring account activity is a strong defense against fraud.

Lastly, report any unauthorized transactions you find. This helps your bank take action to protect your account. It can also help them catch the bad guys.

Learning these digital wallet safety tips can save you stress. It can stop fraud and keep your hard-earned money safe. Always stay alert. Your financial security is worth it.

Safe Payment Practices: Tools and Habits for Consumers

Choosing Trustworthy Payment Apps and Gateways

When you use a payment app, pick one that you trust. How do you know it’s safe? Look for apps with good reviews and a history of secure online transactions. These apps use data encryption for payments. This means they scramble your data, so it’s hard for hackers to read it. It’s like turning your card number into a secret code. They also follow PCI DSS compliance, which is a set of rules to make sure all payments are secure.

You also want to use secure payment gateways when you shop online. A gateway is a service that sends your payment info from the store to the bank. Think of it as a bridge for your money. These gateways protect your card details by using tokenization. They replace your real card number with a different number for each transaction.

Educating on Safe Online Shopping and Secure Network Use

Now, let’s talk about shopping smart online. First, never use public Wi-Fi for buying things. Public Wi-Fi can be a door for thieves to get your info. Instead, use a secure wireless network or a VPN for online payments. A VPN hides what you do online, even on public Wi-Fi.

Always check that the site you’re buying from has an SSL certificate. This is a kind of digital ID for websites. It means the site promises to keep your data safe. You can tell if a site has this if the URL starts with “https” and shows a little lock icon.

For an extra layer of safety, turn on two-factor authentication on your e-wallet. This asks for two proofs you’re you — like a password and a fingerprint — before you can pay. It’s like a double lock on your data.

Finally, always keep an eye on your bank account for any fishy activity. If something seems wrong, report it right away. It’s better to be safe than sorry.

By choosing trusted apps, being smart about where and how you shop online, and keeping tabs on your accounts, you help protect your money and your peace of mind. Remember, in the digital world, being alert and careful is your best defense.

In this post, we talked about keeping your money safe with the latest tech. We saw how encryption keeps your digital payments away from prying eyes. Biometric and two-factor methods make sure it’s really you using your funds.

Next, we dived into personal settings that are your safety net. Fine-tuning your e-wallet’s privacy settings and choosing strong passwords are key moves.

We also covered how to stay on top of your accounts, spotting fraud fast and knowing what tricks scammers use. Remember, always keep your eyes open for weird activity and phishing traps.

Last, we shared tips on smart payment habits. Pick payment apps you can trust and learn how to shop online safely. Use secure networks to shield your shopping sprees.

Secure your cash with these steps and enjoy stress-free spending. Stay safe out there!

Q&A :

How can I ensure the security of my personal information during digital transactions?

In the world of increasing online financial activity, protecting your data during digital payments is of utmost importance. Always use secure networks, update your software regularly, and opt for services that require multi-factor authentication. It’s also wise to monitor your transaction history frequently and set up alerts for any unusual activity.

What are the best practices for safeguarding data in mobile payment apps?

To safeguard your data within mobile payment apps, the foremost step is to use strong, unique passwords for your accounts and change them periodically. Employ biometric features if available, like fingerprint or facial recognition, and never store your passwords or PINs on your device. Additionally, be sure to only download official payment apps from trusted sources like the App Store or Google Play.

Are there specific security features to look for in digital payment platforms?

When selecting digital payment platforms, look for integrated security features such as SSL (Secure Socket Layer) encryption, tokenization, which replaces your payment details with a unique code for each transaction, and end-to-end encryption. Trustworthy platforms should also comply with PCI DSS (Payment Card Industry Data Security Standard) and offer additional layers of security like OTP (One-Time Password) verification and biometric authentication.

What actions should I take if I suspect my data has been compromised during an online payment?

If you believe your data has been compromised, act swiftly by contacting your bank or payment service provider to report the incident. Lock or freeze your affected accounts, change your passwords immediately, and monitor your bank statements closely for any unauthorized transactions. It’s also advisable to check your credit report for any unusual activity and consider setting up a fraud alert.

Can updating my devices and payment apps help in protecting my financial data?

Keeping your devices and payment apps updated is crucial in maintaining your data security. Updates often include patches for security vulnerabilities that have been discovered since the last version. By ensuring your software is up-to-date, you minimize the risk of data breaches due to outdated security. Always download updates from official and trusted sources to avoid potential malware.