Choosing a digital payment platform is a vital decision. You want ease, speed, and trust in a service that handles your money. In this deep dive, we put major players to the test in a digital payment platforms comparison. Who ticks all the boxes? From mobile apps to emerging e-wallets, how do they stack up against good old credit cards? We’ll explore, without the jargon, the pros and cons, security must-haves, and the next big thing in flicking funds. Ready for a no-nonsense look at which platform takes the crown? Let’s unlock this puzzle together.

Navigating the Landscape of Digital Payment Services

Evaluation of Top Mobile Payment Apps

Let’s dive into mobile payment apps. These apps let you pay with just your phone. Many top brands are out there, each with cool features. They make buying stuff easy and quick. Some even let you pay friends back. You can use these almost anywhere these days. But remember, they need your phone to work.

When you read reviews, pay attention to user experience. That’s how the app makes you feel. Good apps should make you feel smart and in control. They should work fast and not crash. Think about security too. Your money’s important, so the app’s gotta protect it well.

Now, onto transaction fees. Most mobile payment apps are free. But they might charge for some things, like sending money fast. Compare the costs before you pick one.

Pros and Cons of Emerging E-wallet Systems

E-wallets are like digital pockets for your cash. They’re getting popular, and for good reasons. They hold your card info, so you don’t need to carry plastic. That’s a big win for convenience. And, they often offer rewards for using them.

But e-wallets aren’t perfect. They need the internet to work. So, if your phone’s dead or you’re off the grid, no luck. That can be a downside. Also, not all shops can take e-wallet payments. You might run into trouble if a store’s tech isn’t up to date.

Security’s a biggie too. E-wallets are secure, but you need to keep your phone locked down. If someone gets in, they could tap into your wallet. Always use a strong password.

It’s all about weighing the good against the not-so-good. With a bit of homework, you can choose the right app or e-wallet for you. Go for one that hits the sweet spot between convenience, cost, and security. And keep an eye on new options – they’re coming out all the time.

Breaking Down Payment Processing Ecosystems

Comparing Credit Card Processing Services

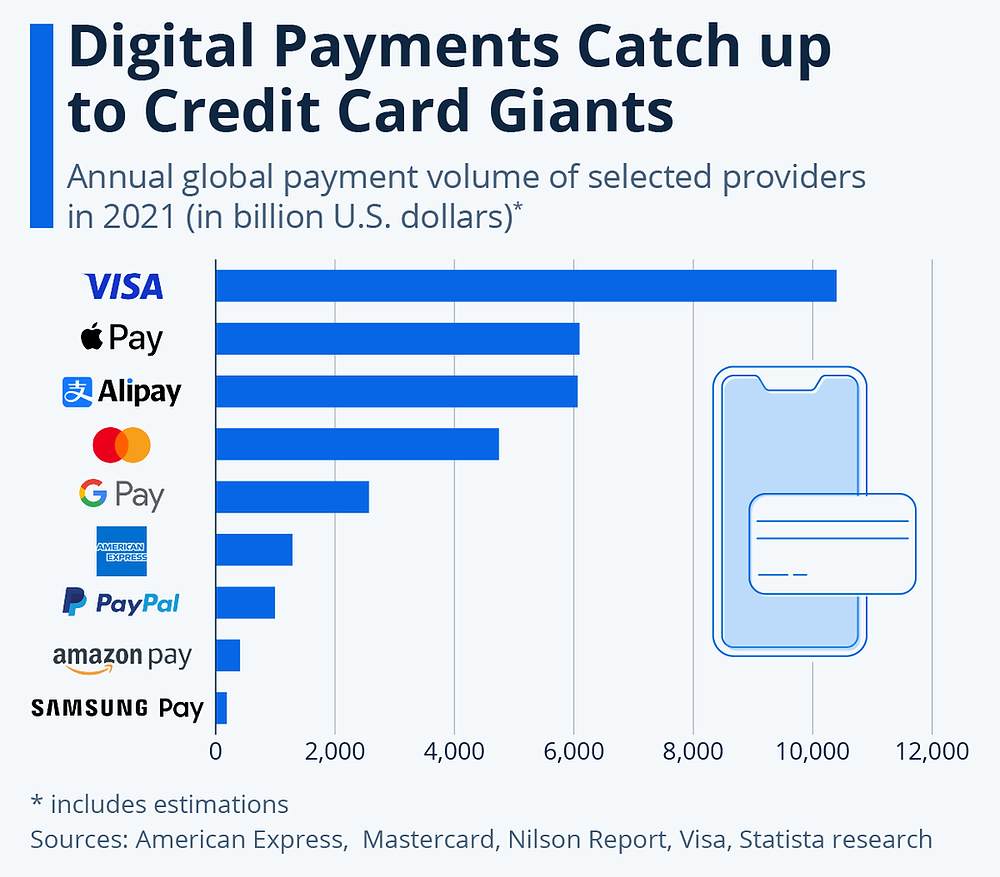

When looking at various types of digital payment services, credit card processing stands out. Credit card processors act as a link between your business, your customer, and the banks. They handle every card swipe. But who, you ask, is the best? It’s not a one-size-fits-all answer.

Different services cater to different needs. Square might win for small businesses with its flat rates. Yet, for large volumes of sales, Stripe’s lower per-transaction fees could be better. Some folks rave about PayPal for its global recognition, while others go for merchant-specific solutions.

Understanding Transaction Fees and User Experience

Now, let’s talk transaction fees; they can bite! Each time someone pays, a tiny slice goes to the processor. This fee varies based on the service, how the card is processed, and the kind of card used. The trick is to balance fees with service quality.

User experience can make or break a platform. Think of the payment process as a journey. You want a smooth ride for your customer, right? Simple checkouts and fast processing speed up the transaction game. Apple Pay or Google Pay might charm users with contactless ease.

For peer-to-peer action,** PayPal or Venmo** shine, making money transfers a breeze. Peer-to-peer services cut the need for cash or checks, a clear win. Businesses, on the other hand, often seek merchant services that support recurring billing—think of subscription models, which are hot now.

But don’t ignore security. You and your customers want peace of mind. Payment gateways are like digital locks for transaction safety. They encrypt and secure data tight. Every step from card entry to money landing in your account must be secure.

For cross-border deals,** international money transfer services** are key. They dodge hefty bank fees and are simpler to use. Western Union or TransferWise? Look at fees, speed, and country coverage before you choose.

New kids on the block, like cryptocurrency payment platforms, are edgy choices. They cut out the middlemen but have a trust curve to climb. And let’s not forget NFC payments with a tap from a phone – fast and slick.

Now, e-commerce integration is crucial too. Your online store must play nice with your chosen payment method. A clunky hand-off to payment screams amateur hour. A sleek transition whispers pro. Think Shopify with its array of built-in payment options.

In the cashless society we’re inching toward, digital payment trends are key. Innovations aren’t slowing down, and neither should you. It’s a race where the sharpest, fastest, and most trusted payment solutions will reign supreme. Whether it’s mobile payment apps or old-school bank transfers, your business needs the best fit.

So, dive into user reviews, test them yourself. Consider your business size, customer location, and security needs. Stay sharp on payment trends and regulations. Be picky—it’s your business after all. Your choice in digital payments is more than a service; it’s the gateway to your earnings.

Innovations and Security in Fintech Payments

Exploring Secure Online Transactions and Fintech Innovations

We want our money moves safe and smart, right? Here’s the lowdown: Today’s fintech payment innovations give us just that. Companies race to offer the best online payment solutions. Think speed, ease, and top-notch security—all rolled into one. How cool is that? Let’s dive right in.

Secure online transactions are a must. No one likes a sneaky thief. That’s why top-notch encryption is the game’s name. Think of it as a secret code. Only you and your payment buddy know it. So when you pay for that awesome new game or order pizza, encryption keeps your card details safe.

Now, mobile payment apps are a big hit. Why carry cash when your phone does it all? Tap, pay, done. You get more than convenience. Many apps buzz your phone with instant payment alerts. That way, you keep track of every dime, on time.

But what about overseas pals? Cross-border payment options are here to save the day. Send money in a snap, no matter the map. However, watch out for fees and speed bumps along the way. Some services are lightning-fast but may charge more; others are cheaper but slower.

Authentication and Digital Wallet Security Features

Keeping your dough secure is top priority, right? So, here’s the scoop on digital wallet security. Say hello to two-factor authentication (2FA). This is like a double door to your money. You need your password plus a code sent to your phone. Two locks are better than one!

E-wallets pros and cons? You bet. On the bright side, you get to pay with a tap of your phone. Many stores now just need a QR code or NFC tap. But keep your eyes peeled—always check for that secure lock icon before you pay. Plus, keep your app updated for the latest security patches.

Credit card processing services in the mix too. They’re like an old friend that keeps getting smarter. With each swipe, dip, or tap, your card talks to the bank. “Is this cool?” it asks. And in a blink, you get the green light—or a red stop sign if something’s fishy.

Peer-to-peer payment services? Think of them as your money messengers. Quick and easy—send cash to friends for lunch, or chip in for a gift. Just punch in their number or email, and bam—money sent! Yet, always double-check who’s on the receiving end. Mistakes here can be a real headache.

Fintech payment innovations are on fire. They’re changing how we think about money. Striving to keep ahead of hackers and keep your cash safe. How’s that for peace of mind? Just remember, the key to keeping your finances snug as a bug? Always pick the right tools and stay sharp on the latest tricks. Your wallet will thank you!

The Future of Transactions: Contactless and Cross-Border Solutions

The Rise of Contactless and QR Code Payment Systems

Tap, pay, and go! Contactless payment methods are a hit. You’ve seen them in stores, the simple touch of a phone or card and you’re done. How easy is that? QR code payment systems follow closely. Open the app, show the code, and it’s a wrap.

Digital payment services review shows these methods win big for speed. Public transport and quick food places love them. Your phone likely has mobile payment apps like Apple Pay or Google Wallet set up already. You know the drill: wave your phone over a reader, that’s it. These apps turn shopping into a breeze.

Birds chirping, sun shining, and no more long waiting lines. Contactless payments often mean better flow in stores. Less time waiting, more time for fun. Use tech and skip the hassle. Plus, studies on user experience in payment apps show high scores for these tap-to-pay gems. They think about what you need, making payments a joy.

But what about safety? Digital wallet security features are tough. Think of them like a vault, locked tight. Security is a must and these apps don’t play around. They keep your cash safer than a piggy bank. Big tech invests big money to keep your spend safe.

Contactless means more than credit and debit cards now. Watches, rings, even stickers can pay! Near field communication (NFC) payments use this trick. Hold your gadget close to a reader and magic happens. Your bill is paid, just like that.

International Money Transfer Services and Regulations

Got pals in far-off places? Cross-border payment options help pay or gift without a hitch. Sending money across borders isn’t a wild quest anymore. It’s a few taps on your phone. Bank transfers vs mobile payments – which reigns supreme? Mobile payments often speed past bank waits, winning the race on ease and pace.

Peer-to-peer payment services are the new talk of towns. Venmo, PayPal, and others make sending cash as easy as a text. Got a friend who covered dinner? Pay them back before you leave the table.

But hold on, not all is calm seas and clear skies. Sending money abroad has its share of storms. Digital payment regulations vary wildly from land to land. Some places welcome the change, while others stick to the old ways. Check the rules before you click send. International money transfer services know the ropes, and help steer your cash safely shore to shore.

Payment service provider (PSP) analysis digs into these details. Look at their reviews, speeds, and how much they charge. No one likes surprise fees, right? Pick services with clear charges and strong track records. User reviews on payment services help sort the hot from the not. Read up before you pick your path.

Yes, the payment world is changing fast, like a speeding train. Contactless, QR codes, and mobile pals – they’re the new normal. Secure, speedy, and oh so simple. You’re riding the wave of digital pay, and the surf’s just fine.

In this post, we explored the ever-changing world of digital payments. We started by sizing up the best mobile payment apps and weighed the good and bad of new e-wallet systems. Then, we dove into how payment processors work, looked at credit card services, and broke down the costs and feel of transactions.

Next, we peeked into fintech’s safe online dealings and new tech. We checked how digital wallets stay safe and what makes them tick. Finally, we peeked at what’s next: touch-free payments and ways to send cash around the globe.

I think we’re on the brink of big shifts in how we pay. Staying informed helps us make smart choices and keeps our money safe. Embrace the change, and let’s ride the wave of new, easy ways to pay!

Q&A :

What are the most popular digital payment platforms available?

With the rise of e-commerce and online transactions, several digital payment platforms have gained significant popularity. These include services like PayPal, Venmo, Apple Pay, Google Pay, and Square. These platforms cater to different needs, offering various features such as online banking integration, peer-to-peer transfers, mobile payments, and contactless payments. When choosing a digital payment platform, consider factors such as fees, security features, ease of use, and acceptance by merchants.

How do digital payment platforms ensure security and privacy?

Security and privacy are critical concerns for users of digital payment platforms. To address these concerns, platforms employ a range of strategies like end-to-end encryption, two-factor authentication, and fraud monitoring systems to protect users’ information and transactions. Regular security updates and compliance with payment card industry standards (PCI DSS) also contribute to enhancing security measures. Users should look for these features and follow best practices, such as using strong passwords and avoiding public Wi-Fi for transactions.

What fees are associated with using digital payment platforms?

Digital payment platforms often charge fees for various services. These fees can include transaction fees, currency conversion fees, instant transfer fees, and monthly or annual account fees. Some platforms may charge the sender, the receiver, or both. It’s essential to carefully review the fee structure of any digital payment platform before usage to understand any potential costs associated with transactions, especially for international payments or business transactions.

Can digital payment platforms be used internationally?

Many digital payment platforms offer international transfer services, allowing users to send and receive money across different countries. However, the availability of international transactions can vary by service, with some platforms having a broader global reach than others. It is important to note that international transfers may incur additional fees and exchange rates that need to be considered. Before initiating an international transaction, check the platform’s support for the respective currencies and countries involved.

How do I choose the right digital payment platform for my needs?

Choosing the right digital payment platform depends on individual needs and preferences. Factors to consider include the types of transactions you’ll be conducting, the platform’s usability, fee structure, security measures, and acceptance among your network of peers and merchants. Additionally, it’s worth considering any additional features such as budgeting tools, rewards programs, or the ability to link multiple bank accounts and cards. Comparing these features among various platforms will help you determine the most suitable option for your digital payment needs.