Latest security threats to digital payments are like quicksand; the more we use digital cash, the deeper the danger seems. Your wallet now lives in your phone and computer. But is your money really safe? Every click could invite unseen thieves. Learn fast how to spot them, and shield your hard-earned cash from their sticky fingers. Let’s dive into the murky waters of online payment dangers and fish out the safety nets you need.

Understanding the Landscape: Identifying the Latest Threats to Digital Payment Security

The Rise of Mobile Wallet Vulnerabilities and How to Spot Them

Do you use a mobile wallet? If you do, listen up. Bad guys are always finding new ways to steal your money. Your mobile wallet could have weaknesses that let them in. You don’t want that. So, how can you tell if your wallet app is at risk? Start by checking for updates. A wallet without the latest security is like a house with an unlocked door. Easy to get in. Look for news about your app. If you hear about a leak or hack, act quick. Change your password. Be on the lookout for strange emails or texts, too. These might trick you into giving away your secrets. This is called phishing. It’s not the fish you want.

Emerging Malware Threats in Online Payments: What to Watch Out For

Paying online is easy but can be risky. Thieves make bad software called malware. It hides in emails or downloads. You click, and bam, they got you. It’s sneaky and can watch what you type. It even gets your payment details. Stay sharp and don’t click on odd links. Your antivirus is a good chap. Keep him strong and updated. If a website looks weird, stay away. Protect yourself. Learn the signs of malware. Slow phone? Crashing apps? These can be red flags. Talk to friends about safety. We can all help each other stay safe and keep our money out of the bad guys’ hands.

Mitigating Risk: The Role and Limitations of Current Fraud Detection Systems

Deciphering Encryption Flaws and Strengthening Transaction Security

We all trust our money is safe when we pay online. But dangers hide in digital payment lanes. My job is to spot these risks before they reach your wallet. Let’s break it down. Have you ever considered how your online payment stays private? That’s encryption at work. Yet, encryption is not foolproof. Crooks are clever and find cracks to slink through.

“What are encryption flaws in transactions?” you might ask. They are weak spots that let hackers see private info. We face these when methods to code data grow old or get set up wrong. We must work fast to fix these holes. As a cybersecurity pro, I keep an eye on data codes. I ensure they’re hard and strong, like a vault door to your funds. Strong encryption keeps peeping hackers away.

The Evolution of Phishing Attacks Targeting Digital Payment Systems

Next up, phishing attacks. Not the kind with water and fish – these are way sneakier. Picture getting an email that looks just like it’s from a shop you trust. You click, sign in, and bam, a fake! Crooks now have your payment info. Crafty, right? Phishing scams pull you in and trick you into handing over the keys to your bank.

“How have phishing attacks on digital payments changed?” they’ve gotten smarter. They now make fake sites that mirror real payment apps. They trick us with texts that cry “Alert! Your account is locked!” They hunt for just one click, one slip. We have to be on guard. Always check who’s really asking for your payment details. Only then do we stand a chance to block these baited traps and keep our cash safe.

Cybersecurity in financial transactions is no small thing. It’s our shield against data breaches in e-commerce. Fraud detection systems are always learning, getting better. They track our spending and flag what seems off. If someone tries to buy a thousand-dollar gadget in another country, detection systems ping. “Is this you?” they ask. And if not, they snap shut, like a trap on a thief’s fingers.

Yet fraud systems aren’t perfect. They miss things sometimes. New tricks slip by them. That’s why we can’t lean on them alone. We have to be smart. We must hide our payment info with care. Use two-factor authentication. It adds a step but think of it as a double-lock on your virtual front door. It’s worth it.

Remember, malware waits for a chance to pounce, and identity theft is a shadow always lurking. We must stay sharp, update often, and question everything. That’s how we fight the latest security threats to digital payments. Keep your eyes open. Stay wary of mobile wallet vulnerabilities and tap into the knowledge of cybersecurity. Your money—and peace of mind—are on the line.

Prevention and Response: Tackling Identity Theft and Fraud Techniques

Biometric Security Measures vs. Card-not-Present Fraud Scenarios

Your money faces risks every day. Let’s talk about how to keep it safe. We need close-up security, like in spy movies. Think eye scans and thumbprints. This is biometric security. It’s tough to fake who you are when a machine knows your body’s unique stuff. Your eyes and fingers can guard your cash when you buy stuff without showing your card—what we call “card-not-present” buys. Thieves like these buys. They don’t need your actual card, just your card number. No card, no problem—for them.

Why do we like biometrics? Faces and fingers don’t get lost like passwords. But even this cool tech has its weak spots. Hackers use fake fingers or messed up systems to break in. Weird, right?

“Are biometric checks safe for all our tech?” you ask. Mostly, yes. They’re usually a tight lock. But we need backups like codes or taps on our phones to be super safe.

The Implications of Compromised POS Systems and Digital Skimming Devices

Next up, we’re in stores buying snacks or cool shoes. You swipe or tap your card. But hey, what if the machine’s been tricked? Bad guys put nasty tech, skimming devices, on card machines to steal your info. It’s sly and hard to spot.

“Can we trust card machines?” Keep an eye out, friend. If it looks odd or has weird stuff stuck on, go to another till or tell a worker. Use mobile pays or chips for more peace. Thieves have it rougher with these.

What about the whole store’s system getting hit? This is big trouble. Thieves get lots of card info at once. Shops fix these breaches, but not always quick. Use cards with care and watch your accounts. If you see buys you didn’t make, yell for help. Call your bank—fast.

We’ve talked about keeping your money safe. Eyes and fingers can help, but there’s no 100% safe plan. Be wise with where you swipe. Every step we take to protect our cash can keep thieves away. Let’s stay sharp, stay safe, and shop smart.

Securing the Future: Innovations and Best Practices in Payment Security

The Development of AI-Driven Fraud Prevention Tools and Their Impact

Have you heard about AI in fraud prevention? It’s like a smart cop for your cash. These tools learn from each fraud case. They use this data to stop crooks. How? By spotting tiny details that don’t look right. For example, if someone tries to buy ten TVs at once, the AI says, “Wait a minute, that’s weird.” So it checks things out. It happens super fast, before you blink. Say goodbye to bad buys without having to do anything.

Now you might be asking, “What’s the big deal with these AI tools?” They work non-stop to pick out bad transactions. This means scammers get caught quicker. Your money stays safe, and businesses lose less to fraud.

The Significance of Timely Security Patches in Payment Software and Compliance Challenges

Patches are like armor for payment apps. They fix weak spots where hackers can sneak in. Ever get those update messages on your phone or computer? They’re important. They’re security patches, and they help keep hackers away from your money.

Why do these patches matter? Well, bad guys love old software. It’s easier for them to break in. So when a payment app says, “Hey, I’ve got an update,” it’s like putting on a new suit of armor. Stronger, better protection.

But there are rules about these patches too. Payment apps need to follow laws to make sure they’re safe for everyone. Sometimes, it’s hard for the apps to keep up with all the new laws. Still, they work hard to do it. If they don’t update in time, your money could be at risk.

Keeping your app fresh and ready is key. It helps you, me, and everyone keep our money away from crooks. So, next time you see that update alert, go for it. Your wallet will thank you.

We’ve looked at the dangers that lurk in digital payments and how to spot them. Mobile wallets and online payment gateways aren’t bulletproof. Malware and sneaky phishing attacks can get past even the smartest fraud systems. It’s a game of cat and mouse with encryption flaws and clever scams always evolving.

But it’s not all doom and gloom. We’ve got sharp tools like biometrics to fight card fraud and we’re keeping an eye on those crafty digital skimmers. The tech is getting better every day. AI is stepping up to spot the baddies and regular updates keep our defenses tough.

Staying safe means being smart and staying ahead. We need to use the top tools and practices to secure our money. Trust me, with the right moves, you can keep your cash out of the hackers’ hands. Let’s lock it down and keep it safe. Always be alert, always be ready. It’s your money – protect it like a pro.

Q&A :

What Are the Latest Security Threats to Digital Payments?

The digital payment landscape is constantly evolving, and with it, the security threats that target these platforms. Some of the latest threats include phishing attacks, where scammers send fraudulent messages to steal login credentials; man-in-the-middle attacks, which intercept transactions between consumers and merchants; advanced malware that can bypass traditional security measures; and the exploitation of zero-day vulnerabilities that haven’t been patched by software vendors. Additionally, there’s an increase in mobile payment-related threats such as fake payment apps and unauthorized SIM swaps.

How Can Consumers Protect Themselves from Digital Payment Fraud?

To safeguard against digital payment fraud, consumers should exercise caution by using secure and trusted Wi-Fi networks for transactions, installing antivirus software on devices, regularly updating apps and device operating systems, and using multi-factor authentication. It is also crucial to monitor bank statements for any unauthorized transactions and only download payment apps from legitimate app stores.

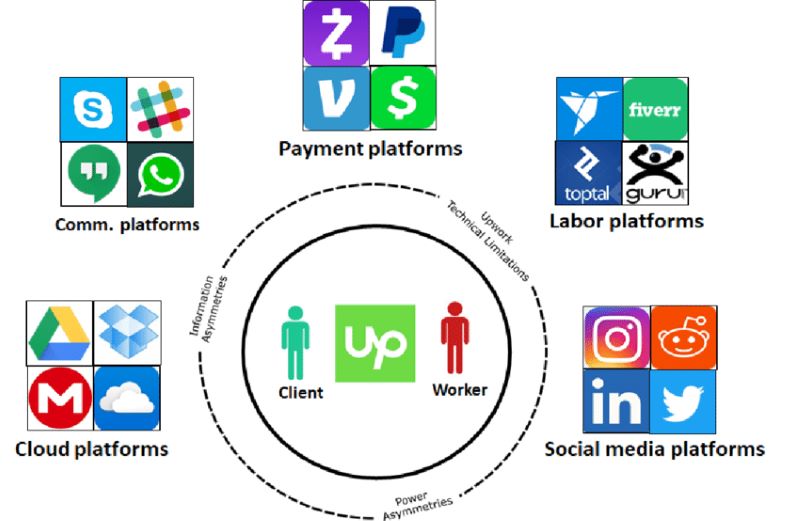

What Measures Are Payment Platforms Implementing to Enhance Security?

Payment platforms are implementing several advanced security measures to tackle new threats. They include employing sophisticated encryption methods to protect transaction data, using biometric authentication like fingerprints or facial recognition for user verification, and implementing artificial intelligence and machine learning algorithms to detect and prevent fraudulent activities in real-time. Payment vendors are also working on enhancing the security of the hardware used in digital payments, such as point-of-sale systems and smartphones.

Has COVID-19 Impacted Digital Payment Security?

The COVID-19 pandemic has significantly impacted digital payment security due to the increased adoption of online and mobile payments as consumers shift to contactless transactions. Cybercriminals are taking advantage of this change in behavior by launching targeted phishing campaigns, creating fraudulent websites, and devising new malware specifically designed to steal financial information. As a result, there’s an urgent need for heightened security awareness and improved cybersecurity practices.

What Future Security Enhancements Are Expected for Digital Payments?

Moving forward, the digital payment industry is expected to see the implementation of more advanced security technologies. Expect to see broader use of tokenization, which substitutes sensitive data with non-sensitive equivalents, the adaptation of blockchain technology for its tamper-evident ledger benefits, increased utilization of machine learning for fraud detection, and further development of contactless payment methods that reduce the risk of card skimming and other forms of theft. Additionally, regulatory changes like the Payment Services Directive (PSD2) in Europe are expected to provide a more secure framework for digital transactions.