Growth vs. Value Investing: Which Strategy Wins for Beginners?

As you dip your toes into the investing pool, you’re faced with a vital choice: Which investment strategy is better for beginners growth or value? Unpacking this quandary is no small feat, but fear not. I’ll guide you through understanding the core of growth and value investing—breaking down their pros and cons with the simplicity and clarity you need to make an informed decision. You want a strategy that aligns with your goals, risk appetite, and the time you can devote to managing your investments. Let’s dive in and explore which approach might lead you to the financial successes you’re aspiring to achieve.

Understanding Investment Strategies: Growth vs. Value

Defining Growth and Value Investing Principles

Let’s cut right to the chase. Growth investing finds companies that look set to grow fast. It’s like spotting a rising star before they hit big time. Value investing is different. It’s about finding stocks that trade for less than their real worth. Think of it as buying a top-quality item on sale.

Growth stocks often belong to new industries. They soar based on future potential. But they carry bigger risks. And no, they often don’t pay dividends yet. Value stocks, on the other hand, may belong to older, stable companies. They might not grow fast, but they often pay steady dividends. Plus, they’re less likely to give investors a rollercoaster ride.

Pros and Cons for Beginners

New to investing? Here’s the lowdown on growth and value strategies. Growth stocks can give you a thrill. They can climb high. Fast. But be aware – they can drop just as quickly. If you have time and can stomach some risk, they might work for you.

What about value stocks? These can be gems hidden in plain sight. They’re often overlooked but offer stable gains over time. Plus, dividends can add up. They tend to do better when the market stumbles. This can make them a safer choice if you’re starting out or like a less bumpy ride.

But how do you pick one? Think about what you can handle. Can you face big ups and downs? Or do you prefer a secure and steady approach? Remember, you’re in this for your future. Don’t just follow the crowd.

As a beginner, you must balance risk and return. We’re not talking about picking one stock over another. We’re talking about a solid base for your portfolio. Low-cost index funds, for example, are great for starters. They let you grab a slice of the market’s overall growth without much cost or fuss.

Still, choosing an investment strategy is not about finding a one-size-fits-all solution. It’s about matching your goals and how you feel about risk. Ask questions. Do your homework on growth and value stocks. Then start building a portfolio that fits you just right.

In the end, it’s not only about growth vs. value. It’s about understanding what you want from your investments. And it’s about learning as you go, adjusting your choices to suit your needs and the market’s shifts. So dive into learning about growth investing basics and value investing fundamentals. They are your tools to carve out a path in the world of investing.

Remember that investing for new investors should be about smart choices, not just following trends. Look at the big picture. Aim for long-term investment strategies that match your life goals. And always, always know what you’re getting into. This way, you’re not just investing. You’re growing your future on your terms.

Analyzing Financial Metrics for Growth and Value Stocks

The Role of P/E Ratio and ROE in Stock Selection

Let’s talk money. But first, numbers. Price to Earnings (P/E) ratio helps us pick stocks. It says if a stock costs more than it earns. High P/E could mean a stock has much room to grow. Or it’s way overpriced. Look for low or medium P/E in value stocks. These might be deals waiting for smart investors like you.

Return on Equity (ROE) shows if a company uses money well. High ROE means good management that turns investments into profits. It’s a green light for both growth and value stocks. Companies with solid ROE are often strong runners in the long market race.

Now, don’t ignore these numbers. They are your treasure map in the vast stock ocean. P/E and ROE guide you to the riches or traps. Use them, and you’ll learn to spot winners.

Evaluating Company Performance and Market Trends

The next big tip for rookie money makers. Check how companies do before you give them your hard-earned cash. Are they making money? How’s their debt? Are people loving their products? All this info paints a picture of what your future with their stock might look like.

Market trends can be fickle friends. They ride high on news, fall on bad days, but always have a story to tell. Fancy a good growth stock? Look for one that’s riding the wave up. Want a value stock? Find one that’s down but not out, waiting for the market to see its true worth.

Don’t just throw your money up in the air. Keep your eyes on how companies perform and what the market whispers. It’s your ticket to smarter stock picks that can grow your green stacks.

Remember, the best investment approach isn’t just about one number or trend. It’s about reading the whole story. Turn those pages carefully, and you might just end up with a bestseller in your portfolio.

Choosing between growth and value isn’t a race with a clear winner. It’s about what fits you. Your style. Your goals. Your stomach for risk. Mix them right, and you’ll build a portfolio as unique and promising as you are.

Building an Investment Portfolio with Balance

Asset Allocation Strategies for New Investors

You’re starting to invest. Great move! But now you may ask, “Where do I start?” First, learn about asset allocation. This means spreading your money across stocks, bonds, and other types. Why? To help balance risk and reward in your portfolio. Think of it like this: different investments act differently over time. Some may go up when others go down. By having a mix, you can smooth out the ups and downs.

For most, a mix of growth and value stocks is key. Growth stocks are from companies expected to grow at an above-average rate. Think tech firms. But they can be pricey and risky. Now, value stocks are different. These are from companies that may be underpriced. They’re like hidden gems. They may not grow as fast, but they offer solid value.

Your mix depends on your goals and how much risk you can take. Young investors might risk more for higher growth. Older investors might want more value stocks for safety and steady returns.

Diversification: Mitigating Risks and Optimizing Returns

Diversification is your safety net. It helps you not put all your eggs in one basket. Imagine investing only in tech stocks and then tech has a bad year. Your portfolio could take a hit. Now, if you have a mix of different types—some tech, some healthcare, some utilities—you’re better protected.

Start with low-cost index funds if you’re new to investing. These funds track a market index, like the S&P 500. They’re a simple way to diversify because they hold many different stocks. This reduces your risk without needing to pick individual stocks.

Then, as you learn more, you can add in individual growth or value stocks. Look for blue-chip and dividend-yielding stocks for long-term growth and returns. These companies are large, well-established, and financially sound. They often pay dividends, which you can reinvest to grow your wealth.

Remember, diving into growth stocks can tempt you with high returns, but it comes with high risk. On the flip side, value investing seeks stocks at a low price, which could increase in value over time. It’s often seen as lower risk, but it requires patience. Beginners should work to understand both before picking a side.

Find the right balance for you by looking at your financial goals. Are you saving for a house, retirement, or building wealth? Your goals shape your investment mix. Keep that mix in line with your risk level. Review it regularly, and adjust as your life and the market change.

Asset allocation and diversification aren’t just buzzwords. They’re ways to build a foundation for your investments. They can guide you through market highs and lows. So, take the time to learn them. Your future self will thank you.

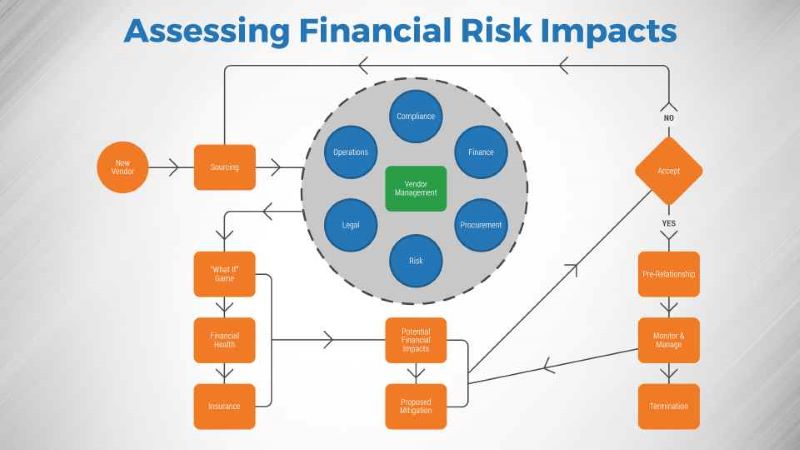

Making Informed Decisions: Financial Planning and Risk Assessment

Low-Cost Index Funds vs Stock Picking for Beginners

When you start investing, it can feel like you’re in a thick forest. Low-cost index funds are like a map. They help you move without guessing. With these funds, you buy a slice of the market. That means less work figuring out which stocks to pick. Vanguard was a game-changer. It made it easy for beginners to start with little money.

Stock picking is like trying to find hidden treasure. You might strike gold, or you might not. It takes time to learn. You look closely at companies and try to pick winners. But it is risky: choose wrong and you might lose cash.

Beginners should start slow. Index funds work well for that. They’re a safe way to learn and see your money grow over time. You can switch to picking stocks once you learn more.

Compound Interest and Long-Term Financial Goals

Picture compound interest as a snowball rolling down a hill. As it rolls, it picks up more snow and gets bigger fast. That’s what happens to your money. It grows as you earn interest on the interest you’ve already earned. It takes time. Start early and even a little money can grow big.

The more you save and the longer you keep it, the bigger your snowball gets. It’s more important than how much you save each month. For real! That’s why setting long-term goals matters. They guide you, keep you on track, and help you make smart choices. It’s about seeing the big picture and not just today.

Saving for the long run is a big win. You get peace of mind knowing your future is secure. Plus, your snowball of cash keeps getting bigger, no extra work needed. Just let time do its thing.

So, when you start off, think about what you want down the road. That dream house? A cool retirement? College for the kids? Plan it out. Then, let compound interest work its magic. Before you know it, you’ll be closer to those dreams than you think.

Making wise choices early sets the stage for success. Low-cost index funds and compound interest are two heroes for new investors. They help you grow your cash and hit big goals without too much risk or hassle. Remember, starting early and thinking about the long game is key. Happy investing!

In our journey today, we dove deep into the world of investments, showing you the ropes of growth and value strategies. We kicked off by defining what growth and value mean for your money. We looked at the good and bad of each route to give newbies a clear start.

We didn’t stop there. We checked out key financial numbers like P/E ratio and ROE, crucial for picking solid stocks. We also touched on how to read company scores and what market swings mean for your cash.

Next, it was all about balance. We covered how to mix different assets to build a strong portfolio. It’s like a treasure box for your future. And you learned about spreading your bets to nail the perfect blend of risk and reward.

We wrapped it up with smart choices for your bucks. Choosing between cool, low-cost index funds or the bold path of picking stocks – that’s a big decision. And let’s not forget how your money can grow over time with compound interest.

So there you have it – solid advice to make your money work its hardest for you. Keep these tips in mind, and here’s to your bright financial future!

Q&A :

What is the best investment strategy for beginners: growth or value investing?

When starting out, beginners may struggle with deciding between growth and value investing. Growth investing involves focusing on companies that exhibit signs of above-average growth, while value investing is based on looking for undervalued companies with strong fundamentals. Beginners should consider their financial goals, risk tolerance, and investment horizon when choosing a strategy. Growth investments can offer higher returns but come with increased volatility, whereas value investments can provide steady, more reliable gains but may take longer to appreciate.

How can beginners determine if growth or value investing is suitable for them?

Beginners should assess their personal investment goals, time frame, and risk tolerance to determine the suitability of growth or value investing. A keen understanding of one’s readiness to withstand market fluctuations is essential. Growth investing may be appropriate for those able to accept higher risks and seeking substantial returns over a long-term horizon. Value investing may appeal to conservative investors interested in stock market bargains and willing to be patient for returns.

What are the key differences between growth and value investment strategies?

The key differences between growth and value investment strategies lie in their approach to selecting stocks. Growth investors seek out companies with strong potential for future earnings growth, which often means paying a higher price for these stocks. In contrast, value investors look for stocks that are undervalued by the market but have solid fundamentals, aiming to buy at a lower price and wait for the market to recognize the true value. Growth stocks are typically associated with higher risk and volatility, while value stocks are often considered more stable, but potentially with slower growth.

Can a beginner investor combine growth and value investment strategies?

Yes, a beginner investor can combine both growth and value investment strategies to diversify their portfolio. This can help in balancing potential risks and returns. By allocating a portion of the investment capital to both growth and value stocks, beginners can take advantage of the unique benefits each strategy offers. This blended approach can also help mitigate market volatility as the performance of growth and value stocks may differ in various economic cycles.

What should beginners consider when looking for growth or value stocks?

Beginners should consider several factors when seeking growth or value stocks. For growth stocks, important considerations include the company’s projected earnings growth, market trends, and industry potential. For value stocks, investors should look at financial indicators like price-to-earnings (P/E) ratio, dividend yield, and book value, which can suggest undervaluation. Regardless of the strategy, beginners should also pay attention to the company’s management, competitive position, and overall financial health.