As an investor, you’ve likely asked yourself, What is the difference between growth and value stocks? It’s critical to understand this to smartly direct your cash. Growth stocks sprint ahead, promising you high returns as they reinvent the wheel. Think tech go-getters, their eyes on sky-high growth, not on paying dividends. On the flip side, value stocks are the market’s unsung deals. They’re the sturdy choices, often overlooked and undervalued, but brimming with potential for a windfall. Here’s where I come in. I’ll dive into each type, strip down their traits, and give you the lowdown on how they can shape your portfolio. We’re talking long-term plays and smart diversification to keep your investments solid. Get ready to uncover which of these stocks fits your game plan and how they can lead you down the road to solid wealth building.

Deciphering Growth and Value Stocks: A Primer

Understanding the Fundamentals of Growth Stocks

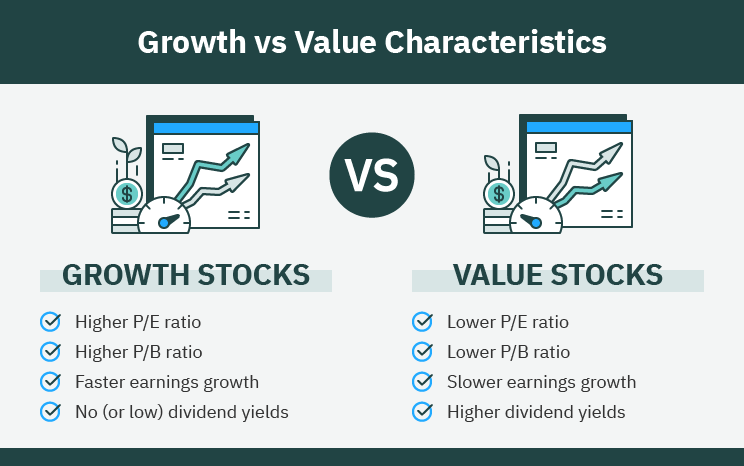

Growth stocks shine in earning potential. They are like sprouting seeds with room to shoot up. Think of companies making waves with groundbreaking tech or services. They grow fast and often skip giving cash to investors as dividends. Instead, they reinvest to grow more. Big gains await if you pick the right ones, but so does risk. No rewards without taking chances, right?

These companies often have a high price-to-earnings (PE) ratio. It shows investors pay more now for later growth. Market caps are big, showing people believe in their future. The excitement is over how much they can grow, not what they’re worth today. High growth hopes can mean high prices, and a drop can hit hard. Not for the faint-hearted.

Identifying Core Characteristics of Value Stocks

Now, let’s cross over to value stocks. They’re the time-tested, sturdy ships of the stock ocean. These companies have been around. They’re not flashy, but their prices are lower than they should be. How do we know that? Ratios like price-to-book (P/B) and PE, and dividend yields help. They let us peek into a company’s real worth versus its sticker price.

Value stocks give out dividends more often. They share profits, giving you income as you hold their stock. This is great if you like steady cash flows. Also, when markets get rough, they can be safer. Their low prices mean less room to fall. They’re often found in industries that don’t change much. They don’t skyrocket but offer a safer, steady path.

Investing in growth or value stocks depends on what you want and what you can handle. It’s a match of your goals with each stock’s dance. Growth favors bold moves and long waits for big payoffs. Value is about finding diamonds in the rough, getting income, and playing it safe. Both take savvy moves and a cool head. Choose wisely.

Financial Metrics: Evaluating Growth and Value Stocks

PE Ratio and Intrinsic Value Variances

When we talk about growth stocks, think fast movers. They’re like rockets. Their prices can soar as the company grows. Their PE ratios, that’s price-to-earnings, often stand high. This means people pay more for each dollar of earnings. They bet on a bright future. But their intrinsic value, or true worth, can be a puzzle. It takes skill to figure out.

Now, toss the coin and you have value stocks. These shares are more like hidden gems. They may look dull, but their worth is solid. Their PE ratios usually sit lower. So, investors pay less for each dollar of earnings. This can mean a bargain deal. But their low price doesn’t mean they’re a sure win. They could stay cheap for a long time.

Dividend Yields and Price to Book Differences

When you pick stocks, you must eye dividends. Dividends matter a lot for value stocks. They often offer higher yields. This means you get more cash for each share you own. People love this steady income. It’s like having a reliable friend who always spots you cash.

And then there’s the price to book ratio, a handy tool. It compares a stock’s market value to its book value. Think of it like comparing sale price to how much something is really worth. For growth stocks, this ratio might be sky-high. That’s because folks expect them to shoot up in worth. But with value stocks, this ratio often sits low. They’re like a car sold below its Kelly Blue Book value – a potential deal.

So, here we are, talking about two different worlds – growth and value. Growth stocks dazzle with potential while value stocks promise a sturdy bargain. But remember, stocks are tricky! They need your watchful eye and a cool head. Choose your path after you weigh the facts. And never forget the saying: the higher the risk, the higher the reward. But also, sometimes, slow and steady wins the race. Choose wisely!

Investment Strategies: Risks and Rewards

Risk Profiles: Growth vs Value

Let’s talk about risk in growth vs value investing. Growth stocks shoot for the stars. They are like rockets. They aim to rise fast but can be risky. And risks in growth investing are higher. Value stocks are more like trees. They grow slow and steady and might feel safer. Understanding stock investment strategies needs good knowledge of risks.

When picking stocks, think of your own risk likes. If big ups and downs scare you, value might suit you. Growth is for those who can handle ups and downs in hope of big wins. Evaluating company potential is crucial. Growth firms often reinvest earnings. They aim for rapid expansion. Value firms might be under the radar but have solid bases. They might cost less than they are worth.

Risk tolerance in stock investing is key. Always check how much risk you are okay with, before you pick growth or value. Financial metrics for stock comparison help us see the risks clearer. PE ratio analysis shows how much we pay for each dollar of earnings. Intrinsic value in investing is about the real worth of a company. Growth stocks often have high PE ratios and expected high growth rates. Value stocks have lower PE ratios. They might be priced below their real worth.

In the end, every investor is different. Some may sleep better owning steady, value stocks. Others aim for the big leaps growth stocks can offer. So, know your risk style before you dive in.

Historical Performance and Long-term Outlook

Now let’s peek at past performance and future views. History shows that both growth and value have their win times. When tech is hot, growth stocks might lead. When markets are tough, value can be king. Long-term investment approaches must see past the now.

Looking at historical returns of stock types, keep in mind the ‘when.’ What worked in the past may not shine in the future. And always be wary of short-term trends. Stock market performance indicators guide us but can’t predict all.

A look at long-term views is where it gets interesting. Growth stocks could grow fast and bring high returns. Still, a market drop or bad news can hit hard. Value stocks might be more resistant to market shocks. They can pay solid dividends over time. Dividends matter in income investing. Growth bets more on stock price leaps.

It’s not just about now. We think of the years ahead too. Economic cycles and stock picks go hand in hand. Some cycles favor growth, others value. We can’t ignore this dance.

In the long view, balance matters. Some choose growth for possible big gains. Others lean on value for a calmer path to profit. Some even mix both. The aim is a portfolio that can face tomorrow’s ups and downs. Your choice should match your hope for rewards but also your peace of mind with risks.

Building a Balanced Portfolio: Diversification Tactics

Combining Growth and Value for Stability and Appreciation

To make smart money moves, mix growth and value stocks. Growth stocks are like speedy race cars. Fast, exciting, but sometimes risky. They’re from companies that grow quick. They reinvest profits to grow bigger. But, these stocks can drop fast if the market gets shaky.

Value stocks, on the other hand, are like sturdy trucks. Strong and reliable. They come from companies priced lower than what they’re really worth. These stocks might not speed up fast, but they offer steadiness. This helps when the market gets tough.

By having both types, you’re setting up a safety net. When growth stocks soar, you can see big wins. And when things look grim, value stocks can keep you from losing too much. This combo can help you reach your money goals over time.

With both growth and value in your pocket, you’re ready for anything. It’s a top-notch way to handle the crazy ups and downs of the stock world. If you want your money to grow and stay safe, this is a smart play!

Growth and Value ETFs and Mutual Funds as Investment Vehicles

Not sure how to pick individual stocks? No problem. You can still get in on growth and value strategies. Consider ETFs and mutual funds that focus on these stocks.

ETFs are like baskets of stocks you can buy and sell. Some ETFs only have growth stocks. Others only have value stocks. And some mix them up, giving you the best of both worlds.

Mutual funds are similar but a pro manages them. You put your money in, and they pick the stocks. This can be a chill way to invest. You don’t have to stress over each stock pick. And you can still enjoy the growth and safety dance.

Both of these options let you spread out your risks. That means if one stock dips, it won’t mess up your whole plan. Plus, they’re a breeze to buy. You can find them at most banks or online brokers.

In short, ETFs and mutual funds give you a simple path to a solid mix of growth and value. They’re great tools for folks who want to grow their stash without all the hassle.

In this post, we unpacked the puzzle of growth and value stocks. We broke down the basics of growth stocks and pinpointed what makes value stocks unique. Then, we dove into the numbers, looking at how financial metrics set them apart. We weighed the risks and checked out their past wins and future chances.

To wrap up, nailing your investments is like mixing the perfect meal. A bit of growth adds zest; value gives it soul. Mix them right, and you get a solid feast that could last you a lifetime. Keep learning about these stocks, and you might just build a portfolio that stands strong through the market’s ups and downs. Remember, balance is key, and with the right mix, your financial goals could be within reach. Happy investing!

Q&A :

What defines growth versus value stocks?

Growth stocks are typically characterized by their potential to outpace the average market growth. These companies often reinvest profits to accelerate growth in the short-term, disregarding the immediate dividend payouts to investors. They usually appeal to those looking to increase the capital appreciation of their investments. In contrast, value stocks are often established companies that are considered to be traded for less than their intrinsic value. These equities may be underappreciated by the market, but they are attractive for their discounted price and stable dividend yields.

How do investors choose between growth and value stocks?

Investors tend to choose between growth and value stocks based on their individual risk tolerance, investment timeline, and market conditions. Those with a higher risk appetite and patience for long-term potential gains may prefer growth stocks. Alternatively, risk-averse investors looking for stable returns and a conservative approach might lean towards value stocks. The choice also depends on the investor’s assessment of economic cycles, as growth stocks tend to do better in a booming economy, while value stocks can be more resilient during economic downturns.

Can a stock be both a growth and a value stock?

While growth and value stocks are seen as opposites on the investment spectrum, it’s possible for a stock to embody characteristics of both. This tends to happen when a growth stock’s price has fallen due to market conditions, hence appearing undervalued but still has potential for significant growth. Alternatively, a value stock with a solid turnaround plan may start showing robust growth prospects.

Why do growth stocks typically not pay dividends?

Growth companies often do not pay dividends because they prefer to reinvest any earnings back into the company to fuel further growth and expansion. Management might believe that investing in the business provides a better return on equity for shareholders than distributing profits as dividends. This reinvestment strategy is focused on capital appreciation for investors over time, rather than immediate income through dividend payments.

How does market volatility affect growth and value stocks differently?

Market volatility typically affects growth and value stocks in different ways. Growth stocks, with their higher valuation and focus on future potential, are often more sensitive to market swings and may exhibit higher price volatility compared to value stocks. Contrarily, value stocks, with their often more mature and stable business models, may provide a degree of protection against market downturns, although they too can be affected by broader market or economic changes.