Two-factor authentication for digital payments isn’t just a fancy buzzword; it’s your money’s digital armor. Think of it as the trusty sidekick to your password, working around the clock to keep your dough safe. I’m diving into why this duo is the hero your online purchases need. From thumbprints to secret codes, your cash deserves more than a flimsy fence—it’s time for a security fortress. So let’s break it down and build up your defenses!

Understanding Two-Factor Authentication in Digital Payments

The Role of 2FA in Enhancing Payment Security

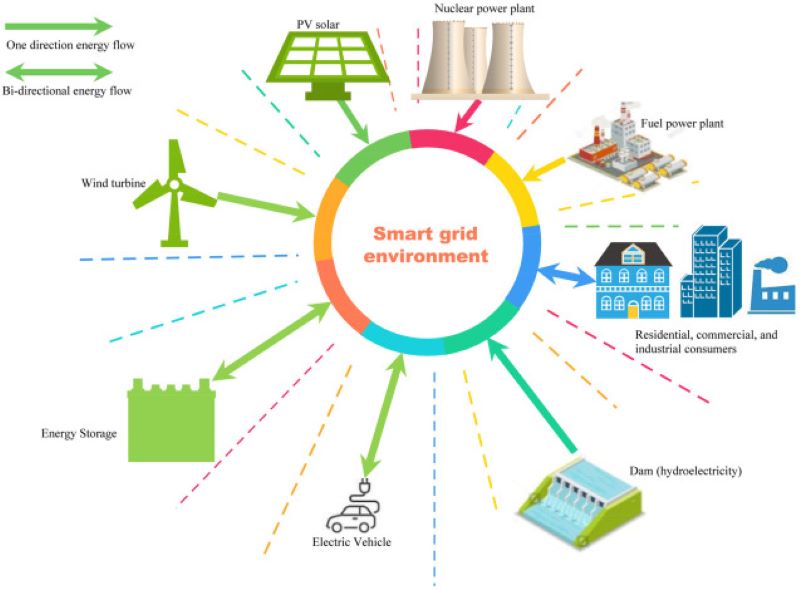

When you buy online or check your bank app, you want to stay safe, right? Two-Factor Authentication, or 2FA, is like a double lock on your digital money. You use two proofs to show it’s really you. Let’s say you log in with your password—that’s one proof. 2FA asks for another, like a code sent to your phone or your fingerprint. That way, if someone learns your password, they still can’t get in. And you keep your money safe.

Banks and shops online are using 2FA to help stop fraud. It’s a strong way to check identity, making sure a customer is who they say they are. Plus, it’s not too hard for you to use. The extra step does a lot for your safety. So when a site asks for 2FA, it’s a good sign. It means they take your security seriously.

Different Types of Two-Factor Authentication Methods

Now, there are many ways to do 2FA. Each one adds an extra layer to keep your cash and cards secure. Here are a few:

SMS Authentication Codes: These are codes sent to your phone. You get them via text when you try to log in. Just type the code on the website, and you’re in.

Authenticator Apps: These apps create codes that change every so often. You open the app, and there’s a new code waiting for you. It’s a secret between you and the app, so it’s tough for bad guys to guess.

Biometric Payment Authentication: This is high-tech safety. It uses your body as proof. It can be your fingerprint, your face, or your voice. Your phone or computer can check it’s you by these unique signs before it okays a payment.

OTP for Online Payments: OTP stands for “One-Time Password.” It’s a code that only works once for a brief time. You might use it to confirm a money transfer or online buy.

The point is, these 2FA methods add a beefy bolt to your online banking and shopping. They stop crooks dead in their tracks.

When it’s time to choose a method, think about what suits you best. If your phone is always by your side, SMS codes or authenticator apps might be handy. If you want cutting-edge safety, go for biometric like your fingerprint.

Whatever you pick, 2FA is your amigo in the fight against payment crime. Using it could mean the difference between safe shopping and a stolen card. It’s worth that extra click or scan to keep your money from slipping into the wrong hands.

Implementing Two-Factor Authentication for Banking and E-Commerce

Integration of Biometric and SMS Authentication in Banking Apps

Banking apps are getting safer each day. This change helps keep our money secure. We can thank two-factor authentication (2FA) for this improved safety. It’s like a double lock on your account. First, you have your password. But now, banks ask for more proof that it’s you. They might send you a code by text. You would need to enter this code in the app.

These text messages are called SMS authentication codes. They are a popular kind of 2FA. Each code is for only one time use. It’s good because if someone steals your password, they still can’t get in. They need that code from your phone too. This makes mobile payment verification so much better.

But wait, there’s another cool way banks keep your cash safe. It’s biometric payment authentication. What’s that? It’s when the bank uses parts of your body to check it’s you. Like your fingerprint or your face. It’s not science fiction! Most new phones can do this now. So you could be using your face to sign in to your bank account. It’s quick and simple. Plus, it stops crooks in their tracks.

Securing Online Transactions with OTP and Authenticator Apps

When we shop online, we want it safe and sound. That is where OTPs come in. OTP stands for one-time password. It works like those text message codes from banks. But it’s for online shopping. Let’s say you fill up your cart and get ready to pay. The store’s site can send you an OTP. You put this OTP in the site to finish buying your items. This small step is huge for online transaction protection.

Authenticator apps are here to help too. These apps create codes that you use when logging in or paying. They’re safe because the codes change all the time. Even if a bad guy gets a code, it won’t work for long. This is why people call it multi-factor authentication. It’s because there are many ways to prove who you are. You have your password, but you also need this changing code from the app.

For credit card security, online stores use the CVV code. That’s the short number on the back of your card. Never share it with strangers or untrusted sites! It’s a big part of keeping your card safe. With these tools, shopping and banking on your phone is just like a fortress. It’s all about strong walls and smart guards.

We’ve got to keep up with the bad guys. They’re always trying new tricks. So, we need to use stuff like 2FA to stay ahead. It’s our shield in the big world of banks and stores on the internet. Remember, every time we add another check, we’re making it tougher for the thieves. With biometric checks like fingerprints, we’re making it almost impossible. And with OTPs and apps, we keep our money locked down tight. It’s all to help us sleep a bit better, knowing our cash is just ours, safe and secure.

Navigating the User Experience with Secure Payment Verifications

Balancing Convenience and Security in Mobile Payment Verification

When you shop or bank on your phone, it should be easy but also safe. Two-factor authentication, or 2FA, makes sure of that. Picture this: you’re buying new sneakers online. You enter your card info and then, bam! You get a text with a code. That’s 2FA at work. It’s another step, but it’s like a second lock on your door. Your purchase is safe, and that’s what counts.

Mobile apps for shopping and banking now often use 2FA. It’s not just codes in texts anymore. Now, you might use your fingerprint or even your face to show it’s really you. This is called biometric payment authentication. It’s quick, and no one but you has your fingerprints, right? So it’s super safe.

Some folks worry that this extra step will slow them down. I get that. But think about this: a little wait for a code or a quick fingerprint scan can stop a thief. That wait is worth it when it keeps your money safe.

And companies are working hard to make 2FA smooth and fast. They want you to feel good about how easy and safe it is to use their apps. That way, you keep using them! It’s all about hitting that sweet spot – quick enough to be handy, but tough enough to block the bad guys.

The Impact of Multi-Factor Authentication on Online Shopping Behavior

Let’s dive into online shopping. You want it to be safe, but no one wants to jump through hoops. That’s where multi-factor authentication, or MFA, comes in. This is like 2FA, but with even more checks. You might use your password, get a text, then scan your fingerprint. It sounds like a lot, but it’s a fortress around your cash.

So, does this change the way folks shop online? You bet it does. MFA helps people feel secure. They know their money and info are locked down. When shoppers trust a website, they come back, and they might buy more. It’s peace of mind that leads to loyalty.

Even with these layers of safety, speed is key. You’re in a hurry, and clicking “confirm” on your shopping cart shouldn’t take forever. The goal is to keep that MFA snappy. When it’s done right, you might not even notice those extra steps. But they’re there, watching over every purchase you make.

And remember, MFA isn’t just for when you buy stuff. It’s for anytime you peek at your bank account online, or send money to a friend with your phone. Every single time, MFA is your silent guardian. It works behind the scenes to make sure it’s really you tapping on that screen.

Put simply, MFA is the hero we need in the world of online shopping and mobile payments. It marries the fast pace of our lives with the top-notch security we all deserve. And in a world where online threats never sleep, tools like MFA stand guard. So next time you check out online, take a moment to appreciate that silent guardian making your digital life safer.

Advancing Security Measures in Payment Technology

The Evolution of Encryption in Payment Gateways

We all want to keep our money safe, right? Well, payment gateways are the online versions of a bank’s vault. They’re where the magic of secure online shopping happens. Think of a payment gateway as a digital fortress that protects your money as it moves. In the old days, we just had plain passwords. But that’s not enough anymore. Now we use something called encryption, which scrambles up information so only the right person can read it.

Encryption makes sure that when you buy those cool sneakers online, nobody else can see your credit card info. It’s like sending your card number through a secret code that only you and the store understand. And this code? You can’t guess it. It’s super tough, like a puzzle with a billion pieces. Plus, it changes every time, so even if someone cracked the code once, they couldn’t use it again. It’s always one step ahead.

But we can do even better! What about when two steps are better than one? That’s where 2FA comes in. 2FA stands for “two-factor authentication.” It’s a fancy way of saying you need two keys to open the lock. You’ve got something you know, like a password, and something you have, like a text with a code sent to your phone. Or it could be your fingerprint.

Preparing for the Future: Voice and Facial Recognition Transactions

Let’s chat about the future. Imagine shopping with just your face or voice. No need to type or swipe. Imagine just saying “I’ll take it” and it’s yours. Or the store scanning your face when you walk up to check out. It sounds like a sci-fi movie, but it’s real, and it’s getting more popular.

Voice and facial recognition are types of biometric authentication. That means instead of using a password, you’re using your body as the key. It’s like your voice or face is a secret password that only you have. It’s personal and can’t be easily copied.

Here’s how it helps with payments. When you use your voice or face, it’s quick. No more trying to remember a bunch of letters and numbers. Plus, it’s hard to fake someone else’s voice or face. This means less worry about someone pretending to be you. It’s a big step for security and makes buying stuff a breeze.

But we’ve got to make sure it’s all safe. So, we work on designing systems that can tell if it’s really you or just someone with a picture of your face. It’s about making it secure so that you can trust it every time you use it.

Voice and facial recognition are like the new kids on the block. They shake things up and make payments exciting. But most importantly, they keep our money safe while we’re living in a world that never stops shopping online. We keep pushing for safer, faster, and cooler ways to buy what you want, without letting the bad guys get a peek at your cash. That’s what I call smart spending!

We’ve just walked through the need-to-knows of two-factor authentication in digital payments. Starting with how 2FA ramps up payment security, we explored the different methods, each with its own perks. We saw how banks and online stores are making paying online safer with things like biometrics and one-time passwords.

Now, let’s think about our own safety. Every time we buy something, it’s on us to make sure it’s secure. Yes, typing in an extra code can feel like a hassle. But that hassle is nothing compared to the trouble of getting hacked. As technology gets smarter, so do the bad guys. That means we need every tool we’ve got to keep our money safe.

Never forget, a safer payment world is better for all of us. Tooling up with things like voice and facial recognition could be our next step. So here we are, on the front lines, making sure every swipe, click, or tap keeps our cash away from the crooks. I’m here for it. Are you?

Q&A :

What is two-factor authentication for digital payments?

Two-factor authentication (2FA) for digital payments is an extra layer of security that requires not only a password and username but also something that only the user has on them, such as a physical token or a short-term confirmation code sent to their mobile device. This method ensures that the person making the payment is the rightful owner of the account, reducing the risk of fraud.

How does two-factor authentication enhance security for online transactions?

Two-factor authentication enhances the security of online transactions by adding an additional verification step. After entering the account credentials, the user is prompted to provide a second piece of evidence of their identity – this could be a fingerprint, a received text message with a unique code, or a prompt on an authentication app. This makes unauthorized access to the account much more difficult, as the attacker would need to compromise both forms of identification.

Can I still make digital payments if my device used for two-factor authentication is unavailable?

If your primary device used for two-factor authentication is unavailable, many services offer alternative methods to authenticate your identity. This could include backup codes, secondary devices, email verification, or security questions. It’s important to set up these alternatives in advance to ensure continued access to your digital payment accounts.

What should I do if I receive a two-factor authentication request that I did not initiate?

If you receive an unexpected two-factor authentication request, it could be a sign that someone else is trying to access your account. Do not approve the authentication request or provide the code to anyone. You should immediately change your passwords and review your account for any unauthorized activity. It’s also a good idea to contact the service provider to inform them of the suspicious activity.

Does two-factor authentication mean I don’t need to use strong passwords?

Even with two-factor authentication in place, it is still critically important to use strong, unique passwords for all your accounts. 2FA adds an extra layer of security, but strong passwords are your first line of defense. Ensure that your passwords are long, complex, and not easily guessable. Avoid using the same password across multiple sites to reduce the risk of a single compromised password giving an attacker access to all of your accounts.