Navigating the New Norms

Hey there! Today, we dive into the Regulatory challenges of financial disintermediation and what it means for you. No more long lines at banks to get what you need; direct finance is changing the game. But it’s not all smooth sailing. We’re hitting roadblocks made of tough rules that we have to learn to get around. These new ways to manage money cut out the old middle men but they also come with new hoops to jump through. Now, it’s about staying smart and ahead of the game. Ready to explore how this shakes up the way money moves? Let’s go!

Understanding the Implications of Financial Disintermediation

The Evolution from Traditional Banking to Direct Finance

Long gone are the days when the local bank was the only place to get a loan. Now, we turn to the web, where money moves with a click. This leap from old-school banks to direct finance is huge. People lend straight to others through platforms called peer-to-peer, or P2P, without a bank in the middle.

Assessing the Impact of Non-Bank Financing on Regulatory Frameworks

This shift to direct lending is tricky for rules set for banks. Non-bank finance—like crowdfunding or online loans—doesn’t fit neatly into these old rules. We ask: “How do you control something that’s always changing?” We work to keep users safe from bad deals and bad actors.

Let’s think about what non-bank finance really means. Folks can now give money to businesses or each other using the internet. It’s fast and often easier than getting help from a bank. But, because it’s new and online, it changes fast. Keeping up with it is part of the job.

Regulators try to protect everyone’s money, but it’s complex. They look at peer-to-peer lending rules to keep things fair and safe. In P2P, you might lend $50 to someone across the country for their new café. It’s exciting, but you want to know your money is safe. That’s where regulations step in, to check on the businesses and people you lend to.

Now let’s talk about blockchain, a tech that’s changing finance a lot. It helps make sure everything is recorded and open. But, it also makes creating new rules a must. It’s not just about safety—it’s ensuring people trust the system.

Rules for mobile payments and digital banks are getting updates too. Old laws didn’t see smartphones coming. Today, we pay for coffee or send cash to friends all from our phones. So, we need laws that know how tech works now.

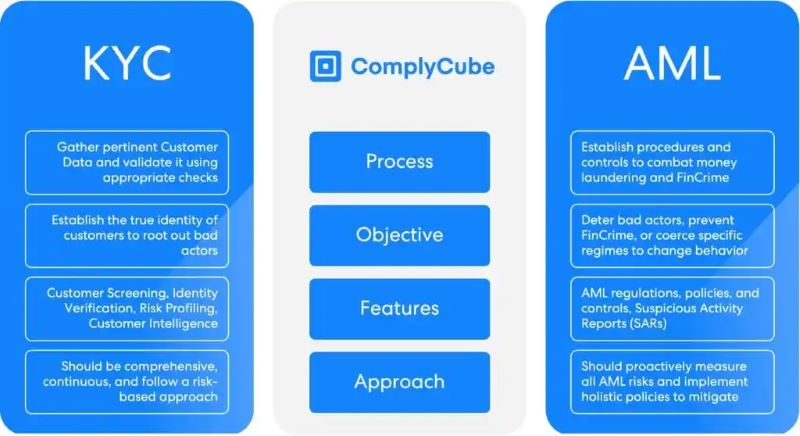

And don’t forget, keeping bad money out of the system is key. We call this anti-money laundering, or AML. It stops crime and keeps our cash clean. Fintech firms must ensure they know their customers well. This is known as KYC. Both are big deals in the digital world.

The shadow banking system is another part of this puzzle. It’s like a bank but none of the typical rules apply. Watching over it is vital. It holds a lot of money, which means a lot of risk too.

As for legal bits, non-bank finance has its own framework. It’s like a rule book for the new ways people get and give loans. It works to make sure that even if a bank isn’t involved, the loans are still okay.

In all this, we find new tech to help with rules, called RegTech. It’s smart software that helps fintech stay within the lines. It’s also there to make complex law easier to handle.

This wave of direct finance and tech is reshaping how we view money’s flow. It’s about being smart and safe as the finance world speeds into the future.

The Compliance Hurdles in Fintech Innovation

Balancing Technological Advancements with Banking Regulations

Fintech is shaking up how we handle money. We’re moving fast from old banks to neat apps and tools. But, there’s a catch. With new tech come new rules. We’ve got to play it safe and fair, and that means following banking regulations. They’re there to make sure money stays clean.

Banking rules are like traffic signs for money. They tell you where to go and stop you from crashing. If you’re in fintech, you’ve got to know these signs by heart. Sure, it’s tough. Sometimes the rules change, or they’re hard to understand. But we don’t give up. We learn and adapt. That way, we keep the money moving right, and folks trust us.

Peer-to-Peer Lending and Equity Crowdfunding: Adhering to New Sets of Rules

Now, let’s chat about lending without the big banks. That’s what peer-to-peer (P2P) lending is. It’s like lending money to your friend, but online, and to folks you don’t know. It’s a cool idea. But, it comes with a bunch of rules.

Why all the rules? Two words: trust and safety. When you’re lending money, you want to know you’ll get it back, right? P2P lending rules make sure borrowers are checked out. They also help keep your money safe.

Then there’s equity crowdfunding. That’s when many folks chip in a bit of money to help start a business or project. It’s like backing your buddy’s new cafe, but on the internet and with strangers. Again, rules are key. They help make sure the business is real and not just a pie-in-the-sky idea.

With these rules, you can lend money or fund a dream without too many worries. They’re like a safety net. Yes, it’s a bit of a tightrope to walk, keeping up with all the legal stuff. But it’s worth it. That way, everyone gets a fair shot at making or getting a loan, and new businesses can bloom.

In fintech, the game is always changing. Rules keep popping up, like new levels in a video game. And we’re on it – upgrading our skills, beating those levels. It keeps us sharp and our customers smiling. So, when we talk about money, let’s not forget the rules. They’re the secret sauce that keeps the financial world spinning.

Cryptocurrency and Blockchain: The New Frontier in Finance Regulation

Striking the Balance: Cryptocurrency Oversight and Innovation

Cryptocurrency makes waves in finance daily. It’s changing how we think about money. But with great power comes great responsibility, and that’s where oversight steps in. We need rules that do two big things: keep us safe and let innovation grow. Think of it like a garden. If we tend it well with the right mix of care—enough water and sunlight—new ideas can flourish.

For instance, regulators are keen on protecting consumers. They focus on keeping money safe from crime, like money laundering. But at the same time, they don’t want to stunt growth. They work to craft rules that allow new services to bloom. We are in a dance, trying to find the right steps to harmonize both needs.

Blockchain’s Influence on Finance and the Ensuring Regulatory Challenges

Blockchain is big news—it’s not just for bitcoin anymore. Picture a giant book where everyone can write but no one can erase. That’s blockchain, and it’s great for tracking things like transactions. This tech is shaking up the old ways, big time, and that’s exciting.

But with new tech comes new puzzles to solve. How do we handle these changes? We are in uncharted waters, needing to map out safe paths. Finance was once a world of banks and branches. Now we look at apps and algorithms. This shift makes heads spin at regulatory agencies.

The big goal is to steer clear of danger. We don’t want the finance world to be like the Wild West. We want it to be more like a well-guarded treasure chest. So, folks in suits are working to figure out the rules of the game for blockchain. They ask things like “Who watches over transactions?” and “How do we keep records safe?”

With blockchain, it’s a bit trickier. The tech is new, and it stretches across the globe. We need to be super smart to make rules that can cross borders. It’s like trying to create one rulebook for every playground in the world—even those we haven’t built yet.

Take peer-to-peer lending. It’s a prime example of where old rules meet new ways. In the past, if you needed money, you went to a bank. Now, you can just hop online and find someone willing to lend you cash. This puts regulators in a pickle. How do they protect both the person lending the money and the one borrowing it?

And let’s not forget about those pushing the boundaries further—like in crowdfunding. People pitch in to fund a new idea they believe in. But here, too, we need to make sure everyone plays fair.

It boils down to this: we have shiny, new finance tools. But they need rules so they work as intended. No one wants a cool new app to turn into a way for bad guys to move money. We have to be watchful, but also wise. We need to nurture new ideas while keeping our feet firmly on the ground.

So, folks at places like the Financial Action Task Force (FATF) are scribbling away. They’re making guides for countries to follow. Their aim? To make sure that as the financial world speeds up, it doesn’t spin out of control. We’re seeing an amazing race between innovation and regulation. And believe me, it’s a race we all have a stake in.

The Future of Financial Regulation in the Age of Disintermediation

Embracing Decentralized Finance (DeFi) While Ensuring AML and KYC Compliance

I work where money meets tech. It’s a space full of change. Banks are no longer the only game in town. Now we have DeFi—short for decentralized finance. It’s a big shift. Want to hear more about the challenges it brings? Keep reading.

DeFi cuts out the middleman. No banks, no brokers, just you and the tech. Sounds great, right? But here’s the rub. This freedom means regulators are playing catch-up. They want to stop bad actors from dirty money moves. That’s where AML comes in—it stands for anti-money laundering. And KYC? It’s know your customer. Both of these are big deals in the finance world.

You might ask, “What’s the trouble with DeFi and these rules?” Well, DeFi is like the Wild West. It’s new, fast and if we’re honest, a bit wild. Making sure everyone plays by the rules is tough. AML and KYC were made for the old world of banks. Bringing them to DeFi is like fitting a square peg in a round hole. But it’s a must. We need to know who’s who, and keep the bad money out.

That’s where my job gets interesting. I see what’s missing and find ways to fix it. We make new tools—digital ones. They help DeFi play nice with AML and KYC. It’s about keeping everyone safe while letting the good stuff happen.

RegTech’s Role in Simplifying Compliance for Disruptive Financial Technologies

RegTech stands for regulatory technology. It’s a helper for the tech finance world. RegTech makes following rules easier. It’s key for new tech like peer-to-peer lending and mobile payments. These aren’t your average bank transactions. They’re new, they’re fast, and they don’t fit snug into old laws.

What does RegTech do? Picture this: you’re making a puzzle. It’s a big one, with pieces everywhere. RegTech is the friend who sorts the corner pieces for you. It’s a starter guide. RegTech helps financial companies see what’s what. It makes sure they follow the law. It’s smart, saves time, and keeps things tidy.

Why does this matter? Our money world is changing fast. We’re not just using cash or cards. We’re also paying with phones, online platforms, and digital coins. The old ways of watching over money don’t work here. They’re too slow, too clunky. We need smooth, smart systems that can keep up. That’s RegTech.

In sum, I live in a world of new tech, new challenges, and new solutions. My place is at the crossroads—where money and tech meet. And I make sure we move forward without leaving safety behind. It’s not just about the rules. It’s about making them work in a world that never stands still.

In this post, we explored big shifts in finance, from classic banks to direct lending. We saw how new players like fintech and cryptocurrencies are shaking things up. They offer cool ways to handle money but also bring new rules to learn. We must find a sweet spot between letting new tech grow and keeping things safe. Our future looks like it will blend tech and finance even more, making money matters simpler but also making sure we all play fair. As we step into a world where finance gets more tech-savvy, keeping up with rules will help us all win. Let’s get ready for a smart, safe money future!

Q&A :

What are the primary regulatory challenges associated with financial disintermediation?

Financial disintermediation poses several regulatory challenges, including the difficulty of applying traditional financial regulations to peer-to-peer lending platforms and crowdfunding websites. It also raises concerns over investor protection, prevention of money laundering, and systemic risks associated with the shift in capital flow from regulated entities to non-bank actors. Regulators are faced with the task of ensuring stability and fairness without stifling innovation.

How does financial disintermediation impact conventional banking regulations?

The rise of financial disintermediation has a disruptive impact on conventional banking regulations, which are traditionally designed for institutions such as banks and credit unions. As non-banking entities begin to perform functions similar to these institutions, regulations may become inadequate or obsolete. This necessitates an update in regulatory frameworks to accommodate the new market players and ensure that consumer protection measures remain effective.

What measures are being taken to address the risks of financial disintermediation?

Regulatory bodies are taking various measures to address the risks of financial disintermediation. These include updating legal frameworks to cover new types of financial activities, enhancing consumer protection laws, improving transparency and disclosure requirements, and implementing stricter anti-money laundering and counter-terrorism financing controls. Additionally, collaboration with international regulators is increasing to manage the cross-border nature of digital fintech platforms.

How do financial disintermediation trends challenge investor protection?

Trends in financial disintermediation present challenges in investor protection due to increased exposure to risk without the traditional safeguards provided by regulated financial institutions. Investors may face higher risks of fraud, lack of information, or defaults with peer-to-peer lending and crowdfunding platforms. Regulators are tasked with enhancing oversight and putting in place measures that safeguard investors while still allowing them to benefit from the opportunities such platforms provide.

Can existing financial regulatory frameworks adapt to the rise of disintermediation?

Existing financial regulatory frameworks can adapt to the rise of disintermediation, but they require substantial modification. Regulators must understand the nuances of technological advancements and the new financial tools being used. They need to work closely with fintech companies, non-banking financial actors, and legacy financial institutions to develop regulations that promote security, transparency, and fairness across all financial interactions while also fostering innovation in the financial sector.