In the clash of investment styles, the question of Growth vs value investing which is more risky? stands tall. You’ve heard the buzz around each method, but maybe you’re still puzzled about where the risks really lie. Hear me out as I break it down for you. With growth stocks, think high speed – rapid gains with possible sharp drops. On the flip side, value stocks are like time-tested classics; they promise steadiness, with fewer wild rides. Let’s dive in and deconstruct the risk factor of both contenders, making sure your next move on the investment chessboard is a power play, not a blunder.

Understanding the Risk Landscape in Growth vs Value Investing

Defining Risk in the Context of Investment Styles

Risk, put simply, is the chance you take that your investment may not pan out. Think of it as the odds your money might not grow as hoped, or worse, shrink. When you look at growth vs value stocks, each dances with risk in its own way. Growth stocks are like sprinters, aiming to move fast and lead the pack. They can soar high but also fall hard. While value stocks are more like marathon runners, keeping a steady pace aiming for endurance, not speed.

Analyzing Investment Strategies Risk Analysis

Let’s dig into why growth stocks can be a wild ride. They’re companies expected to outpace the rest. With this potential comes a higher price tag, making them a high-risk choice. They ride on hopes and dreams of what could be. When folks are upbeat about the market, growth stocks can shoot up. But if the mood swings, they can tumble just as fast. This swing is called market volatility, and growth stocks know it well.

Now, throw in some math – like the price to earnings (P/E) ratio. This helps you figure out if a stock is priced right or too high. Growth stocks often have sky-high P/E ratios, hinting that they’re pricey. In contrast, value stocks typically have lower P/E ratios. That means they might be bargains waiting to shine. So, while growth stocks buzz with possibility, value stocks hum with steady potential.

When it comes to risk tolerance in investing, think about how rough of a ride you can handle. If sharp dips and dives make you queasy, you might lean towards value stocks. They may not zip up fast, but they don’t often crash down hard, either. Value stock characteristics like dividends also lend a hand to their stability. They give value stocks a foundation that can hold up even when the market is moody.

On the flip side, growth stock characteristics play well with investors who are okay with more ups and downs. These folks can stomach the swinging because they dream of the high peaks growth stocks promise. Just know this: growth stocks often favor sunny economic days. When storms hit – like in bear markets – they can get soaked. Value stocks, on the other hand, can be your umbrella. They’re more likely to hold their ground.

But before you pick sides, look at the long game. Over years, growth and value stocks can take turns leading the charge. Check out their historical performance during different market conditions. Remember, past wins don’t promise future glory, but they offer clues. Watching these trends is a part of smart asset allocation risk management.

Also, don’t put all your eggs in one basket – that’s what diversification is all about. Spreading your money across different types of investments can smooth out the bumpy ride. Whether it’s a bull market charging ahead or a bear market taking a nap, having a mix of growth and value can help keep your portfolio on track.

So which packs more risk? Growth could have you riding high, but with steep drops. Value plays it safer but might not hit those exciting highs. It all circles back to your risk tolerance and financial goals. Remember, investing isn’t just about picking stocks. It’s about crafting a strategy that matches who you are as an investor, so you can sleep at night and still reach your dreams by day.

Characteristics and Risks of Growth and Value Stocks

Growth Stock Characteristics and Associated Volatility

Growth stocks are often from companies aiming for fast profit jumps. They put money back into their business to grow quickly. This means they might not pay dividends yet. Prices can swing a lot because they rely on future success. This can make them high-risk. But, if they do well, they can offer high returns.

When we look at tech stock shake-ups, we get why growth stocks can be wild. A hot new product can send prices way up. But if there’s a misstep or market shift, those same stocks can plummet. So, picking growth stocks is about seeing who has the edge and can keep it.

Value Stock Traits and Stability Considerations

Now, let’s swing to value stocks. They often come from more stable, seasoned companies. Think of big firms that have been around and have steady earnings. These stocks may not jump in price quickly. But they often pay dividends. This can help your cash grow even when the market is asleep.

Value stocks can be seen as low-risk, especially when markets dip. During tough times, they can be safer shelters for your money. Companies with strong books and regular profits tend to wobble less when things get rough. This is why when clouds gather over the economy, value stocks can be like a warm coat on a cold day.

Remember, value stocks shine in slow markets, offering steady gains. On the flip side, growth stocks can race ahead when times are good. But in a crash, they might be the first to tumble. Your move depends on how you feel about ups and downs. Do you cheer at every market jump or wince at each drop? That feeling is your risk tolerance. It’s key to pick stocks that let you sleep at night.

In choosing between growth and value, it’s like deciding between a fancy sports car and a reliable sedan. The sports car, like a growth stock, can zip ahead fast but might skid in the rain. The sedan, like a value stock, won’t race, but it’ll get you home safely, even in a storm. It’s about what ride you’re up for.

For a deeper dive into risk and investing, check out how market conditions sway the decision between growth and value stocks. Even if your interest is short-term gain or long-term growth, know that risk plays a big part. Aligning your choices with your goals and nerves is what smart investing is all about. And that’s a match you’ll want to make right.

Historical and Economic Perspectives on Investment Risk

Comparing Historical Performance of Growth vs Value

When we talk about stocks, we see two main types: growth and value. Growth stocks are like the fast cars of investing. They’re the companies growing quickly, like tech giants. People buy these expecting the value to shoot up. Yet, with big growth comes big swings in price. They can lead to large gains or hefty losses, often tied to how the economy is doing.

Now, let’s look at value stocks. Think of these as sturdy trucks. Their prices don’t jump around too much. They’re often seen as deals, like getting an awesome toy on sale. The companies might be slow-growing, but they pay dividends and can hang tight when the market is rough.

Over time, growth and value stocks have taken turns leading the race. In some years, growth speeds ahead. In others, value shows it has lasting power. Growth may seem riskier because of the price jumps. Value might seem safer, giving steady but smaller returns.

How Economic Cycles Influence Growth and Value Risks

Economic cycles are like weather for stocks. When it’s sunny and the economy grows, so do growth stocks. They thrive, getting bigger and better. But when storms hit and the economy drops, these stocks can fall hard.

Value stocks, though, are more like good rain boots. When it rains, they handle it better. During tough times, their steady nature can protect you, like a trusty umbrella.

But what we must remember is, no season lasts forever. When growth stocks fall, they might get up stronger. Or, when value stocks aren’t shining in a growing economy, they can still provide safety and dividends.

Which is riskier? That depends on the track—or the economic conditions—we’re facing. It also depends on how long you’re racing for. Short dashes with growth stocks can be wild. Yet, long treks with value can steady your steps.

Think about mixing them up, like having both sneakers and boots. This way, you can run fast but also walk through puddles safely. Balancing both styles can help you stay on track, no matter the weather.

Strategic Considerations for Aligning with Investor Profiles

Balancing Short-term Gains with Long-term Strategy

Investing is a tug of war between wanting quick results and planning for your future. Growth stocks tempt with high-speed wins. Value stocks woo with steady gains. Both have a place in your money plan. Yet, they fit different life stories.

For those who can weather ups and downs, growth stocks shine. Tech is a star here but beware, it can fall as fast as it climbs. If you can’t watch your cash dip without a flinch, think twice. Growth works for those ready for a bumpy ride.

Long-term plays call for value picks. These firms often stand the test of time, with their worth unfolding slow but sure. It’s a less wild way to build wealth. And, it lines up with goals that won’t budge, like retirement.

In all, mix your basket. Don’t bank on just one type. Spreading across both guards your cash and sets you up for wins, big or small.

Risk Tolerance and Portfolio Diversification in Value and Growth Investing

Know your stomach for risk. Value or growth? Your pick should mirror how much risk you can take. Value stocks are your friends in tough times. Their prices don’t jump around so much. They even hand out dividends, which help when markets dip.

Growth stocks, on the other hand, are the daredevils. They can skyrocket, but also plunge. Here, timing is key. Get in or out too late, and it could hurt. But pick right, and you could see your money grow fast.

To play it smart, don’t put all your eggs in one basket. Spread your bets. Own different types of stocks. This way, you don’t lose all if one goes down. Plus, you can grab gains across the board.

Think about the market too. Bull or bear – each plays to different strengths. Growth stocks often win in cheerful (bull) markets. Yet, when it’s gloomy (bear market), value might be your safe harbor.

Sort your stocks by their job. Some are there to make quick cash. Others are in it for the long haul. Check their history. How did they do when times were bad? This tells you a lot.

Using charts and numbers helps too. Look at price to earnings ratio (P/E) and book value. These can tell you if you’re getting a deal or buying too high.

So, to tie it all together: match your picks to your money goals, and don’t fear a mix. Smart choices in good and bad times can give you peace and profit. Take a step back, look at the map of your life, and place your bets where they fit best.

In this blog post, we dove into the risk world of growth and value investing. You now know investment styles each carry their own risks. Growth stocks are often more volatile, but they offer big potential wins. On the other hand, value stocks are usually steadier. They can be safer bets during tough economic times. Historical data gave us clues about how these stocks have done in the past. We also looked at how the economy can shift the risk in these investments.

As for final thoughts, remember, there’s no one-size-fits-all answer. Your own risk comfort and goals matter a lot here. Think about what you’ve learned about growth and value risks. Then, blend them into your plan. That way, you’re more likely to build an investment portfolio that’s just right for you. Investing wisely means looking ahead and staying smart about the risks. Choose well, and you may find success on your investment journey!

Q&A :

What are the main differences between growth and value investing?

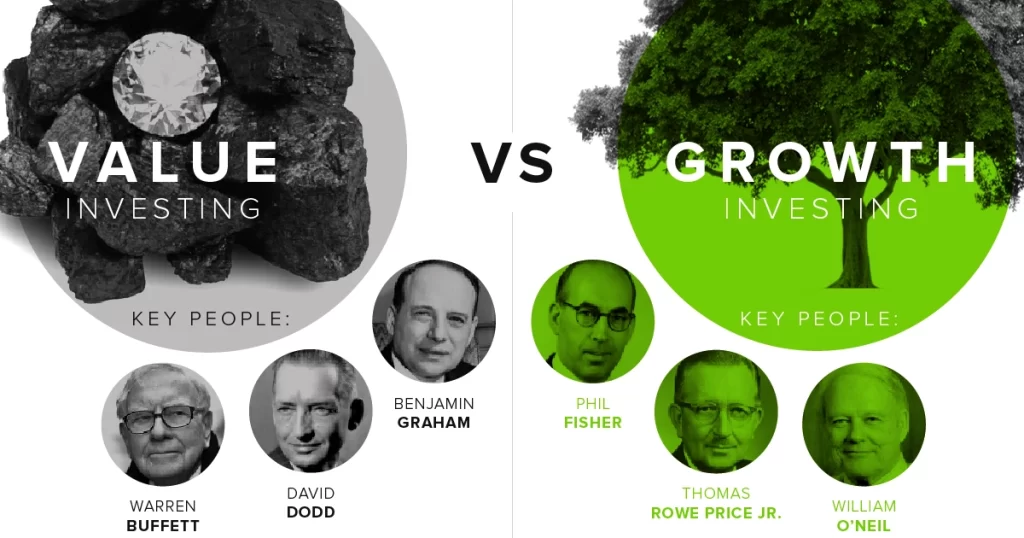

Growth investing focuses on companies expected to grow at an above-average rate compared to other firms in the market. Growth investors seek companies with strong potential earnings, often disregarding current valuations like high price-to-earnings ratios. Value investing, on the other hand, looks for undervalued companies with strong fundamentals – those traded for less than their intrinsic values. Value investors seek stocks with low price-to-earnings ratios, hoping that the market will eventually recognize the company’s true value.

Is growth investing riskier than value investing?

Both growth and value investing come with their distinct risk profiles. Growth investing is often perceived as riskier because it involves betting on the company’s potential, which may or may not be realized, leading to higher volatility in stock prices. In contrast, value investing might be considered more conservative as it is based on existing, undervalued assets with a potential for steady gains. However, both strategies can be subject to market risks and economic factors that could affect portfolio performance.

Which investment strategy performs better in a bear market, growth or value investing?

Historically, value investing has shown to perform better during bear markets. Since value stocks are typically more mature and financially stable, they are often better equipped to weather economic downturns. On the other hand, growth stocks, due to their higher valuations and expectations for future earnings, may decline more sharply as investors flee from riskier assets. However, performance can vary from one bear market to another based on numerous factors, so this is not a hard and fast rule.

How do I choose between growth and value investing based on my risk tolerance?

Your risk tolerance is key in deciding between growth and value investing. If you’re more comfortable with volatility and believe in your ability to pick companies with high growth potential, you might lean towards growth investing. On the other hand, if you prefer a more measured approach with potentially lower but more stable returns, value investing could be more suitable. Always consider your investment horizon and financial goals when deciding on a strategy.

Can growth and value investing strategies be combined?

Yes, many investors choose to combine growth and value investing strategies to balance out the risk and to diversify their portfolios. By doing so, they can potentially capitalize on the rapid gains of growth stocks while cushioning downside risk with the stability of value stocks. This blended approach can also help navigate varying market cycles, as the market’s favor between growth and value stocks often shifts over time.