Let’s cut to the chase: knowing when to invest in growth stocks vs value stocks can make or break your portfolio. This isn’t a hunch—it’s strategic. Are you eyeing rapid gainers, or do you prefer stocks with solid potential at bargain prices? It’s more than flipping a coin; it’s about understanding the dance between market rhythms and economic signals. Whether it’s tuning into the PE ratio’s story or reading profit margins like tea leaves, you need to nail the timing. Get ready to dive deep into the specifics, and let’s turn you into a master of the stock investing game.

Understanding Growth Stocks vs Value Stocks

Defining Growth and Value Stocks: Characteristics and Differences

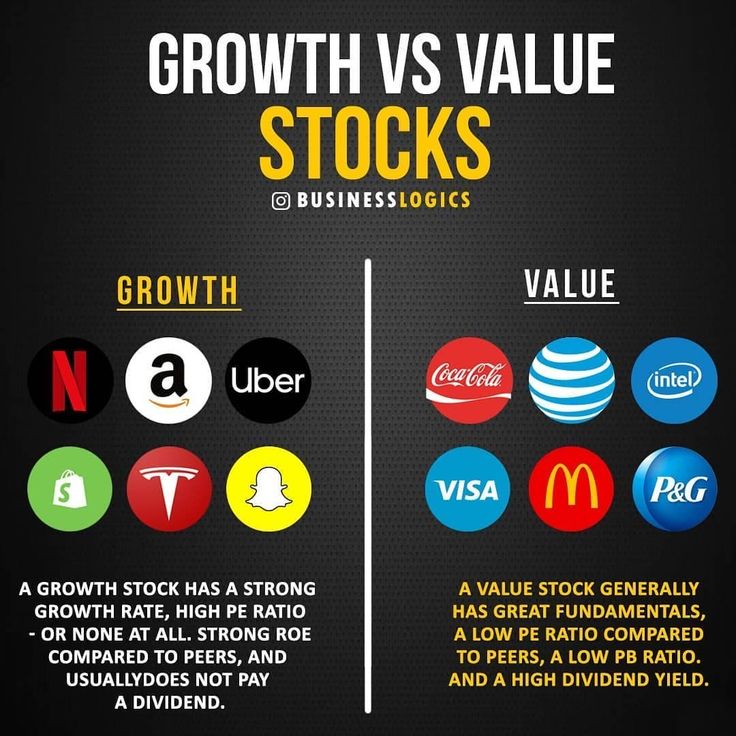

Ever wonder how to pick from growth or value stocks? Come along, let’s make it simple. Growth stocks are the hot rods of the market. They zoom with potential and high earnings. Folks expect them to soar. But, with big dreams come big price tags. They don’t come cheap, as many chase these stars.

Value stocks, on the flip side, are the market’s hidden gems. They’re like a garage sale find – underappreciated and underpriced. The hope here is that others haven’t seen their true worth. When they do, the price should climb. Simply put, growth stocks are about what may come, while value stocks are about the bargain you get now.

Did you get a grasp on that? Good! Let’s keep going.

Assessing Company Value: The Role of PE Ratio and Profit Margins

For the money-savvy among you, PE ratio, or price-to-earnings ratio, is a must-know tool. Think of it like a price tag on earnings. It shows if a stock’s price fits with its profits. Low PE could mean a deal; high PE might flag overpricing.

But PE isn’t all. Profit margins also shine a light on a firm’s health. High profit margins hint at a well-run business. It means they keep more dough from each sale. That’s good news for investors looking for a solid company to back.

When times get tough, or when the market rides like a roller coaster, knowing these tricks helps. High growth sectors might shine, while other times value stocks could be the safe harbor in a storm. All this talk might seem too money-minded, right? But hey, smart investing means smart money, and that’s what helps you achieve your financial dreams.

Remember, friends, the goal here is to build wealth with a cool head. You need to weigh these facts to make your investment sing. To sum up, growth stocks offer dreams of tomorrow’s riches. Value stocks are today’s bargains hoping for a brighter tomorrow. Looking at PE ratios and profit margins helps sort the wheat from the chaff. It puts you in the driver’s seat, revving up for a smart investment ride.

So now you know – timing market investments, eyeing stock market cycles, and understanding economic indicators can lead to wiser stock picks. Whether you’re aiming for that capital appreciation or you’re content with collecting dividend yields. It’s all about matching the stock to your financial goals.

And hey, if you ever feel like you’re losing track, come back here. We’ll walk through this investment maze together. With clear thoughts and solid info, we can make the money dance our tune.

Analyzing Market Conditions for Optimal Timing

Economic Indicators and Stock Market Cycles: Navigating Timing Decisions

When it comes to stocks, timing matters a lot. You want to buy and sell at the best times. Growth stocks can zoom up fast. They soar when the economy is hot. Value stocks are like steady workhorses. They shine when times are tough. Use economic signs to choose right. When the economy grows, it’s often good for growth stocks. Job numbers and sales can show this. If they rise, it means people spend more. That’s great for hot growth stocks in high tech or new industries. So look for these signs.

But there’s more than job stats, right? Think about how often markets move up and down. That’s stock market cycles. They happen over years. Stocks go up—bull market. Stocks drop—bear market. Growth stocks do best in early bull markets. That’s when excitement is high. Prices can double or more! Value stocks, though, get their turn. When the market slows or drops, they get the spotlight. That’s because they have strong basics like steady earnings. They last through tough times.

The Influence of Inflation and Interest Rates on Growth and Value Stocks

Now, inflation and interest rates can mess with your stock picks. They’re like the weather for stocks. When inflation is high, money’s worth less. Each dollar buys less bread or a bike or a car. High inflation can hurt growth stocks. People worry and sell them. Value stocks get more love then. They have real assets, solid stuff. They keep value even when dollars don’t.

Interest rates work with banks. High rates mean loans cost more. So, people buy less, and companies slow down. Growth stocks feel this hard. They need loans for big ideas. So, when rates go up, growth stocks may stumble. But, once again, value stocks stand firm. They don’t rely much on loans. They have the cash.

For smart timing, watch these clues:

- Economy health: More jobs and sales? Growth might be your best bet.

- Interest rates: Going up? Value stocks could be safer.

- Inflation rate: High? Look to value stocks to hold strong.

Remember, no one times the market perfect. But, knowing these signs helps. Think of it like picking a good day for a picnic. Check the weather first. For stocks, check the economy, rates, and inflation. Then, make your best bet. Always think of the long run. Short wins can thrill, but steady gains build wealth over time. Choose stocks that fit your goals. And, don’t chase after the crowd. Be smart and patient. That’s how you win in stocks.

Investment Strategies: Growth or Value Stocks?

Long-Term Investment Strategies vs. Short-Term Market Trends

We often face a common dilemma. Should we chase short-term market trends or stick to a long-term investment strategy? I say it’s a mix of both. But how do we decide?

First, you need to know your end goal. Do you want quick gains or a pot of gold years from now? Long-term strategies favor patience. They rely on strong company growth over years. Short-term trends can offer fast cash. Yet, they often come with higher risk.

The stock market cycles play a huge role. In a bull market, when things look up, growth stocks might soar. They can grow fast and make you money. In a bear market, it’s often better to find value stocks. They’re like hidden gems, sold for less than they’re worth.

Economic indicators for stock selection are your best friends here. They tell you how the market’s doing. High growth sectors can signal where to aim for growth stocks. PE ratio evaluation helps too. It shows if a stock is cheap or pricey. Assessing company value is key. Look for firms with strong futures.

Warren Buffett’s Investment Philosophy and Its Application

Warren Buffett loves a good value stock. But what makes his picks stand out? He looks for a sustainable competitive advantage. That means the company can beat its rivals for a long time. He loves a high return on equity too. This shows the company earns well with what it’s got.

Buffett talks a lot about the price to book value. If it’s low, you might have found a value stock. He waits for the right price. He’s patient. And he’s not scared of bear markets. He sees them as sales on great companies. That’s how he built his wealth.

He’s not a fan of chasing hot trends or quick money. Buffett’s choice? Solid companies at fair prices. Stick with them for years. They’re the ones that tend to pay off big.

Using his ideas means we put our money in firms with long tracks. We look for those that keep making money, no matter what. It’s not about getting rich quick. It’s about building wealth slowly, with less risk.

Remember, stock market timing is tough, but not impossible. Understand the investment horizon. Mix it with fundamental analysis and a dash of technical analysis. Keep an eye on the economic growth impact on stocks. Watch inflation. It can eat into your stock profits. And always check those interest rates. They can change the whole game.

Finally, keep tabs on the corporate earnings reports. They give you the inside scoop on a company’s health.

And there you have it. Mix the lessons from long-term growth strategies and Warren Buffett’s wisdom. You’ll navigate the growth and value stock debate like a pro. Choose wisely, invest wisely, and most importantly, stay informed. Happy investing!

Risk Management and Portfolio Diversification

Assessing Risk Tolerance and Financial Goals in Stock Investing

Let’s talk about risk and dreams when picking stocks. First, your risk comfort level is key. Are you okay seeing some ups and downs in your investments? Or do you like things steady? Your choice may lead you to growth stocks or value stocks.

Timing market investments means knowing when to act. You watch stock market cycles and find the best times to buy. When growth is fast in the high growth sectors, growth stocks shine. If you’re aiming for big, quick earnings, they are your go-to. For long-term goals, you may eye blue chip stocks. They have strong records and often pay dividends.

A balanced portfolio uses both growth and value picks. Look at economic indicators for stock selection. They help tell you what to pick and when. Growth stocks can soar when the economy is buzzing. Value stocks can be safer when things look shaky. But they can also leap when the market turns up.

Market Volatility and Sector Rotation: Balancing Growth and Value Stocks in a Portfolio

The stock mix in your plan needs care. You must keep up with short-term market trends and sector swings. Growth areas like tech stocks may jump high, but they can also fall fast. Assessing company value guides you to add solid stocks to your mix. Stocks that can stand firm when the wind blows.

Market volatility touches all stocks. But some like value picks based on low PE ratio evaluation hold up better. Growth picks rise when profit margins are up. Yet, when the market stirs, value may be your rock.

Folks often think it’s all or nothing – all growth or all value. Not true. Balance is the word. You rotate sectors, mixing in tech for the zip and blue chips for the steady drip of returns. It’s a bit like a weather vane. It spins with the wind, pointing to where your money could grow next.

A bull market loves growth stocks, they run with good news. In a bear market, value stocks may offer safety nets. Think of stock diversification as a safety belt. It holds you tight during market bumps.

To wrap up, when you set your plan, blend growth’s sparkle with value’s steady glow. Watch the markets, and remember, it’s balance that keeps your money journey smooth. Keep loss at a distance, and aim for the stars, in your own safe way. Choose growth when the goings are good, tread with value when caution calls.

In this post, we tackled growth versus value stocks, key terms every smart investor should know. We looked at how to tell them apart and the vital signs like PE ratios. We dove into market timing, reading economic hints, inflation, and rates to make better choices.

We also weighed long-term plans versus quick trends and peeked into Warren Buffett’s smart moves. Lastly, we covered balancing risks and spreading out investments to stay steady no matter the market twirls.

To cap it off, investing is a game of smarts, timing, and guts. Keep learning, stay alert to shifts, and balance your bets. Whether you choose growth, value, or both, know your stuff and invest with confidence. Play it right, and watch your wealth grow.

Q&A :

What are the key indicators for investing in growth stocks over value stocks?

The decision to invest in growth stocks over value stocks depends on several key indicators, such as the current market environment, the investor’s risk tolerance, and investment goals. Growth stocks typically exhibit high earnings growth rates, expanding market shares, and innovative product offerings, but they can also be overvalued and more volatile. It’s essential to look at the company’s historical performance, projected earnings, and industry trends to make a well-informed decision.

How can an investor decide between value stocks and growth stocks in their portfolio?

An investor must consider their investment horizon, risk appetite, and financial objectives before deciding to allocate funds between value and growth stocks. Value stocks are often underpriced relative to their fundamentals and have the potential for steady gains, while growth stocks offer the opportunity for higher returns albeit with increased risk. Diversification across both types, possibly using a balanced or targeted investment approach, can mitigate risks while providing exposure to the growth potentials of both categories.

When is the optimal time to invest in value stocks?

The optimal time to invest in value stocks often materializes when the market is in a downturn, or specific sectors are experiencing temporary challenges. During these periods, investors can find well-established companies trading below their intrinsic value due to short-term market overreactions. It’s also important to assess economic indicators and consider whether a low market valuation is due to temporary factors versus long-term decline. A comprehensive analysis of a company’s balance sheet, earnings, dividend yield, and P/E ratios, along with broader market conditions, can guide these investment decisions.

Are there certain market conditions that favor growth stocks?

Certain market conditions tend to favor growth stocks, such as periods of low-interest rates, economic expansion, and technological innovation. During these times, growth companies that reinvest their earnings back into the company can capitalize on the environment to expand their operations rapidly. Additionally, investors’ increased risk appetite during bullish markets often leads to a preference for the higher return potential of growth stocks. Monitoring macroeconomic indicators, such as GDP growth and interest rate trends, can help predict favorable conditions for growth investing.

What role does an investor’s time horizon play in choosing between growth and value stocks?

An investor’s time horizon is a critical factor in the decision between growth and value stocks. For those with a long-term investment horizon, growth stocks can be attractive, as they may yield substantial returns over many years. Shorter-term investors or those nearing retirement might lean towards value stocks, which pose less risk and can offer steady dividends. Regardless of an investor’s timeline, it’s important to align stock selection with personal investment strategies and the potential for market fluctuations over the time period in question.