I’ve watched The Rise of Impact Investing transform the financial landscape. Investors are no longer just chasing profits; they want their money to make a positive mark on the world. It’s a move that intertwines cash with conscience. I’ll break down this trend that’s changing how we think about investments. Gone are the days where returns were the sole focus. Now, it’s about weaving in environmental, social, and governance (ESG) criteria to shape where money can do good. It’s a win-win: robust portfolios with real-world impact. Dive in as I unveil the compelling reasons why impact investing is not just a wise choice, but a necessary shift for modern portfolios.

Understanding the Fundamentals of Impact Investing

Exploring ESG Criteria and Impact on Investment Choices

Impact investing changes game rules. It says you can make money, do good. It’s powerful, right? This shift isn’t just good vibes; it’s about strong, sound ESG criteria guiding our money smartly. ESG stands for Environmental, Social, Governance. It means we look at a company’s care for Earth, its team, and how it runs its show. This trio matters as much as the green cash it can make.

Investing once cared for profits alone. Now, ESG flips this idea on its head. We ask, “Can we keep trees tall, air clean, and folks happy while getting rich?” The answer is a driving force for change. It’s yes.

Look around. More companies set clear ESG goals. They know it pays off. People, young and old, want products and work that mirror their hearts. They pay more, stay loyal to brands that get ESG right.

But there’s a trick. It takes work to tell if a company truly shines in ESG. Some may just talk a good game. So, investors use tools and teams to dig deep. We have to. Our world’s health and wealth hang in the balance.

Unpacking the Benefits of Impact Investing for Modern Portfolios

The perks of impact investing are big and clear. You get to back the change you want to see. Feels good, but it also makes dollars and sense. Here’s why.

First, risk drops. Think about it. A company that treats Earth and people well is thinking long term. It’s ready for new laws that protect our blue and green ball. It can ride storms better than firms that don’t think ahead.

Next, there’s growth. Sectors that score high on ESG – like clean energy or health care – are booming. They’re the future. A slice of your cash in these areas means you grow with them.

And it’s not just about the big picture. Local is key, too. Impact investing can pump cash into towns and cities. It puts up schools, clinics, homes where they’re needed most. Good jobs follow. People with jobs make towns better, buy more, lifting everyone up.

But here’s the special bit. This kind of investing counts more than just cash. It asks, “What’s the good beyond the bank?” Social return on investment, SROI, is that measure. It counts things like health, learning, and safety. All that jazz that makes life worth living.

So, picking where to put your money means more now. It shapes our home, feeds our spirit. It’s no fairy tale. Hard facts, sharp analysis guide us. And truth told, investing this way, with eyes wide, heart open, usually hits the jackpot. Not just for me, you, but for all of us. That’s a win we can all bank on.

The Evolution and Expansion of Impact Investment Strategies

Delving into Sustainable Investment Strategies and Green Bonds

Investing isn’t just about making money anymore. It’s about doing good while doing well. Impact investment trends show more folks want this. They want profits with a clear conscience. That’s where sustainable investment strategies come in. They’re like a map for folks who want to invest with their hearts and heads.

Green bonds are a big deal now. Think of them as a promise. When you buy a green bond, you lend money to projects that help our planet. It could be solar power, clean water, or even making buildings use less energy. And here’s the kicker: they pay you back with interest. It’s a win-win. You help the earth and your wallet.

Examining Social Impact Funds and Ethical Investment Options

Let’s switch gears to social impact funds. They are like teams. Teams that take your money and use it to back companies that do good stuff. We’re talking education, health, housing – things that make life better for folks. And guess what? These companies can also make money. So your investment works double time.

Now, ethical investment options set the rules of the game. They help you make sure your money stays clean. These options don’t just look at profits. They look at how companies behave. Do they treat workers well? Do they care for the environment? This matters more now than ever.

So what’s the bottom line? Impact investing is not just a trend. It’s a revolution. It’s changing the way we think about money and meaning. And it’s here to stay.

Measuring Success in Impact Investing

Navigating Social Return on Investment and Impact Assessment Tools

Impact investing is all about making money while doing good. We look at both profit and the good it brings. The value given back is “social return on investment” or SROI. It shows how much social good every dollar creates. Think of it like a report card on helping people and the planet.

To measure success, we use tools. These tools check on the good impacts of our investments. They look at things like how much waste is cut, or if jobs are made. This lets us see if we are really making a difference. When we invest, we want to know our money is used well to solve big problems.

The Role of Global Impact Investing Networks in Evaluating Performance

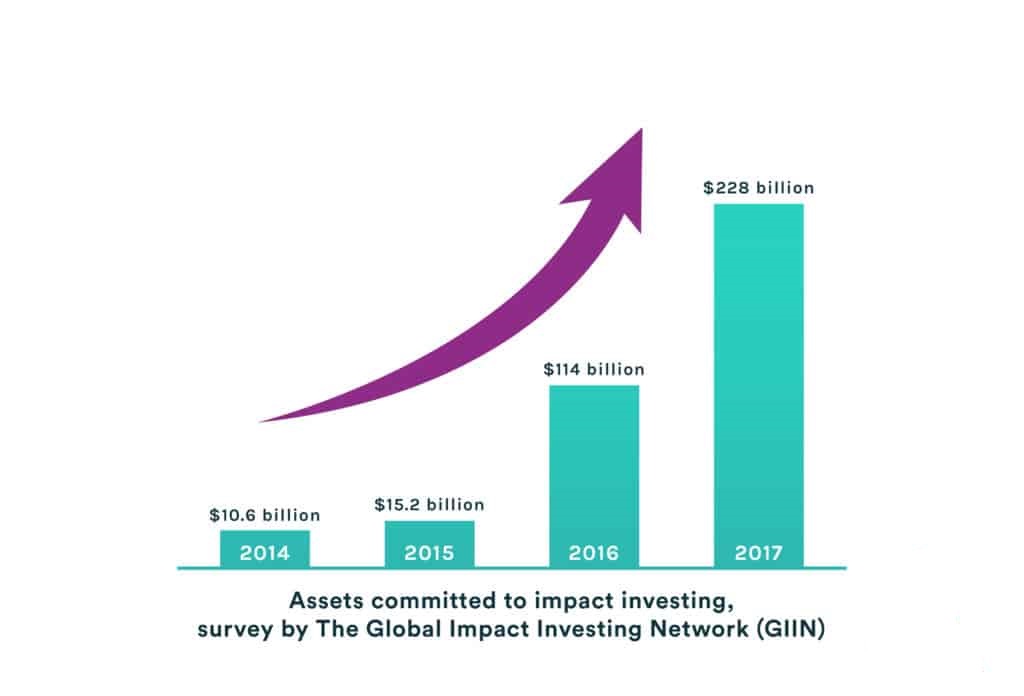

Now let’s talk about teams that connect impact investors everywhere. One key team is the Global Impact Investing Network. They share rules on good impact investing and give data on what works best. They help us judge our success and guide where to invest next.

They bring people together to learn from each other. With their help, an investor in New York and another in Nairobi can work together. They can share tips and grow impact investing around the world.

Being good at impact investing means taking the time to learn and use what works best. It’s not just about money. It’s about change for the better; for people and our home, Earth. With good tools and friends around the world, we can make a huge difference.

Beyond Profit: Impact Investing’s Influence on Society and Environment

Linking Financial Returns with Social Impact for Holistic Growth

Money talks, and nowadays, it speaks of change. Impact investing is making waves, and here’s why: it marries making money with making a difference. Think about it. Your investments can bloom, and so can the world around you. You put your dollars to work — not just in your pocket but in people’s lives too. We’re talking education, clean water, and good health for all.

Impact investing isn’t a side gig for your cash. It’s a main act, pushing for real results. We see businesses sprout that care for profit and the planet. This shift is big — investors of all kinds jump in. Folks like you and me, all the way to huge funds. Everyone’s eyes are open to the power of impact investing.

Yet, the main question is: Can your investment really grow while doing good? The answer is a strong yes. How do I know? Here’s what I’ve seen: companies that follow ethical rules often do better. They think long-term and dodge risks linked to shady practices. Plus, people want to buy from and work for places that do right by the world.

Realizing Sustainable Development Goals through Responsible Investment Practices

Let’s zoom out and see the bigger picture. The world has set goals — Sustainable Development Goals. These are our to-dos to fix global issues, like hunger and climate change. Investors play a key part in this. When investments flow into good causes, these goals inch closer to reality.

We’ve got wind farms, solar panels, and schools popping up, thanks to investors who get it. They’re not just dreaming of a greener world; they’re building it, one dollar at a time. This isn’t just talk; it’s action. It’s people putting money behind their hopes for the future, and it’s working.

I’ll let you in on a secret: doing good pays off. Green bonds are a smart pick. They fund projects like renewable energy. This means more jobs, fewer greenhouse gases, and a stronger economy. It’s a win-win if you ask me.

Here’s another thing: companies can’t just say they’re green. They have to prove it. There are rules, checks, and reports. None of this “We’re good for the earth, trust us” without the receipts. This helps you, the investor, see where your cash is going, and the good it’s doing.

In the past, making money was all about the bottom line. Now, there’s a different kind of bottom line — one that counts in people and the planet. It’s called the triple bottom line. It’s not just talk; it’s about action and real change.

As an investor, you’ve got power. The power to pick where your money goes, and to choose the kind of world you want. Impact investing is a big deal; it’s reshaping how we think about cash and conscience. It shows a simple truth: doing good can also mean doing well financially. Now that’s something to get excited about.

In this post, we dived into impact investing and its power to change the world. We started by understanding the basics, how ESG criteria guide where money goes. We saw how this kind of investing can boost modern financial portfolios. Then, we looked at how impact investing has grown. We learned about green bonds and funds focused on doing good. This isn’t about just money; it’s about making a positive mark on society and our planet.

We also covered how to tell if these investments are working. Tools for measuring social return help investors see the difference they make. Networks around the world guide us in judging our success.

Lastly, we tied it all together. Impact investing lets us link our cash to causes we care about. It shows us how we can reach global goals for a better future.

I believe we’re at a tipping point. Money talks, and where we put it can shout for change. Impact investing is not just a trend; it’s a shift in thinking for a better, fairer world. Let’s be the investors who think beyond profit, for our future’s sake.

Q&A :

What is Impact Investing and why is it gaining popularity?

Impact investing refers to investments made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return. This dual-purpose investment strategy is gaining popularity as more investors seek not only financial rewards but also to make a positive contribution to society or the environment.

How does Impact Investing differ from traditional investing?

Impact investing stands apart from traditional investing by prioritizing tangible positive impacts on society or the environment alongside financial gains. While traditional investing typically focuses on the financial return exclusively, impact investors aim to support businesses and projects that align with certain ethical values or social benefits, creating a broader value proposition.

What kind of returns can one expect from Impact Investing?

The returns from impact investments can vary widely, depending on the project, sector, and individual investment vehicle, and can range from below-market to market-rate returns. However, the underlying goal is to achieve a balance between social/environmental outcomes and financial performance, with the understanding that the impact achieved is an integral part of the return on investment.

Who can participate in Impact Investing?

Impact investing is accessible to a broad range of investors, from individuals and families to institutions and funds. The entry points and investment mechanisms may differ, with opportunities available across public and private markets, and through various types of financial instruments and fund structures designed to cater to different investor profiles and goals.

What sectors are most commonly associated with Impact Investing?

The sectors most commonly associated with impact investing include sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services such as healthcare, education, and housing. These sectors are targeted due to their potential to address key social and environmental challenges while also providing economic opportunities.