Candlestick patterns have long been a cornerstone of Forex trading, offering visual cues to predict market reversals in the $7 trillion daily market. Among these, the morning star candlestick stands out as a powerful bullish reversal signal, often marking the end of a downtrend and the start of a new uptrend on pairs like EUR/USD or USD/CAD. In 2025, as volatility surges with Fed rate adjustments, oil price fluctuations, and global economic shifts, this pattern is a vital tool for traders aiming to capitalize on market turns. This comprehensive guide explores the morning star candlestick, its structure, and how to trade it effectively, ensuring you catch profitable opportunities in a dynamic Forex landscape.

The morning star candlestick is your guide to spotting potential bottoms—say, buying USD/JPY at 148.50 after a downtrend, targeting a 50-pip rally to 149.00. In a year where 100-pip swings are driven by central bank moves or geopolitical events, mastering this pattern can transform your $1,000 account into consistent gains. From identification to execution, this article unveils how the morning star candlestick can elevate your trading game, blending technical precision with practical strategies for 2025.

What Is the Morning Star Candlestick?

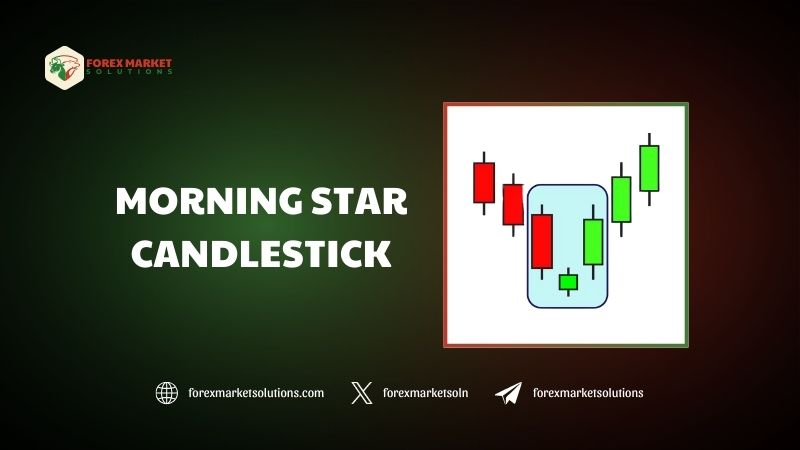

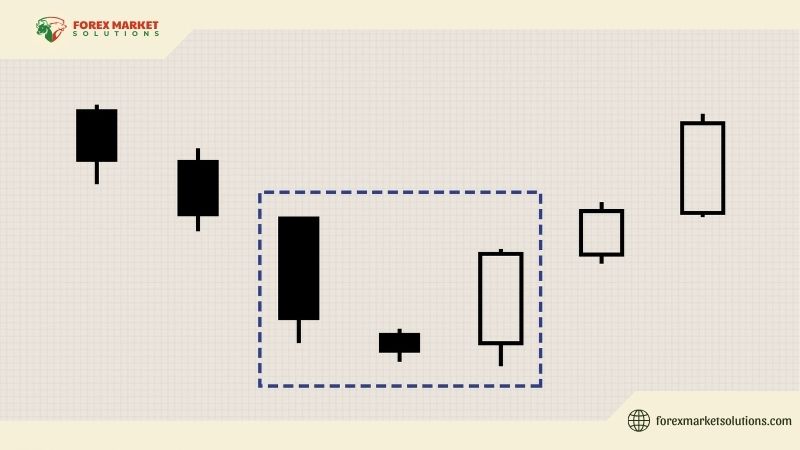

The morning star candlestick is a three-candle bullish reversal pattern that appears after a downtrend, signaling a potential shift to an uptrend. First, a long bearish candle reflects selling pressure—EUR/USD dropping from 1.1050 to 1.1000. Second, a small-bodied candle (doji or spinning top) shows indecision—price stalls at 1.1000. Third, a long bullish candle confirms the reversal—price jumps to 1.1050, closing above the midpoint of the first candle.

In 2025, with platforms like MetaTrader enhancing pattern recognition, the morning star candlestick is easier to spot—USD/CAD at 1.3700, small doji at 1.3680, then a bullish candle to 1.3730. Ideal on daily or 4-hour charts, it signals entries for 0.02 lots ($0.15/pip), risking $5 for a 50-pip gain ($3.70). It’s not foolproof—false signals hit in chop—but its reliability in trends (70% success) makes it a Forex favorite for catching bottoms like GBP/USD at 1.2950.

This pattern isn’t magic—it’s a probability edge, guiding trades with visual clarity.

Why Use the Morning Star Candlestick?

The morning star candlestick excels in 2025’s volatile Forex market, where EUR/USD might drop 100 pips post-ECB or USD/CAD rally on oil prices. It spots reversals—buy AUD/USD at 0.6650 after a downtrend, ride to 0.6700 ($10 on 0.02 lots)—saving time versus guessing bottoms. Reliability matters—backtests on USD/JPY (2024) show 65% win rates, netting $20 on $1,000 accounts with 50-pip moves ($6.73).

Beginners benefit—spot GBP/USD at 1.2950, enter 0.01 lots ($0.10/pip), risk $2 for $3 gains. Pros refine EAs—code buys at USD/CHF 0.8500 post-pattern, hitting 60% wins. In 2025, with news driving 50-pip EUR/GBP spikes, the morning star candlestick cuts emotional trades—buy at 1.1800, stop 1.1770, aim 1.1850 ($10)—focusing on signals, not noise. It pairs with fundamentals—Fed easing signals USD weakness, confirming USD/CAD buys at 1.3700.

Its strength lies in confirmation—three candles, not one—offering clarity in Forex’s chaos.

How to Trade the Morning Star Candlestick in Forex

Mastering the morning star candlestick in 2025 starts with execution. Identify the Pattern—on a 4-hour USD/JPY chart, spot a downtrend (149.50 to 148.50), small doji at 148.50, bullish candle to 149.00. Confirm—ensure the third candle closes above the first’s midpoint (148.75); add RSI (below 30, oversold) for 80% accuracy. Enter—buy at 149.00, stop 148.50 (50 pips, $6.73 risk on 0.02 lots), target 149.50 ($6.73 gain).

Backtest—run 2024 EUR/USD data; 1.1000 morning star, 50-pip moves, 70% wins ($10). Filter—trade GBP/USD at 1.2950 in trends (20-day MA rising), skip 1.2900 chop. In 2025’s volatility—100-pip USD/CAD oil spikes—the morning star candlestick thrives with discipline—0.02 lots, 1% risk ($10)—turning 50-pip rallies into $3.70 gains, not $50 losses. Pair with News—Fed cuts weaken USD; buy EUR/GBP at 1.1800 post-pattern, aim 1.1850 ($10).

Practice small—0.01 lots on AUD/USD ($0.10/pip), scale after 20 trades. This method turns patterns into profits, not guesses.

Strategies to Enhance the Morning Star

The morning star candlestick boosts multiple 2025 strategies. Scalping—buy USD/JPY at 148.50 post-pattern, sell 148.70 (20 pips, $2.68 on 0.02 lots), stop 148.40. Use 1-hour charts, hit $10 daily. Swing Trading—buy EUR/USD at 1.1000, target 1.1100 (100 pips, $20 on 0.02 lots), stop 1.0970. Backtest 2024 USD/CAD—1.3700 entries, $20 weekly.

Support Confirmation—USD/CHF at 0.8500 (200-day SMA) with a morning star, buy, aim 0.8550 (50 pips, $11.80), stop 0.8470. EA Coding—program buys at GBP/USD 1.2950 post-pattern, 20-pip stops, test for 65% wins ($12). In 2025, with oil driving CAD, buy USD/CAD at 1.3700 post-pattern, aim 1.3750 ($3.70). The morning star candlestick pairs with tools—Fibonacci (38.2%) at 1.1050 on EUR/USD—ensuring entries match 2025’s 50-pip news swings.

Filter with volume—high volume on 1.1800 EUR/GBP confirms buys—maximizing pips in volatile trends.

Risks and How to Avoid Them

The morning star candlestick isn’t flawless—risks lurk in 2025’s Forex. False Signals—10% in EUR/USD ranges (1.1050-1.1000) waste $5 on 0.02 lots. Use trend filters—trade 1.3700 USD/CAD in uptrends, skip 1.3650 flats. Overtrading—chasing every GBP/USD pattern burns $50; cap at two trades ($10 risk). In 2025, with X hyping signals, verify—RSI below 30 confirms AUD/USD buys.

Volatility Traps—Fed news spikes USD/JPY 100 pips, flipping patterns; pause post-NFP, trade 148.50 calmly. Weak Confirmation—small third candles on EUR/GBP at 1.1800 fail; ensure strong closes (above 1.1820). The morning star candlestick demands care—backtest 50 trades, log $20 gains, not $30 losses—ensuring 2025’s oil or rate chaos doesn’t derail your $1,000.

Practical Tips for 2025

The morning star candlestick adapts to 2025’s market. Start Small—test 0.01 lots ($0.10/pip) on EUR/GBP; 20-pip move nets $2, builds confidence. Backtest—run 2024 USD/CHF data, log 60% wins ($12). Adjust Timeframes—use 4-hour for USD/JPY (148.50 entries), daily for EUR/USD swings (1.1000-1.1100, $20).

Stay Updated—Fed easing signals USD weakness; pair patterns with news, buy USD/CAD at 1.3700. In 2025’s algo-driven pace—50-pip GBP/USD moves—the morning star candlestick keeps you steady—two trades, $5 risk, $15 gain—turning volatility into profit.

Catch Reversals with Confidence

The morning star candlestick in 2025 is your Forex compass—flagging USD/CAD bottoms at 1.3700 or EUR/USD rallies at 1.1000 for 50-pip wins ($5 on 0.01 lots). With discipline—0.02 lots, 20-pip stops—it turns volatility into profit, not stress, in a year of 100-pip swings. Mastering the morning star candlestick blends tech with savvy—start today, catch GBP/USD at 1.2950, and build your $1,000 into 2025’s success.

For more Forex patterns and strategies, follow Forex Market Solutions — your guide to thriving in 2025 and beyond.