The world of money moves fast, and leading fintech payment platforms are changing the game. Gone are the days of bulky wallets and waiting in bank lines. Now, a few taps on a phone can send cash across the globe. We’re diving headfirst into this digital revolution, exploring the tech that makes safe, quick, and easy payments possible. Join me as we unravel the rise of mobile wallets, the spread of touch-free transactions, and the tech that’s shaping our financial future. From contactless cards to blockchain buzz, we’ve got the scoop on the shifts that are redefining the way we transact. Get ready to discover how these platforms aren’t just keeping up but are driving the charge towards a world where paying is a breeze.

Demystifying the Current Landscape of Fintech Payment Platforms

The Rise of Mobile Payment Platforms and Digital Wallet Trends

If you’ve shopped online or grabbed coffee lately, chances are you’ve noticed more folks paying with their phones. These are mobile payment platforms. These tools let you carry your money right on your phone. No more digging in wallets or purses for cards!

Now, why do mobile payment platforms matter? They make buying fast and safe. Think of buying a cool toy, just a few taps on your screen — and done!

But what’s the tech behind it? It’s the digital wallet trends pushing us forward. Apps like Apple Pay or Google Wallet store your card info safely. Then, when you’re ready to pay, they use it to send the money.

This way of paying is growing fast! Merchants love it too, because it’s quick and safe for everyone. This leads us to wonder how these platforms will evolve next.

Embracing Contactless Payment Adoption and Its Global Impact

Contactless payments, like Apple Pay, are booming worldwide. The idea is simple: tap your card or phone and pay. No swiping, no PINs, no fuss. What’s cool is you don’t wait. It’s quick.

The global impact? Huge. In many countries, folks are skipping cash and even cards. They just tap and go. It helps lines move faster and lets stores serve more people.

But contactless payment is also about safety. It reduces the chance of lost or stolen cards. A quick tap, and your info stays with you.

Plus, contactless payment is about trust. When you tap to pay, top-notch security works in the background. This makes sure your money stays with you. Shops get their pay, and you keep your peace of mind.

Watching both mobile and contactless payments grow is exciting. These tools are not just about shopping. They’re shaping how we think about, handle, and even define money. They’re part of our daily lives now more than ever.

And there’s more ahead. As people and shops get comfy with these fintech transaction services, we’ll see even more cool stuff. Think faster, safer, and even more ways to pay.

Prepare to say goodbye to old-school payment methods. Leading digital payment solutions are not just the future. They’re the now. And they’re thumbprint easy to use!

So, next time you’re about to buy or sell, think about this. Are you tapping into today’s top online payment systems? They’re ready to make transacting smooth and worry-free.

Remember, the key word here is ‘evolution.’ Mobile payment platforms, digital wallet trends, and contactless payment adoption are more than buzzwords. They are part of a revolution, shaping how we exchange value each day. We are moving towards a world where transactions are lightning-fast and as common as saying hello.

Keep your eyes open. The world of payments is spinning fast, and it’s thrilling to be part of this change.

Innovations Shaping Tomorrow’s Payment Processing Technology

Unpacking Real-Time Payment Processing and Its Benefits

Think about buying a coffee and the payment zips through before you sip. That’s real-time payment processing. It speeds up money movement. Funds transfer in seconds. This tech is big for businesses and shoppers. Everyone loves a quick deal.

Real-time payment processing means we wait less. Companies turn profit faster. They also manage money better. Customers smile when transactions don’t lag. Imagine sending cash to a friend and it shows up right away. That’s real-time at work. It’s about making cash flow quick.

Everyone asks, why is it useful? It makes life smooth. Bills get paid on time. No late fees catch you off guard. Shop owners see sales in their account at once. It can really help during tough times when every second counts.

The Role of Tokenization and Secure Payment Services in Fintech

Now let’s talk safety. Ever heard of tokenization? It’s keeping your card safe online. Each time you buy, a unique code represents your info. Even if hackers strike, they find useless tokens, not real card details. Super smart, right?

Tokenization secures every swipe, tap, or click in digital buys. Your details stay hidden. You shop without worry. Stores prefer it too. They have less risk to deal with. It’s a shield for everyone’s cash. This is how fintech fights fraud while we shop from our sofas.

People often wonder, does tokenization change the way we shop? Yes, it does. It builds trust. When we feel secure, we enjoy shopping online. We return to apps and services that protect our info. Plus, merchants rest easy knowing both sides win.

Tech is taking our money handling to new heights. Leading digital payment solutions make our lives easier. From paying rent to buying games online. Look for leading mobile payment platforms. They offer neat features and high security.

Payment processing technology is now a part of our daily lives. We use innovative payment technologies without a second thought. They help us grab lunch, get rides, and watch movies. Fintech transaction services have grown important. They must stay quick and safe.

The top online payment systems know this. They work hard to scale up without hiccups. Scalable payment gateways mean even small shops can serve more folks. And they ensure everyone enjoys secure payment services fintech offers.

As we move forward, we’ll keep seeing better tools. Digital wallet trends keep changing, and so does payment infra modernization. We’re part of a world where finance and tech mix to make magic. A world where buying a toy or trading across borders takes just a tap.

This is just the start. There’s much more to explore in payment tech. Keep your eyes peeled for peer-to-peer payment apps and more. Businesses are matching pace with financial technology advancements. They want to give us user-friendly payment interfaces. And behind the scenes? They count on payment analytics tools. These tools help businesses understand how we buy and sell.

Open banking and payments also bring about change. They free up our financial data. This helps create new services for us. Imagine mixing and matching bank services like LEGO. That’s open banking for you!

In all, these advances transform how cash flows. We can expect exciting times ahead in the realm of payment tech.

Cross-Industry Insights: How Payment Solutions Are Evolving

Exploring Cross-Border Payment Solutions and API-Driven Integrations

Cross-border payment solutions have changed how we do business worldwide. They let people and companies send money across the world quickly and often cheaper than before. Let’s break down what’s going on behind the scenes.

Why are these global payment options a big deal? First, they are fast. You send money and boom – it arrives on the other side of the world. This wasn’t the case years ago. Delays were common, and costs were high. Now, thanks to fintech transaction services, we’ve cut out the long waits.

APIs, or application programming interfaces, make these fast services possible. They let different computer systems talk to each other. This means banks and fintech can work together to move your money safely.

To give you a type of real-time example: when you buy a product from a country far away, the payment could pass through several banks along the way. But, with fintech’s help and the right payment processing technology, this becomes one smooth journey.

The Synergy Between Omnichannel Experiences and Enterprise Payment Platforms

In retail, the game has changed. No longer do you just walk into a shop, pick a thing, pay, and leave. Now you browse online, maybe test it in-store, and pay with your phone’s mobile payment platforms.

Omnichannel means being where the customers are, on any device, anytime. And here is where it gets good: enterprise payment platforms make this a breeze. They link all these ways to shop and pay into one easy system.

Imagine buying shoes online. You try them on in the store later and decide to buy them. The shop can see you started shopping on your phone. This is all possible because of scalable payment gateways that link everything together.

This isn’t just for big shops, though. Small businesses also get the same cool tools from leading digital payment solutions. They can act big, offering you ways to pay anyplace, anytime.

And it’s secure, which matters a lot. Your card details stay safe because of innovative payment technologies like tokenization. It turns your card number into something that’s not worth stealing. Even if someone got it, they couldn’t do much with it.

All this is to say, payments are not just about moving money. They’re about the experience – smooth, safe, and fitting into your life. Fintech is leading this charge, taking us into a world where paying is the easiest part of shopping.

Your small restaurant takeout or that dress from another country – fintech makes them feel local. And the cool part? This is only the start. As tech gets smarter, so will your ways to pay. Better hold on, because it looks like a fun ride ahead.

Navigating the Regulatory and Security Paradigm in Payment Technologies

Compliance Challenges: Digital Payment Regulations and Secure Transaction Environments

Leading digital payment solutions face tough rules. Each country has its own laws. Staying legal takes hard work. Mobile payment platforms must protect user data. This is not easy but is key for trust.

Top online payment systems make sure they follow these laws. They use scalable payment gateways. This helps them grow without risk. Secure payment services fintech works day and night. They aim to keep every dime safe.

Payment processing technology has to evolve. They face new laws all the time. Fintech transaction services put security first. This helps users know their money is safe. It’s critical in an online world.

Digital wallet trends show more people pay with their phones. So, the contactless payment adoption rate is high. More people wave their phone, not their card. This change needs new rules to keep it safe.

Peer-to-peer payment apps now need to be extra careful. They use innovative payment technologies. This must meet strict rules too.

Cross-border payment solutions also face compliance hurdles. Different countries, different rules. Fintechs must know them all and play fair.

Enterprise payment platforms handle big money. So, they need to get the law right, every time. The stakes are high!

Payment infrastructure modernization is ongoing. Everyone wants easy but safe ways to pay. Tech keeps moving forward.

Financial technology advancements offer hope. They help us follow rules in smarter ways. Merchant services fintech also helps businesses keep up.

E-commerce payment integration is becoming a standard need. Online stores should offer a safe, fast checkout.

Mobile payment security is a focus area. Everyone carries a phone. Top fintechs make sure threats stay low.

Real-time payment processing is another area to watch. Speed is great, so long as it’s secure.

User-friendly payment interfaces are a must. People want it easy, but they also want it secure.

Advanced Fraud Prevention: Leveraging AI and Machine Learning in Payment Security

Fraud can break a bank. So, securing fintech is a top job. Using artificial intelligence in payments helps. AI spots fraud before it happens. Machine learning payments systems learn from each fraud try. This makes them smarter every time.

Tokenization in payment systems is a smart move. It hides real card details. This makes data theft hard.

Payment analytics tools offer insights. They show patterns in how money moves. This helps catch bad actors.

Open banking and payments go hand in hand. Open systems share data. This needs strong checks to keep safe.

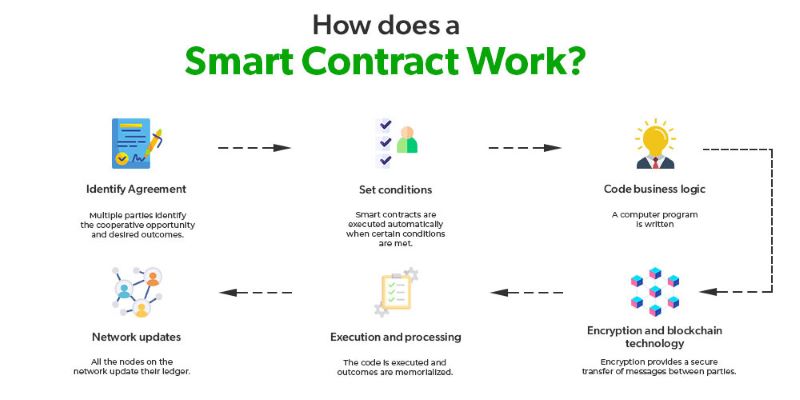

Blockchain payment systems can track each coin. This tech holds promise for safer payments.

Cryptocurrency payment platforms are new kids on the block. They too need to keep user trust.

Regulatory compliance payments are a big talk point. Fintechs need to follow the rules, or they close shop.

Digital payment regulations guide how money moves online.

API-driven payment solutions make different systems talk to each other. This needs tight security.

Subscription management fintech helps you pay bills without sweat. Automated billing systems need to handle data with care.

Point of sale innovations change how we pay in stores. This new tech also needs to follow the law.

Omnichannel payment experiences blend online and offline shopping. This needs a secure path across all.

Payment fraud detection uses systems that keep an eye out. They try to spot trouble before it strikes.

Machine learning payments learn and improve over time. They look for fraud in places we can’t see.

Artificial intelligence in payments is not just a cool idea. It’s now a key guard against fraud.

In the world of payment technologies, staying ahead in security and obeying the law are not just goals. They’re what keep the industry alive and kicking.

We’ve explored the fast-changing world of fintech and how we pay for things. From the rise of mobile wallets to the spread of contactless pay, we see tech shaping our money moves. Real-time payments and token security are big wins for us all. They make everything quicker and safer.

Cross-border deals and APIs are joining up the dots of our shopping experience. They make it a breeze to buy from anywhere. And with one-click, we are done, no matter the store or platform.

We also can’t ignore the rules and safety steps in payments. Staying safe and within the law is tricky but smart tech like AI is lending a hand.

So, what’s next? Our wallets are going digital, and our payment tools are smarter than ever. This is exciting for shoppers and businesses alike. Keep your eyes open for what’s coming, and always think about safety with your money. Trust in tech is good, but stay sharp. Let’s embrace this world of new payment possibilities!

Q&A :

What are the top leading fintech payment platforms currently dominating the market?

Several fintech platforms have gained prominence in the digital payments space. Some of the leading ones to consider include PayPal, Square (now Block, Inc.), Stripe, and Adyen. These platforms have revolutionized the way businesses and individuals conduct transactions, offering a range of features from mobile payments to e-commerce integration.

How secure are transactions on leading fintech payment platforms?

Security is a top priority for fintech payment platforms, as they utilize advanced encryption technology and comply with industry-standard security regulations such as PCI DSS. Many of these platforms employ additional measures like two-factor authentication (2FA), real-time fraud monitoring, and secure tokenization to protect users’ sensitive information and transaction data.

What are the unique features that set leading fintech payment platforms apart?

Each leading fintech payment platform offers a set of unique features tailored to different user needs. For example, some may offer no-fee transactions, real-time processing, or specialized tools for subscription management and invoicing. Others distinguish themselves with extensive global reach, multi-currency support, and seamless integration options for online businesses.

How do leading fintech payment platforms handle international transactions?

Leading fintech payment platforms usually facilitate international transactions by supporting multiple currencies and offering competitive exchange rates. They work to reduce fees associated with cross-border transactions and streamline the process to make it as efficient as possible for users, enhancing the user experience for both senders and recipients globally.

Can small businesses and startups benefit from using leading fintech payment platforms?

Absolutely. Leading fintech payment platforms are often designed with scalability in mind, making them ideal for businesses of all sizes, including small businesses and startups. They provide access to advanced payment processing tools, data analytics, and customer support that can help these smaller entities compete with larger corporations, often with lower upfront costs and pay-as-you-go pricing models.