Imagine driving a car where your only tool is the brake and gas pedal. That’s how central banks use interest rates in monetary policy—fine-tuning the economy’s speed. When they want to slow down inflation, they hit the brakes with higher rates. And to speed up growth, they hit the gas, dropping rates lower to make spending easy. I’ll show you how this powerful tool works and why it matters to you. Whether loans, savings, or jobs, interest rates touch every part of your cash life. Let’s dive into the heart of central banking and see the real deal behind these changes.

Understanding the Role of Interest Rate Policy in Central Banking

Decoding the Objectives of Interest Rate Policy

Think of the central bank as a pilot steering a huge plane – our economy. The main tool they use is the interest rate policy. It’s like the plane’s controls. It helps the bank reach two big goals: keep prices stable and make the economy grow in a healthy way.

How does it do this?

By changing interest rates, the bank can control inflation – the rate at which prices go up. If prices rise too fast, life gets hard for people as stuff costs more. The bank raises rates to cool things down. But if prices are stable, or if they go down (that’s called deflation), the bank might lower rates. This makes it cheaper to borrow money, which can help people and businesses spend and invest more.

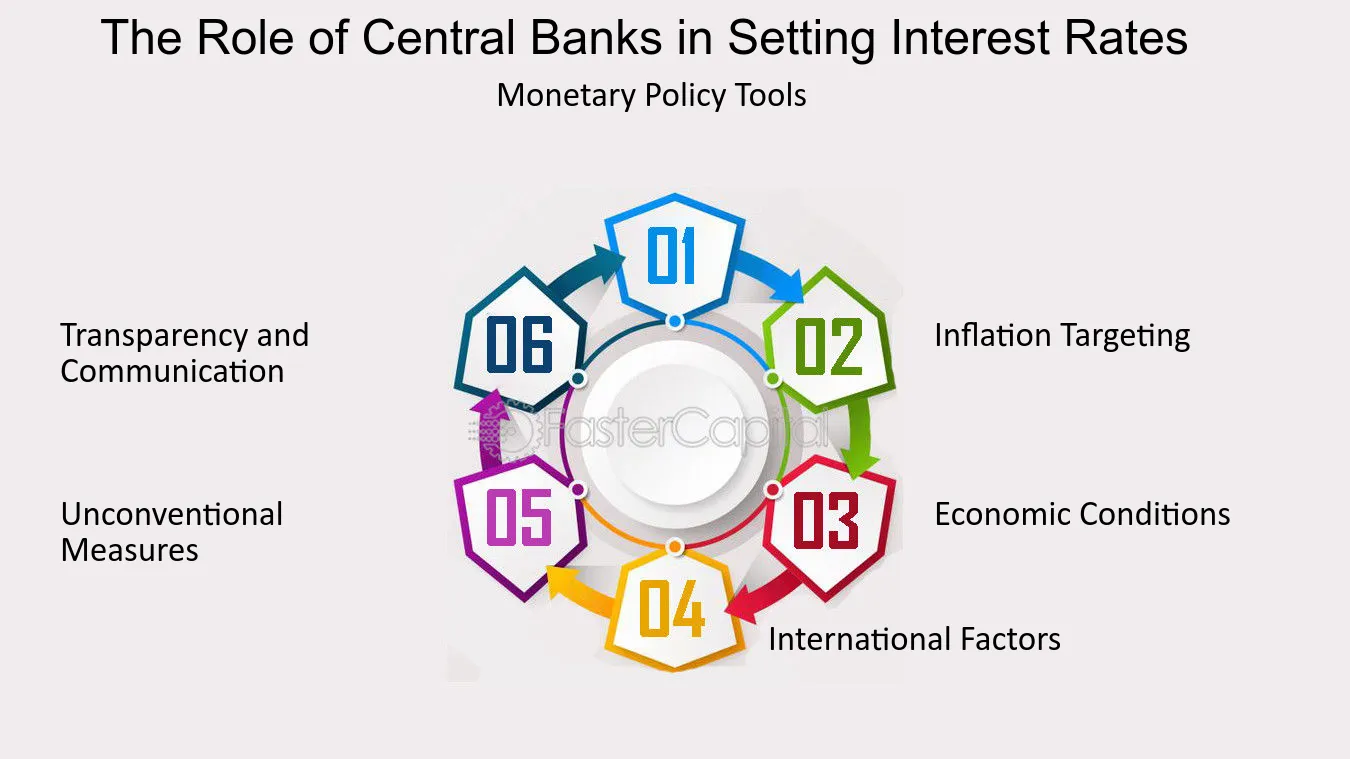

Assessing the Tools for Interest Rate Adjustment

Now, let’s talk tools. There’s a whole toolbox the bank uses to tweak interest rates. First up, open market operations. This is where the bank buys or sells government bonds. Next, we have the discount rate.

What’s that?

The discount rate is what banks pay to borrow money from the central bank. If the central bank hikes up this rate, regular banks might tighten their belts. They might lend less to folks or to each other, and this can lead to higher interest rates all around.

But wait, there’s more. There’s the cash reserve ratio and the repo rate.

What do they do?

The cash reserve ratio dictates how much money banks need to keep on hand. The repo rate is the rate at which the central bank lends money to commercial banks. If these rates go up, banks have less money to play with. This can also make borrowing more expensive and slow down spending and investment.

Each of these tools helps control how much money is out there and how pricey it is to borrow. That way, the central bank can push towards its main goals: keep the economy steady and prices in check, while making sure it’s able to grow. These central bank strategies are all about balance – not too hot, not too cold, just right for a stable, growing economy.

Central Bank Strategy: Balancing Inflation Control and Economic Growth

The Dual Mandate: Price Stability and Sustainable Development

For a central bank, keeping prices stable is key. But they also must help the economy grow. That’s a tough line to walk. Think of a central bank as a driver. With one hand, they control inflation. With the other, they push for growth. Their eyes? Always on the road signs: price levels and job numbers.

Central banks use interest rates like a gas pedal. If the economy is slow, they cut rates to give it a kick. It’s cheaper to borrow money. People spend more. Businesses grow. Jobs spring up. More jobs mean people can buy more stuff. When everyone’s buying, the economy gets buzzing.

Now, picture the economy getting too hot. Prices soar. Money’s worth less. Nobody likes that. So, the bank steps on the brakes. They hike up interest rates. It means higher costs to borrow. People think twice before buying that new car or house. Spending cools. Prices stabilize. It’s all about finding that sweet spot.

Leveraging Inflation Targeting and Deflation Management Techniques

Inflation targeting is all about keeping prices just right. Not too high, not too low. Central banks set a clear aim for inflation, like 2%. They want folks to know what to expect next year or the year after. It’s about trust. With a target, businesses and people can plan ahead. They can invest and spend smart.

But what if prices are falling? That’s deflation. It scares people into not spending. “Why buy today what might be cheaper tomorrow?” they think. This can slow the economy to a crawl. So, central banks fight deflation too. They might cut interest rates or buy government bonds to pump money into the system. It’s all to keep cash flowing and prices steady.

To sum it up, the big job is balance. Central banks use their tools – interest rate tweaks, money talk, and buying big stuff – to juggle growth and stable prices. It’s a bit like patting your head and rubbing your tummy at the same time. Tricky, but with practice and a watchful eye, central banks can keep the economic car on the right track.

The Mechanics of Monetary Policy Tools

Market Operations: From Open Market to Repo Rate Significance

Central banks pack a powerful punch with interest rate policy. They use it to guide where an economy sails. It’s like a rudder on a ship, turning things just right to keep moving smoothly. A main tool they use is open market operations. Here’s what that means: central banks buy or sell government bonds. They do this to control how much money banks can lend. Think of money like water in a garden. The central bank controls the hose, making sure there’s just enough water for the plants to grow, not too much to flood them, and not too little to dry them out.

Now, let’s talk about the repo rate. This rate is what banks pay when they borrow money overnight from the central bank. It’s like a short loan so banks can meet their needs. When the central bank wants to make it easier for banks to lend to us, it lowers the repo rate. This means banks can borrow easily and then, lend to businesses and families cheaply. If it’s too easy, inflation might rise, like how too much candy gives you a toothache. Then, the central bank hikes the repo rate to slow things down. It’s a delicate balance to keep the economy humming along just right.

The Quantitative Easing Effect and Discount Rate Adjustment Impact

Sometimes though, the usual tools don’t work well enough. That’s when a central bank pulls out the big guns: quantitative easing. This is when a central bank creates new money to buy things like government bonds. It’s like pouring more water into our garden but in a big gush. It helps lower interest rates and makes borrowing even cheaper. This should get people to spend and invest, waking up a sleepy economy.

Let’s not forget the discount rate. This is the interest rate central banks charge when lending to commercial banks. Changing the discount rate is another way to steer where the money flows. It’s like tweaking that garden hose again—to add a little water or cut back on the flow.

Central banks are quite the gardeners. They tend crops like inflation control, economic stability, and economic growth. Using tools like interest rates, they keep an eye on the health of the economy. They pay close attention to the inflation rate, which is like a garden thermometer. If it’s too high, they turn down the money supply. If it’s too low, they turn it up. They watch other signs, like how much we all spend and invest, to decide if they need to turn the dial up or down on the interest rate hose. It’s a big job, making sure the economy grows strong, but not too wild, and that’s what central banking is all about.

Impact of Interest Rate Changes on the Economy

Interest Rate Transmission Mechanism and Borrowing Costs

When central banks tweak interest rates, they have one big goal: to guide the economy. This is like turning the thermostat in your home up or down to stay comfy. Central banks use interest rate policy as a tool to keep prices stable and help the economy grow strong.

You might wonder, “How does changing the interest rate affect me?” The answer is simple: it alters borrowing costs. For example, if rates climb, loans for houses and cars get pricier. This could lead you to hold off on buying a new car or home.

This whole process has a special name: the interest rate transmission mechanism. When central banks set the base rate, other banks follow suit. They then change the rates they charge on loans and offer on savings. Let’s dive deeper on this – a higher interest rate means you’ll pay more over time for any borrowed money. Yes, your savings might earn more, but getting and using credit becomes more expensive.

Interest rates impact everything from small business loans to government bonds. So, when rates go up or down, it also affects where businesses invest their cash and if you decide to save or spend more.

Long-Term and Short-Term Rate Effects on Economic Stability

Now, let’s talk about the lasting impacts of rate changes. Stick with me. The effects are quite different when we look at the long-term versus the short-term.

In the short term, when the central bank hikes its rates, your immediate reaction might be to spend less and save more due to higher borrowing costs. This can cool down an economy that’s overheating with too high inflation. The cost of goods and services starts to stabilize as demand goes down.

But that’s not all. Long-term rates also shape how we plan for our future. If rates stay high for a long time, you and your family might think twice about big purchases or taking on debt. This careful behavior helps prevent the economy from overheating but can slow down growth if kept up for too long.

However, if inflation gets too low or the economy needs a boost, the central bank can do the opposite. It can cut rates to encourage spending instead of saving. This means cheaper loans, which can lead to more houses being bought, more businesses being started, and, overall, a warmer economy.

In essence, the central bank uses the ebb and flow of interest rates to balance two key things: keeping the prices of what we buy stable and making sure there are enough jobs for everyone. By doing this, they help us all plan our money moves better, be it saving up for college or investing in a dream business.

Overall, central banks are like expert sailors navigating the vast sea of the economy. They adjust the sails, which are the interest rates, to keep the ship steady whether the waters are calm or stormy. Your life, from your wallet to your job, can feel the wind change when they do. It’s all for the sake of a smooth sail—keeping the economy stable and growing just right.

So, we’ve dived deep on how central banks use interest rate policy to keep economies healthy. We looked at their goals and the tools they use to tweak these rates. Remember, it’s all about finding that sweet spot between low inflation and steady growth. The central bank has a tricky job — it aims to keep prices stable and support the economy.

Also, we touched on the tactics like managing inflation or deflation. These help the bank make sure money keeps its value while the economy grows. And we can’t forget those key tools we talked about. From market operations and tweaking the discount rate to the big move of quantitative easing, each one has its role.

Finally, we explored how changes in interest rates can ripple through the economy, affecting everything from loans to long-term growth. It’s complex stuff, but it’s vital for keeping our economic engine running smoothly.

To wrap it up, think of the central bank as a skilled pilot, guiding our economy through the skies. They’ve got to maneuver through some tricky weather — like inflation or a downturn — to help us land safely with a stable and growing economy.

Q&A :

How do central banks implement interest rate changes to influence monetary policy?

Central banks adjust interest rates as a key tool in monetary policy to control economic growth, inflation, and employment levels. Lowering rates tends to stimulate borrowing and spending, thus boosting the economy, while raising rates can help cool down inflation and excessive growth.

What are the primary objectives central banks aim to achieve with interest rate adjustments?

The primary objectives include controlling inflation, managing economic growth, and achieving full employment. Interest rate changes are made to maintain price stability and to steer the economy towards sustainable growth without excessive inflation or deflation.

How often do central banks review and modify interest rates?

Central banks often review interest rates at scheduled policy meetings, which can range from once a month to eight times a year, depending on the bank. However, they may call unscheduled meetings to address sudden economic changes.

What is the impact of interest rate changes on the average consumer?

Interest rate changes affect the cost of borrowing, savings yield, and price levels. Higher rates can mean more expensive loans and mortgages but better returns on savings, whereas lower rates generally reduce the cost of borrowing and incentivize spending at the expense of savers.

How do central banks’ interest rate decisions affect the global economy?

Decisions made by major central banks, such as the Federal Reserve or the European Central Bank, can have far-reaching impacts, influencing global trade, investment flows, and exchange rates. Investors watch these decisions closely as they can affect economic growth and market trends internationally.