Forex trading demands precision and confidence, qualities that don’t come overnight but are honed through experience and practice. Enter the forex simulator, a powerful tool that allows traders to test strategies, analyze market movements, and build expertise without risking real capital. In 2025, as the Forex market evolves with economic shifts, technological advancements, and heightened volatility, this virtual playground has become indispensable for both beginners and seasoned traders. Whether you’re eyeing a breakout on EUR/USD or a pullback on USD/JPY, a forex simulator offers a risk-free environment to sharpen your edge. This comprehensive guide explores the role of this tool, its benefits, and how to leverage it effectively in the year ahead.

The appeal of a forex simulator lies in its ability to mirror the real Forex market—24/5 action, live price feeds, and all—while keeping your funds safe. In a year where central bank policies might swing USD/CAD 100 pips or oil prices jolt AUD/USD, practicing in a simulated setting lets you master these dynamics without the sting of losses. From testing a 50-pip scalp to perfecting risk management, this article dives into the forex simulator, offering clear steps to transform virtual trades into real-world success in 2025.

What Is a Forex Simulator?

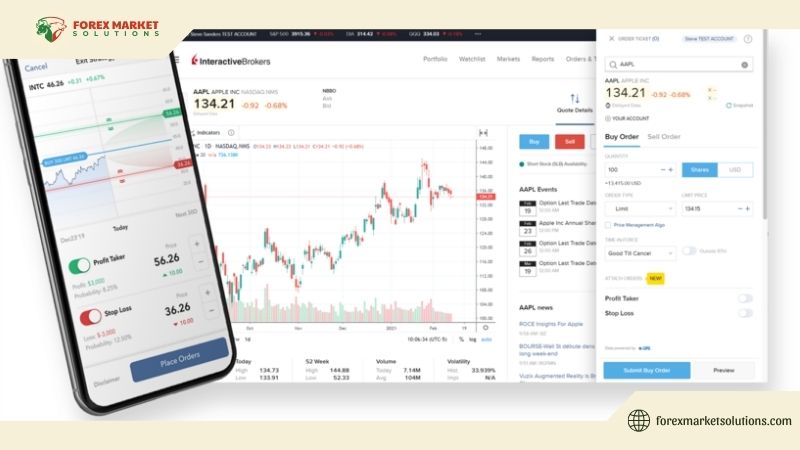

At its essence, a forex simulator is software that replicates the Forex market, letting traders execute virtual trades using historical or live data. Platforms like MetaTrader 4, TradingView, or dedicated tools like Forex Tester provide this functionality—load USD/CAD, set a $5,000 virtual balance, and trade 0.1 lots at 1.3700, watching it hit 1.3750 for a 50-pip gain. Unlike demo accounts tied to brokers, simulators often offer deeper control—rewind to 2023’s EUR/USD crash, fast-forward through 2024’s Fed hikes—mimicking real conditions without financial stakes.

This tool’s power lies in its realism—spreads (1 pip on EUR/USD), leverage (10:1), and swaps match live trading. In 2025, with brokers enhancing simulators with AI-driven features—like predictive candles or sentiment analysis—the forex simulator becomes a sandbox for testing ideas. Beginners learn pips (0.0001 moves) and lot sizes (0.01 = $1/pip on USD/JPY); pros refine expert advisors (EAs) or scalping tactics. It’s practice with purpose, bridging theory to execution.

Unlike paper trading—jotting trades on a notepad—a simulator logs every move—buy at 148.50, sell at 149.00—tracking profit ($5) and drawdown, offering data to dissect. This depth makes it a Forex cornerstone.

Why Use a Forex Simulator?

The forex simulator shines as a training ground, especially in 2025’s unpredictable market. First, it eliminates risk—trade GBP/USD from 1.3000 to 1.2900, losing 100 pips ($10 on 0.1 lots), and your real account stays untouched. This safety net builds confidence—miss a USD/CAD breakout at 1.3700, tweak your stop, retry—without the dread of blown funds. In a year of volatility—Fed rates at 4.5%, oil at $90—these dry runs are gold.

It accelerates learning—test a breakout strategy (buy EUR/USD at 1.1050, stop 1.1020) over 2024 data in hours, not months, spotting a 60% win rate. Seasoned traders backtest EAs—sell USD/JPY at 148.50, target 147.50—refining code for 2025’s chop. The forex simulator offers instant feedback—50 pips gained, 20 lost—sharpening skills faster than live trial-and-error.

Emotional control grows too—watch a $50 unrealized loss on AUD/USD shrink to $10 without panic, training discipline for real trades. In 2025, with news jolting markets—ECB cuts or NFP beats—this mental prep is key. It’s a lab where mistakes teach, not punish.

Forex Simulator: How to Use It Effectively

Mastering the forex simulator in 2025 hinges on a structured approach. Start with setup—choose MetaTrader 5, load 2023-2024 USD/CAD data, set $1,000, 10:1 leverage. Define a strategy—buy at 1.3700 on a 20-day moving average pullback, stop 1.3670, target 1.3760 (60 pips). Run it—simulate 50 trades over six months, logging wins (30), losses (20), and profit ($100). In 2025, with platforms offering 4K data, this mirrors live precision.

Vary conditions—test EUR/USD in 2022’s bear market (1.1100 to 1.0900), then 2024’s range (1.1000-1.1050). Adjust variables—tighten stops to 20 pips, raise lots to 0.02—seeing if gains jump to $150 or drawdowns hit 10%. The forex simulator thrives on repetition—trade USD/JPY daily, hitting 148.50 to 149.00, until entries feel instinctive.

Analyze results—60% win rate, 1:2 risk-reward (20-pip risk, 40-pip gain)—tweak if losses cluster on news days (Fed announcements). In 2025’s AI-enhanced tools, export stats—Sharpe ratio 1.5—ensuring your edge holds. Pair with live demos—$100 real account—bridging virtual to actual, making the forex simulator a launchpad.

Strategies to Test in a Simulator

The forex simulator is a playground for strategies in 2025’s Forex. Scalping suits fast learners—buy GBP/USD at 1.3000, sell 1.3020 (20 pips), stop 1.2985, on a 5-minute chart. Run 20 trades, netting $40 on 0.1 lots, refining timing—London open spikes work best. Breakouts fit trends—sell USD/CAD at 1.3690 below 1.3700 support, stop 1.3720, target 1.3630 (60 pips), testing 2024 oil rallies.

Swing trades test patience—buy EUR/USD at 1.1005 after a 1.0950 bottom, stop 1.0975, aim 1.1065 (60 pips) over days. Simulate 2023’s Fed-driven drops, hitting 70% wins. In 2025, with volatility from rate shifts, the forex simulator lets you backtest—did 1.3700 hold?—ensuring strategies match market pulse.

EAs shine here—code a USD/JPY bot (sell at 148.50, stop 149.00), run 100 trades, tweaking for $200 profit. This virtual lab turns ideas into systems, ready for live Forex.

Pitfalls to Avoid

The forex simulator isn’t flawless—overconfidence bites. A 90% win rate on EUR/USD in 2023’s calm might flop in 2025’s chaos—100-pip swings post-NFP. Real spreads (1.5 pips) and slippage (2 pips) skew results—simulators often idealize at 1 pip. In 2025, with brokers tightening, adjust settings—add 0.5 pips—to match live.

Overfitting traps too—tweak a USD/CAD strategy for 2024 perfection (1.3700 to 1.3600), failing 2025’s range. Test across years—2022-2024—ensuring the forex simulator builds robustness, not illusions. Skipping analysis—50 trades, no log—wastes time; track every move (1.3000 to 1.3050, $5) for lessons.

Simulate to Succeed

The forex simulator in 2025 is your Forex proving ground—EUR/USD breakouts, USD/CAD scalps—honed without risk. From backtesting 60-pip wins to mastering emotions, it turns novices into pros and pros into masters. In a year of market flux, the forex simulator is your edge—practice today, profit tomorrow. Start simulating now, and build skills that conquer 2025’s Forex frontier.

For more trading tools and insights, follow Forex Market Solutions — your guide to thriving in 2025 and beyond.