Looking to understand the factors affecting stock market forecast? You’re in the right place. Stocks sway to the beats of various drums – economic data, central bank decisions, market moods, even world events. Decode the secrets with me as we dive into the GDP’s impact, unravel how inflation weaves its tale in equity lands, and dissect central banks’ role in the corporate world. Ever wonder why your gut sometimes leads your trades, or why news flashes can make or break the market? You’re not alone. We’ll delve into the psyche that fuels financial choices and the outer forces that nudge the market’s pulse. Prepare to be your own financial soothsayer. Let’s unveil the influencers together.

Deciphering Economic Indicators and Their Impact on Stock Predictions

GDP Growth and Stock Performance: Interlinked Dynamics

Ever wonder how the overall health of an economy impacts stocks? Look at GDP growth. When GDP is up, it points to a healthy economy. This can lead to higher corporate earnings. Stocks often perform better in this setting. Businesses have more cash to expand and innovate. They even invest more in staff and equipment. It’s not just about the numbers, though. Feelings play a big part too. When GDP is rising, folks get optimistic. They may feel good about the market’s future. This positivity can push them to buy more stocks.

Here’s the straight talk: a rising GDP can buoy stock prices. But it’s not a sure bet. There are times when other factors like global issues or shifts in market sentiment throw a curveball. That’s why investors keep a close eye on GDP reports.

Inflation Rates and Equity Markets: Unraveling the Correlation

Now, let’s chat about inflation. When prices for goods and services climb, that’s inflation. A little inflation can show that an economy is strong. But too much can be a worry. It can cut into what people and businesses can buy. For stocks, the link with inflation can get tricky. Sometimes, mild inflation can be good for company profits. It might lead to price hikes on what they sell, which can boost earnings.

But when inflation gets too high, trouble brews. Costs for materials and wages can jump. This can eat into companies’ profits. When investors see this, they might get spooked. They know it can harm stock prices. Central banks often step in when inflation heats up. They may hike interest rates to cool things off. This can make loans more costly for companies. It can also slow down spending by customers. Both can be bad news for stocks.

Investors use inflation data to guess what might happen in the markets. No one has a crystal ball. But staying sharp on trends in inflation can help with smart investing choices. This data can signal when it’s time to be cautious or when opportunity knocks.

Understanding how GDP growth and inflation impact stocks is key. They’re big pieces of the puzzle in stock market prediction. They help investors make sense of the market’s ups and downs. It’s a bit like being a market detective. You look at the clues. Then, you try to crack the case on where stock prices might head next.

Central Bank Policies and Market Movements

The Influence of Interest Rates on Corporate Earnings

Let’s talk money, shall we? Imagine you have a lemonade stand. If the cost of borrowing money to make your lemonade goes up, you’ll have less cash to spend on things like sugar and cups. This is just like real big companies when interest rates go up. They make less money because loans cost more. We call this corporate earnings, and guess what? When companies earn less, the stock market often dips. Nobody likes a sour deal, right?

Interest rates are like the price of borrowing money. When the central bank raises these rates, it’s harder for businesses to get loans. This means less spending and slower growth. If this sounds serious, it’s because it is. Higher costs can lead companies to hit the brakes on their plans. Let’s not forget — fewer earnings can mean lower stock prices.

Decoding the Relationship Between Monetary Policy and Market Liquidity

Now for the juice behind the money moves — monetary policy. It’s like the rulebook for the country’s money. Central banks, think of them as the big bosses of money, they use this policy to control how much cash is flowing. We call this flow market liquidity. The easier it is to buy and sell stuff including stocks, the more liquid the market is.

When the central bank tweaks the money taps, it can make markets splash or dry up. If they open up the taps, cash flows easily and businesses can grow quick. But if the taps tighten, cash gets scarce. It’s like having a party but not enough lemonade to go around; nobody’s happy. Tighter money can mean businesses don’t do as much. When there’s less cash in the market, stocks can get jittery and jump around a lot. They might even fall if people get really worried.

In short, understanding the central bank’s moves is key for anyone playing the stock market game. It’s a big piece of the puzzle that can help us guess where stocks will go. Keep an eye on those big bosses of money, the central banks. They can make or break the party in the market with just a few decisions.

Analyzing Market Sentiment and Behavioral Finance

Investor Behavior Patterns: The Psychology Behind Stock Picks

Let’s talk about why people pick the stocks they do. Investor behavior is huge when it comes to the stock market. Think of the market as a large mood ring. It changes colors based on how people feel.

People often buy or sell stocks based on their gut. When many feel hopeful about a company, its stock price might go up. If they’re scared, they might sell, and the stock price could fall. This is the heart of market sentiment analysis. It’s like reading a room to catch the vibe. By watching how folks act, we can guess which way the stocks might sway.

The Power of Financial News on Trading Decisions

Now, let’s chat about the news. News can shake or stir the market big time. Say a big company drops some bad news. This might scare folks into selling their stocks in that company. This is where financial news trading steps in. If the news says things look bad, people may sell. If the news is good, they might buy more.

What we read and hear can guide our trade moves. Just like with weather forecasts, we plan our day. The same goes for stock analyst forecasts. They do a lot of math to predict good or bad trends in the market. Their word can sway folks to act in a certain way with their money.

Ants follow a trail and so do investors. Let’s say there’s a whisper that a company will do well. Many might rush to buy before prices jump. But, if a rumor flies about a company hitting a rough patch, folks might ditch the stock before it loses value. This leap before looking thing can really shake things up.

Market sentiment is not just fluff – it’s about the mood that investors catch from each other and the news. It moves markets, just like ocean currents move ships. Knowing why people buy or sell takes a lot of guessing out of stock market prediction. And that is super important for anyone wanting to make smart money moves.

So, investor behavior and the news are like two peas in a pod. They both help paint the big picture. By understanding this, we can better guess where stocks might go next. It’s like being a detective, piecing together clues to solve the market mystery.

To wrap it up, think of the stock market as a big game of telephone. The message starts somewhere and as it spreads, it can change a bit, but the core stays the same. Our job is to listen, watch, and make the best call from what we gather. It’s a mix of facts, feelings, and sometimes just plain luck. But by understanding behavior and news, we stand a better chance at winning the game.

External Factors and their Bearing on Stock Forecasts

Political Events and Their Resonance in the Financial Markets

People often ask, “How do political events shape stock markets?” The answer is simple: quite a bit. Political events can shake or stir markets. Decisions by governments can change how companies do business. This can make stocks go up or down. When leaders talk of new policies, markets listen. Investors always watch out for changes in the political wind.

Elections, laws, and global events can make waves. Say a country talks trade with another. This can push markets to move. If it’s good talk, stocks might jump. But if there’s trouble, stocks might drop. Think of political events as big signals. They tell us where things might head. They can bring hope or fear to investors. This feeling can spread fast.

Technological Advancements: Disruption and Opportunity in Stock Markets

“Now what about tech and stocks? How do they mix?” Here’s the scoop—tech changes the game. New gadgets and ideas come out. They can start a whole new playing field. Companies that make these tech wins can see their stocks soar. Those that miss out might fall behind.

Tech can make things better and faster. It can help a business grow more than before. This can mean more money for them, and for you if you invest. But it can also shake up the old ways. Companies that don’t keep up might lose out. Tech can change how much companies are worth. It can change it fast.

Investors look for the next big tech thing. They want to get in early. They want to find the next big winner. But they must be careful. If the tech doesn’t work out, they might lose money. Staying in the know is key. Keep your eyes peeled for new tech tales. They might just guide you to your next stock pick.

In this post, we dived into how key economic signs help us guess where stocks will go. We saw how GDP growth hooks up to stock success, while inflation’s link with equities can be tricky.

We also tackled central bank moves, like how interest rates sway company profits and the way money policy steers how much cash is in the market.

Then we checked out how people think when they pick stocks, and how news can shake up their choices.

We wrapped up with a look at outside stuff, like big news in politics and fresh tech, which can shake or boost the stocks.

I think if you keep an eye on these areas, you can make smarter stock choices. It’s like putting together a giant puzzle. Once you know how the pieces fit, you can see the big picture much clearer. Remember, the market moves with these signals, so stay sharp and use them in your favor. Happy investing!

Q&A :

What are the key factors that influence stock market forecasts?

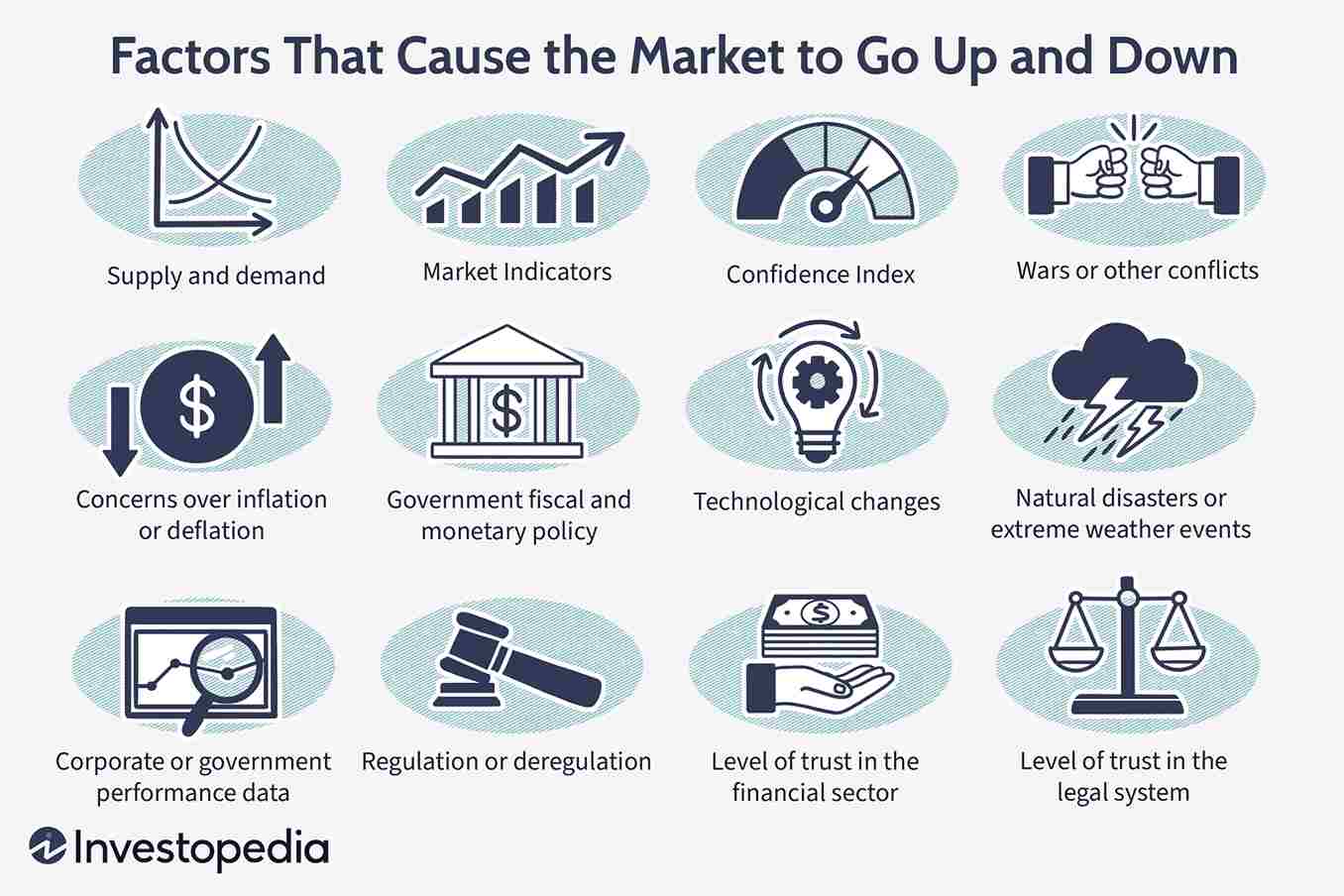

The financial landscape is influenced by a multitude of factors that can make stock market forecasts challenging. Some key elements include economic indicators like GDP growth rates, inflation, and employment figures. Interest rates set by central banks and monetary policies also play a significant role, as do political events, market sentiment, corporate earnings, and even unexpected global incidents such as natural disasters or health crises which can cause market volatility.

How does geopolitical stability impact stock market predictions?

Geopolitical stability, or the lack thereof, has a profound impact on investor confidence and market stability. Geopolitical tensions can lead to uncertainty, which often results in increased market volatility and risk aversion among investors. Events such as elections, trade negotiations, and conflicts can cause major shifts in market dynamics, thereby influencing stock market forecasts. Market analysts closely monitor these developments to adjust their predictions accordingly.

In what ways do interest rates affect stock market forecasting?

Interest rates are a fundamental factor in stock market forecasting as they directly affect borrowing costs for consumers and businesses. When interest rates are low, they tend to encourage spending and investment, leading to potential growth in the stock market. Conversely, higher interest rates can decrease spending and investment, possibly resulting in a market downturn. Forecasters must therefore consider the direction of interest rate trends set by central banks to anticipate their impact on the stock market.

Can corporate earnings reports significantly alter market forecasts?

Yes, corporate earnings reports can significantly alter market forecasts as they provide insight into a company’s financial health and future prospects. Strong earnings reports can boost investor confidence, triggering a positive reaction in the stock market, while weak earnings can lead to a negative market response. The collective impact of numerous earnings reports from various industries can influence overall market sentiment and shape market trends.

To what extent do technological advancements impact stock market forecasts?

Technological advancements have a growing influence on stock market forecasts. They can disrupt industries by introducing new business models, products, or services, thereby affecting traditional companies’ performance and market expectations. Furthermore, the integration of big data analytics, artificial intelligence, and high-frequency trading algorithms has also changed the way market analysis and forecasting are conducted, potentially leading to swifter market movements. Forecasters must stay abreast of technological trends to predict their potential impact on various market sectors.