Welcome to your go-to guide for Evaluating the Success of ESG Investing. As green shoots take root in the financial world, conscious investors like us are tuning in to the drumbeat of ESG—Environmental, Social, and Governance investing. Today, I’ll take you through the thickets and clearings of ESG investing, simplifying its complexities with hands-on analysis that charts out the real-world impact on market performance. We’ll also dig into the metrics that matter and shed light on the ESG scoring systems shaping our investment choices. Before we leap into the future, let’s master the present, ensuring your portfolio aligns with your values without missing a beat on returns. Ready for a deep dive into ethical investing that’s as savvy as it is soulful? Let’s begin.

Understanding ESG Investment Fundamentals

Defining Key ESG Criteria and Metrics

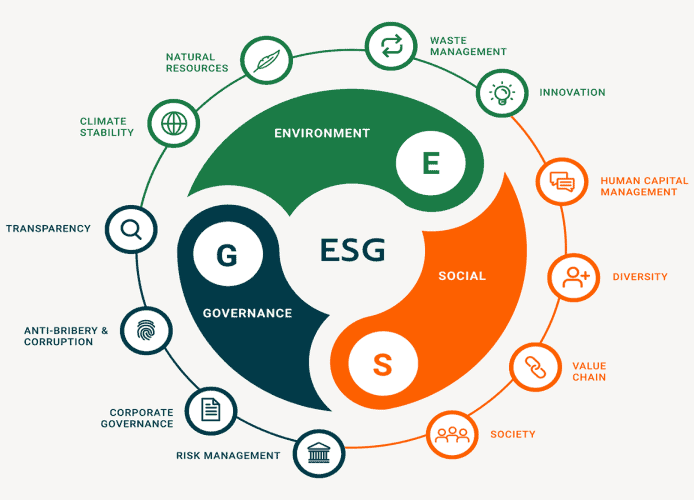

When you pick stocks or funds, you want to earn cash and do good, right? That’s where ESG comes in. ESG stands for Environmental, Social, and Governance. These are a set of standards for a company’s behavior used by socially conscious investors. ESG criteria help us to pick firms that care about the same things we do.

Environmental criteria check on how well the company keeps nature clean. Do they recycle? Do they waste less? These things matter for our planet’s health. Social governance looks at how they treat people. Are their workers happy? Do they support the community? Lastly, governance involves the rules of the company. This means things like a company not just being all about making money but caring about honesty too.

The Evolution of Investor ESG Awareness

Years ago, many folks thought only about quick money when investing. As time went by, people started seeing how their money could help the world too. You might’ve heard about the big oil spill disasters or poor work conditions in some factories. These stories get us thinking about where our money really goes.

People want to put their hard-earned cash into firms that are making a positive change. To do this, they need information about how firms are doing with ESG. This is why ESG rating agencies came up with scores to help us know if we’re investing responsibly. Thanks to these scores, you don’t have to guess which companies are good. You can actually see which ones meet these important ESG standards.

Now, many investors focus on ESG so much that they’ll only invest in companies with top ESG scores. They want a strong return on their investment and to support good causes. Companies see this and start to change. They try harder to reduce pollution and treat everyone fairly.

Monitoring ESG lets us tell firms, “Hey, we notice what you’re doing, and we care.” By shining a light on how companies behave, we make a difference. And it’s not just something that’s “nice to do.” Studies show, again and again, that companies that score well in ESG often make more money and last longer.

So, knowing ESG criteria and watching how they change can help us put our money where our values are. It guides us in finding firms that are not just about profit but also about making the world better. We all want to grow our wallets and help the world. Fortunately, with ESG investing, we can do both. It’s a win-win!

Measuring ESG Impact on Market Performance

The Role of ESG Scoring Systems in Investment Decision-Making

When you pick a stock, think about more than money. Think about its ESG score too. This score tells us if a company cares about ethics and the planet. Companies with good ESG scores often do better because they make smart, future-focused choices. It’s like choosing a car. You want one that’s safe, lasts long, and doesn’t harm the earth. ESG scoring systems are the tools that help us figure out which companies are the good cars of the stock market.

ESG Performance Metrics and Returns Analysis

You might ask, “Do these ethical stocks make money?” Let’s talk numbers. Many studies show stocks with high ESG scores can outperform others. That’s your answer right there: ESG can lead to more cash in the bank for you. But it’s not just about a quick buck. ESG performance metrics show us companies thinking ahead. Companies cutting their carbon footprint or treating workers well are thinking long-term. And long-term is key in investing.

Think of it like planting a tree. The tree is small today. But years from now, it gives shade and even fruit. That’s your ESG investment. Small, green steps today can mean big, ripe rewards tomorrow. This doesn’t just feel good; it makes financial sense. Checking out ESG fund performance lets you compare. It’s like reading reviews before you buy. You see which funds do good and grow strong.

But it’s important to know that not all ESG investments are the same. Some people worry that a few funds just talk the talk. This is where measuring ESG effectiveness comes in. You need clear ESG performance metrics. They help you tell apart true-blue, earth-loving funds from the fakes.

Here’s where things get real cool. ESG criteria can lead to less risk, too. Companies that score high manage their risks better. They’re less likely to face fines or scandals that can hurt your investment. Plus, more and more people want to invest in the planet’s future. This means companies and funds with strong ESG game could see more money flowing in.

In the end, what’s better than making money while doing good? By caring about ESG, you do both. You’re like a superhero for your wallet and the world. Next time you look at your portfolio, think about the ESG scores. Are you backing the heroes of the market? With the right ESG performance metrics and a sharp eye on returns, you’re not just investing. You’re investing for a brighter, cleaner, fairer future. And that’s a pretty awesome way to play the game of stocks.

Analyzing ESG Integration and Reporting Practices

ESG Disclosure Practices and Data Quality

When we talk about how good our investments are for the world, we look at ESG reporting. It shows us how companies care about the environment, society, and how they lead themselves. Good ESG reporting must be clear and true. It should give you the right information to make smart choices. But sometimes, it can be hard to know if the info is good or not. Let’s dive into why that matters.

First off, ESG reporting tells us if a company is thinking about important things like pollution or how they treat their workers. Now, not all companies tell us about these things in the same way. Some might give a lot of details while others might not share much. It’s like when your friend tells you every bit of their day while another just says it was ‘fine.’

This is where things like ESG performance metrics come in. They help us compare different companies. They can show us who’s really working hard to be better for our world. But to trust these metrics, the data has to be good. We want to know that what we’re seeing is real, not just something that sounds nice.

It’s tough, but we need to check things like ESG scoring systems and contrast them. If one company has a high score, what does that mean? Did they earn it by doing great things or just by ticking boxes? To understand that, we look closely at what they report and how they do it.

Now, let’s talk about how we compare these companies.

Benchmarking and Rating Agencies: Assessing their Influence

When we pick ESG investments, it’s like choosing the best runners in a track race. We can only do so if we know who’s racing and how fast they run. Benchmarking is that ‘race info’ for investments.

We measure companies against sets of rules or examples – that’s benchmarking. It’s a tool to say, “This is what good looks like.” And rating agencies are like the coaches who tell us which runners have the best form and speed.

These agencies rate companies on how well they do with ESG. Yet, not all rating agencies use the same rules. Imagine some coaches thought running fast was best, while others liked good running shoes.

This can make picking investments hard. You might think you’re choosing a fast runner, but actually, you just picked one with good shoes. So, we have to look at different ratings and understand why they’re different.

We also want to use ESG benchmarking that fits what we care about. If we’re worried about the air and water, we’ll look more at environmental criteria. If we care about how people are treated, we’ll look more at social governance effectiveness.

In the end, our goal is to find investments that do well and do good. We want to make money while making sure the planet is a nice place to live.

And by checking on these things, we stay smart about where our money is going. We can support companies that truly care, not just those that look good on paper. Plus, we help businesses understand that people who invest want to see these changes.

By being clear and asking tough questions, our investments can make a real difference. We can all grow, and the world gets better too.

The Future of ESG Investing

Challenges and Opportunities in Sustainable and Impact Investing

Let’s dive into what’s ahead for ESG investing. Think of ESG like a compass. It points your money in a direction that matches your values. It’s not just about profit but also about planet and people. Yet, it’s not all smooth sailing. We must look at the tough stuff too, like big data gaps and jumbled standards.

Remember how we play connect-the-dots? That’s like ESG performance metrics. They link your investments to real-world impacts. Are companies reducing pollution? Are they treating workers fairly? ESG scoring systems are our pencils here. They score firms on these issues, guiding our investment choices.

Now, you might ask, “Do green bonds really work?” Yes, they fund projects that help the earth. But here’s a twist. We need to check if they truly make a difference or just look good on paper.

Advancing ESG Strategies and Corporate Engagement Initiatives

As we steer our ESG ship into the future, there’s more good news. Firms are stepping up. They’re taking ESG seriously, and more are sharing their plans and progress. Yet, we can’t just sit back. We must keep pushing for better and clearer reporting (sustainability reporting standards).

When it comes to ESG fund performance comparison, think of buying shoes. You want the best pair for your buck, right? It’s the same here. We check which funds do well for money and morals. Let’s not forget that with ESG, it’s a twin win. We aim for cash and kindness.

Social governance effectiveness is another piece of the puzzle. It’s asking, “Are companies playing fair with everyone?” This is huge because it means better workplaces and happier societies.

ESG compliance monitoring is like a health check for companies. It looks at if they’re really following ESG rules. This is big for trust. We want companies that walk the talk. And for us investors, it’s like a green light to go ahead with our support.

Know that as we measure the good ESG does, we’re not just looking at today. We’re peeking into the future. Long-term ESG investing is about setting up a better world for all, years down the road.

In wrapping up, let’s circle back to our compass idea. ESG guides us toward investments that care for the environment, value social good, and run on strong ethics. It’s not just about money in the bank. It’s about leaving a kinder, cleaner world. This is the promise of ESG, and with every dollar we invest, we’re part of this big, bold move forward.

So, join in. Ask questions. Stay curious. And let’s shape a future where our investments matter—for profit, people, and the planet.

We’ve explored ESG investing from its core to its future. You now know what ESG means and how it grew in the investor’s world. We saw how ESG scores guide smart choices and can affect returns. Better ESG reporting helps, too. Those reports and ratings from big agencies matter a lot.

Looking ahead, green investing faces hurdles but also big chances for growth. Companies and investors alike must step up their game. For me, it’s clear: ESG isn’t just a fad. It’s key to making money and making a difference. Let’s keep our eye on this ball as the field grows and changes. Your wallet and our world will thank you.

Q&A :

How do you measure the success of ESG investing?

To effectively measure the success of ESG investing, investors look at both financial performance and positive ESG outcomes. Financial performance can include traditional metrics like return on investment (ROI), while ESG outcomes may be gauged through the company’s sustainability reports, third-party ESG scores, and the impact on ESG-related goals such as carbon footprint reduction or improved labor practices.

What metrics are pivotal for evaluating ESG performance?

Key metrics for evaluating ESG performance include the ESG scores provided by rating agencies, which consider factors like a company’s energy use, waste management, employee relations, and corporate governance structures. Other metrics might include greenhouse gas emissions, worker safety records, board diversity, and adherence to ethical business practices.

Can ESG investments outperform traditional investments?

ESG investments have the potential to outperform traditional investments as they may identify companies with superior business models that are well-aligned with emerging trends and regulations around environmental and social stewardship. However, like all investments, ESG funds can vary in performance, and thorough research is advised.

What challenges are faced when evaluating ESG investing success?

Challenges in evaluating ESG success include the variability in ESG reporting standards, the subjective nature of what constitutes good ESG practices, and the difficulty in attributing financial performance directly to ESG factors. Additionally, “greenwashing,” where companies exaggerate their ESG efforts, can also pose a significant challenge to accurate evaluation.

How do ESG investments impact overall portfolio risk?

ESG investments can influence overall portfolio risk by potentially reducing exposure to environmental, governance, and social risks that might not be accounted for in traditional financial analysis. Companies that proactively manage ESG risks may also be better positioned to withstand regulatory changes and public scrutiny, potentially leading to a more resilient portfolio.