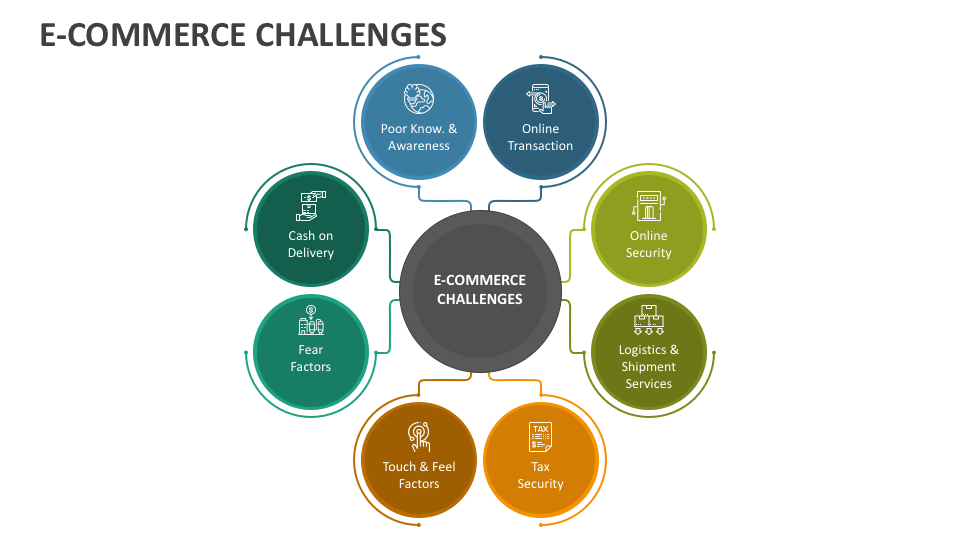

Challenges of e-commerce payment platforms are like a minefield. Ever clicked “buy” and felt a pang of doubt? You’re not alone. Every day, folks face hurdles at digital checkouts. It’s not just ‘Will my package arrive?’ but also ‘Is my data safe?’ and ‘Can fraudsters nab my cash?’ We’re diving deep into these rough waters to steer you clear of dangers. I’m here to arm you with insights on how to keep your cash secure, your customers happy, and your business booming. Ready for a hiccup-free journey through the checkout process? Let’s tackle this – together.

Understanding the Landscape of E-Commerce Payment Security

The Rise of Online Payment Security Concerns

Shopping online has become easy but doubts about safety can scare people away. Worries rise when folks hear about theft online. Think about it: you’re ready to buy, but then you wonder, “Is my credit card info safe?” This is where I come into play. I know this fear well. I’ve seen many get tricked by bad actors lurking online.

Cybersecurity for Online Businesses: Protecting Your Platform

Online stores need tough security to keep buyers and their cash safe. To start, they get something called an SSL certificate. This is like a secret code for your info. Hackers can’t read it. Next, for a store to handle card info safely, it must follow some rules. This is known as PCI compliance. It’s a big deal and quite tricky.

Not just the card details, even the way you pay matters. Think about paying in dollars or euros. It can get complex for stores. Stores also have to deal with charges coming back to them, called chargebacks. These happen when a buyer says, “I didn’t buy that.” Now the store has to prove they did or lose money. Tough, right?

Then, there are different ways to pay. Some like cards, others prefer mobile apps. Stores must handle all these choices well. Speed is key too. No one likes to wait when they are ready to buy. So, the checkout must be quick and smooth.

What about when a buyer and a seller don’t agree? This is a transaction dispute. Resolving these needs care and fairness. An upset buyer can leave and never come back.

Having a safe place to pay online is not easy. Stores work hard to give you peace of mind. So next time you shop, you can feel safe knowing lots of work goes into keeping your info out of the wrong hands.

Tackling Fraud: Strategies for Secure E-Commerce Transactions

The Mechanics of Preventing Payment Fraud

Dealing with fraud is tough. As an expert, I focus on keeping online shoppers safe. It’s a big job. I often compare it to being a goalie: blocking scams and keeping the honest players in the game.

Preventing payment fraud starts with tight security. Think of your favorite online store. You pick some cool stuff, head to checkout, and pay. You want that process safe, right? Well, that’s where secure transactions in e-commerce come in. To make this happen, I make sure every store has solid online payment gateways. They are like super-guardians of your money.

Besides, e-commerce fraud prevention strategies include teaching store teams. I show them how to spot and stop bad guys. This keeps our online shopping world a safe space. Each move to stop the threats adds layers, kind of like an onion. And yes, sometimes it makes you wanna cry. But it’s key to trust because trust is gold in e-commerce.

What are the risks of digital transactions? They’re like potholes in the road—unexpected and can cause a mess. Identity theft, stolen card numbers, and sneaky scams are the main ones. That’s why cybersecurity for online businesses isn’t just fancy talk. It’s real armor against real threats.

Combatting Chargebacks: Strengthening E-Commerce Defenses

Now, on to chargebacks – the bane of online stores. Imagine playing tug-of-war with money. That’s combatting chargebacks in e-commerce for you. Customers say “I didn’t buy that!” and stores need to respond fast.

Chargebacks can mean lost goods and money for stores. To fight this, we use tools and smarts. We set up alerts and traps, like secret agents, to catch these problems before they blow up. These defenses are like building a fortress around the store’s treasure.

Improving payment system security also helps cut down on chargebacks. You’ve got to protect all corners. It’s more than just having a lock on the door. It’s about watching for sneaky stuff and being ready. Imagine being a knight minus the horse and shiny armor, but with a computer instead.

PCI compliance is another big deal for stores. Think of it as rules to play fair in the payment game. It’s tricky, but we keep up, making sure we follow the game plan.

And let’s not forget those SSL certificates for payment safety. They’re like secret handshakes online. When a website has one, it’s giving you a wink, saying your info is hidden from the bad guys.

These are just the start. The game changes all the time, and we have to adapt. Every day we’re working to keep your shopping safe, easy, and fun. This is the cool part of the job – fighting crime behind a screen, making sure good folk like you enjoy the spoils of e-commerce without the worries. That’s what I’m here for, and I won’t stop.

Enhancing User Experience Through Secure Payment Systems

Addressing Cart Abandonment Due to Payment Issues

Ever shopped online and left without buying? You’re not alone. Stores lose sales when checkout is tough. People drop their carts like hot potatoes when payments get tricky. Here’s the deal: Safe checkouts mean happy shoppers. But reach for that card, and worries hit. “Is this safe?” they think. Secure transactions in e-commerce? Big deal. Like, HUGE.

We ensure online payment gateways reliability by kicking payment fraud out. Our job? Make cybersecurity for online businesses a no-brainer. Here’s the heart of it: SSL certificates for payment safety. They’re like secret codes. They lock up your card details tight. No one else peeks.

So, carts ditched due to sketchy payment vibes? Gone. We fix those vibes. Make ’em all about trust. And trust me, this cuts down the risks of digital transactions. Now, can we promise the moon? Nope. Problems can happen. But we gear up to tackle them head-on. E-commerce fraud prevention strategies are our sword and shield.

Payment problems should never cost a sale. So we’re out here, improving payment system security, ensuring frictionless checkouts. If it feels good, it sells. And we want to feel downright awesome.

Integrating Multiple Payment Methods for Seamless Checkouts

Now, brace yourself. It’s the age of “I want options!” Folks love picking. Cash or card? Apple Pay or PayPal? In our world, talking payment equals talking choice.

So we plug in all the ways to pay. We smooth out the bumps. Remember those payment processing speed and customer satisfaction stats? They’re pals. Fast pay means fast smiles. And we want to keep customers beaming.

We’re like DJs, mixing the payment hits. We do the heavy lifting, so it’s all seamless. Slice through the multi-currency payment complexities. Break down the cross-border payment regulation walls. Look at third-party payment processing fees and say, “We got this.”

But wait, there’s more. Phones out folks, ’cause mobile payment snags? They’re out of style. We squash those bugs. Ensure anti-fraud measures don’t scare folks off. Keep the payment service going strong, no downtimes allowed. We’re in the business of keeping you in business.

So, when you’re scaling payment solutions for growth, or just choosing the right payment service provider, think teamwork. We’re here to adapt and grow with you. Like, whether you’ve got a high risk merchant account or deal in rare comic books, we tailor your payment fancy. Meeting diverse payment preferences is just running the bases for us.

In a nutshell? Secure, speedy, and snappy. The checkout charm trio, with no trade-offs. It’s not just about selling. It’s ensuring folks come back for more. Hackers, system crashes, grumpy gateways? Nope. A firm “Not here.”

Our work’s cut out for us, but we’ve laced up our boots. We’re your back in this whack-a-mole game called online payments. From user experience in the checkout process to adapting to new payment technologies, we stand guard. Your success is the score, and my friend, we’re aiming high.

Navigating Regulatory Challenges and Ensuring Compliance

Adopting New Payment Technologies and Keeping Up with Industry Standards

As a kid loves a new toy, so do e-commerce sites with new payment tech. Yet, this love runs deep into serious terrain where keeping up with fast-changing standards is no child’s play. Each online payment tool may bring a new set of rules. So, imagine a game where the only constant is change. Fun? Perhaps. Challenging? Definitely.

For e-commerce, the latest tools must align with industry standards for safe pay. This means that each new system, fancy as it may be, must pass heavy tests for online payment gateways reliability. It’s a quest to ensure every card swipe, tap, or click is secure.

PCI Compliance Challenges and the Role of SSL Certificates

When it comes to secure transactions in e-commerce, PCI compliance is the boss. But getting to this point can feel like climbing a mountain. It’s all about making sure payment info stays safe and out of the wrong hands. SSL certificates are the shields in this fight, suiting up the data for its journey through the web.

Here’s the deal – PCI compliance is hard. There are a lot of rules, and one must follow each one to the letter. We’re talking about steps that run from keeping a tidy network to crafting strong access controls. It’s a game of detail, where one slip can mean a data breach risk for online retailers.

The role of SSL certificates? Simple. They’re like the secret codes you created as a kid. Except these codes guard all the data shared during a sale. So, if someone tries to sneak a peek, all they get is gobbledygook.

But here’s the trick – the certs must be up to code, too. They ensure the chat between buyer and seller is a private one. This stops bad actors from joining in and making a mess of it all. With each new rule and tech, it’s a race to stay on top, which also means leaving no room for slowing down.

In this digital checkout minefield, every step counts. Adopting new payment tech means a deep dive into the pool of standards set by those who know best. PCI compliance is your map, and SSL certificates are your trusty boots. Keep them laced tight, and you’re set to trek through the land of secure e-commerce, ready to face whatever new challenge the online payment landscape throws your way.

In this post, we’ve talked a lot about keeping online payments safe. We first looked at the growing worries about e-commerce payment security and how businesses can protect their sites. Then, we explored how to fight fraud and stop chargebacks. This helps keep your e-commerce site strong. Next, we saw how safe payment systems make shopping online better for customers. They can help stop people from leaving stuff in their carts. Plus, adding more ways to pay can make buying things easier.

Finally, we went through the tough rules for online payments and talked about staying up to date with new tech. We also covered PCI rules and why SSL certificates are key. Keeping your e-commerce payments safe is big work, but it’s worth it. It builds trust and keeps customers happy. Remember, protecting your site is as important as making sales. Both keep your business strong. Thanks for joining me on this security journey. Stay safe and sell well!

Q&A :

What are the common security challenges for e-commerce payment platforms?

E-commerce payment platforms must contend with a variety of security threats, including fraudulent transactions, identity theft, and data breaches. Ensuring the protection of consumer data and maintaining PCI DSS compliance are critical tasks for these platforms.

How do e-commerce payment platforms handle chargebacks and fraud?

Chargebacks and fraud pose significant challenges for e-commerce payment platforms, which must strike a balance between implementing robust fraud detection measures and maintaining a smooth user experience. These platforms typically use advanced algorithms and verification processes to mitigate such risks.

What technical hurdles do e-commerce payment platforms face?

Technical challenges for e-commerce payment platforms involve ensuring seamless integration with various shopping carts, managing high transaction volumes, and providing consistent uptime. They must also keep up with evolving payment technologies and customer preferences.

How do international transactions affect e-commerce payment platforms?

International transactions introduce complexities for e-commerce payment platforms, such as dealing with currency conversion, different payment methods preferred in various countries, and compliance with international regulations. Platforms must be adaptable to serve a global customer base effectively.

In what ways is user experience a challenge for e-commerce payment platforms?

The user experience for e-commerce payment platforms is crucial; platforms must be intuitive, fast, and reliable. The challenge lies in simplifying the payment process while ensuring security and accommodating a range of devices and browsers that customers use to shop online.