Growth stocks vs value stocks is more than an investor’s toss-up; it’s a choice that could define your wealth trajectory. Every savvy investor knows the thrill of spotting the right stock that surges ahead or the satisfaction of picking an undervalued gem that promises steady gains. But what’s the best route to ride the market waves to riches? In this dive into the investing world’s big debate, I’ll tackle the key differences, reveal performance insights, and unravel strategies that could beef up your portfolio. Let’s cut through the jargon, break down the facts, and set the stage for an investment approach that may just steer your next financial move toward greater success. Buckle up, because we’re about to shift your stock-picking game into high gear.

Understanding Growth and Value Stocks

Defining Growth Stocks: Characteristics and Examples

Growth stocks are like rockets. They aim high and grow fast. Think of tech giants you know. They invest a lot back into their business. They do this to grow quick and big. Their prices can shoot up. This happens if people think they will do well in the future. Even if they don’t pay out much money to shareholders now. But watch out! Their ride can be bumpy with big ups and downs in price.

Now, let’s talk examples. You’ve probably heard of companies like Apple or Amazon. They didn’t always make a lot of cash. But they grew super fast. This made their stock prices leap up. People who bought those stocks early are super happy now. They saw something special and it paid off.

Identifying Value Stocks: Key Indicators and Metrics

Value stocks are like hidden treasure. They cost less than what they may really be worth. This can happen for many reasons. Maybe the whole market is down. Maybe just a few people see their true worth. To find these gems, you need to be a bit of a detective.

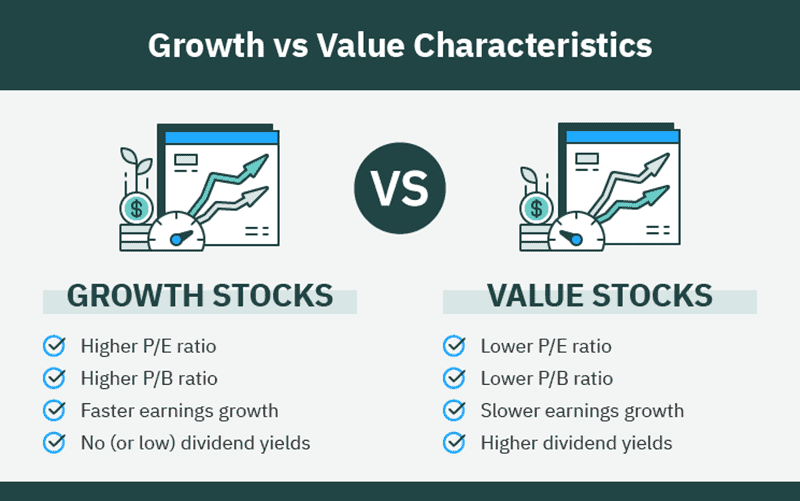

Look for stocks with low price-to-earnings (PE) ratios. This means you’re paying less for each dollar the company makes. Also, check the price-to-book ratio. This can tell you if a stock costs less than what the company’s stuff, like buildings and machines, is worth.

Some big-name companies can be value stocks too. We call these “blue chip stocks.” They’re like strong towers that stand tall even when storms hit the market.

Warren Buffett loves value stocks. His strategy is simple: buy stocks like you’re buying the whole company. Think long-term. He looks for firms with a strong history of making money and leaders who are smart and careful.

What about dividends? Value stocks often give you a piece of the pie. That’s cash paid out from the company’s profits. It’s like getting a thank you note with cash inside, just for owning the stock!

Remember, investing in value stocks is like a long hike. You may not sprint to the top, but you could enjoy a steady climb. And maybe a nice view with fewer surprises than those fast-growth rockets.

So, you’ve got growth stocks that zoom and value stocks that can bloom over time. Each has its own path in the stock market forest. Some folks pick one path. Others walk both. This can help them keep steady when the market waves hit. The key is knowing which stock type fits your goals and your guts when it comes to ups and downs in prices.

Now, you might think, “How do I start?” It starts with learning. Knowing all this is power when playing the stock market game. And remember, it’s a game of patience and smarts. With growth and value stocks, you’ve got two powerful tools. Use them well to build your wealth as you ride the waves of the market.

Measuring Performance: Growth Stocks vs Value Stocks

Assessing Historical Stock Performance and Market Trends

When we talk about growth and value investing, we look at how each performs over time. Growth stocks are the sprinters of the stock market. They run fast and aim to win big, quick. Think of companies that are all about new tech and big ideas. They grow quick and their stock prices often do too. But here’s the catch: they can also fall hard and fast.

Value stocks, on the other hand, are like marathon runners. They move slower but keep a steady pace. These stocks are often companies that have been around for a while. People see them as bargains, priced less than they’re really worth. They can provide solid wins over a long time. Yet, they might not seem as exciting as those high-flying growth stocks.

We can’t just go by what we feel, so we look at historical stock performance. This tells us how stocks have done in the past. And what do we see? Growth stocks can beat the market when times are good. But in tough times, value stocks often hold up better. This makes them less of a wild ride, less stock volatility.

The Role of Market Capitalization in Stock Selection

Market cap tells us the value of a company in the stock market. It’s like a tag that says “This is what I am worth.” Big companies, known as large-cap, are often more stable. Many of these are blue-chip stocks. They’ve got a track record for good performance. These big players can be growth or value stocks.

But let’s not forget the smaller players, the mid and small-cap stocks. These companies can be hidden gems with a lot of room to grow. They might be the next big thing. Or, they could be undervalued equities waiting for investors to spot them.

Choosing stocks isn’t just about big or small, though. It’s about seeing who stands to win in the long run. It’s about picking stocks that match your risk tolerance and your investment goals. You want a mix that can handle the ups and downs of the market, the bear versus bull markets.

Warren Buffett’s investment strategy is a good guide. He loves buying shares in solid companies at fair prices. He’s into that buy and hold strategy. Warren Buffet says it’s not just about the price you pay, but the value you get.

So, when you’re investing in value stocks or those high-growth stocks, remember: know their history, check their market cap, and stick to your long-term investment strategies. By doing this, you set yourself up for smoother sailing on those market waves, building wealth that can last.

Investment Strategies: Blending Growth and Value

Balancing Tech Stock Investments with Blue-Chip Stability

Tech stocks can grow fast but they can be risky too. Blue-chip stocks bring balance. They are like your steady friends who are always there for you, rain or shine. When tech stocks shake up your money, blue-chips keep it safe. Think of a see-saw. On one side, you have tech stocks leaping high. On the other, blue-chips holding strong, making sure you don’t fall off.

Strategic Utilization of Financial Ratios and PE Analysis

Numbers tell stories in the stock world. Financial ratios and PE analysis help us read those stories. They are like secret codes that unlock the worth of stocks. A low PE ratio can mean a stock is on sale. But watch out, it could also mean trouble’s ahead.

Understanding growth versus value investing means looking deep into the numbers. In long-term investment strategies, you want stocks that will still be shining years from now. That’s where fundamental analysis and stock valuation methods come in. They’re your treasure maps, guiding you to the gold of investing in value stocks.

To spot undervalued equities, you need to think like a detective. Look for clues in their history. Has the stock been worth more before? If yes, why did it drop? This could be your chance to get a deal. But keep an eye on the future too. Look for those potential value stocks that are ready to take off.

When investing, you don’t want all your eggs in one basket. That’s why diversifying your investment portfolio is key. Mix it up with high-growth stocks and those undervalued hidden gems. This way, whether it’s a bear or a bull market, you’ve got your bases covered.

Remember, stocks like the S&P 500 can be your guide through the stormy seas. They show you what the big players are doing. But don’t just follow the crowd. Use your own map – financial ratios. They are like the stars that sailors used to find their way home.

Growth and value stocks have different beats. Growth stocks like high-growth technology firms quicken your pulse. Value stocks are the slow, steady heartbeat of the market. But together? They’re the rhythm of a healthy investing heart.

Warren Buffett’s investment strategy teaches patience. His buy and hold strategy is about waiting for the perfect wave to catch. While market timing sounds cool, it’s not easy. Even Buffett knows that. It’s like trying to catch lightning in a bottle.

In the end, it’s about your goals and your guts. Align your risk tolerance with your dreams. Don’t chase the latest hot stock on a whim. Do your homework. Use the right tools – price-to-book ratios, PE ratio analysis, and others.

And there you have it, folks. The strategy’s not just about jumping on tech stock investments or stashing your money in blue-chips. It’s about being smart, patient, and daring, all at the same time. It’s a balancing act, just like life. Remember, in the stock market dance, you lead with knowledge, and your money follows.

Developing a Robust Portfolio

Navigating Bear vs Bull Markets through Diversification

Are you ready to ride the wave of the stock market? Smart investing means being prepared for ups and downs. In the good times, or “bull” markets, when prices go up, growth stocks often shine. They grow fast and their prices shoot up. But hold on, what happens when the market drops in “bear” territory? This is where value stocks come into play. These trusty stocks may not be flashy, but they are solid bets. With their low prices and strong foundations, they can weather the storm. Diversifying means you mix it up – get both growth and value stocks. This way, you’re set for any market mood swing.

Let’s take a moment to understand why diversifying your investment portfolio works. Think of it like a basketball team. You can’t win with only fast players; you also need strong defense. In the stock market, high-growth stocks are your fast players—they score big when the game is fast-paced. But when the game slows down, you’ll be glad to have undervalued equities, the defensive players who protect your score. Together, they balance your team, or portfolio, so you can aim to win in both bear and bull markets.

Incorporating Dividend Yield and Passive Income Considerations

Now, to make your portfolio even stronger, consider “dividend yield”. That’s like a bonus score in your investment game. When you invest in stocks that pay dividends, it’s like getting paid just for holding them. You get passive income. Even if the stock price doesn’t jump, the dividends keep your cash flow going.

Warren Buffett is big on dividends. His investment strategy includes looking for companies that pay well. He loves seeing his money work for him over time. And think about this: if a company can pay dividends consistently, it’s probably doing something right. It’s making enough money to share with investors, like you. So, when you’re picking stocks, look at the dividend yield. It helps you earn while you wait for stock prices to grow.

Value stocks often have higher dividends. They may not grow as fast as tech stock investments, but they bring in steady cash. Blue chip stocks—big, well-known companies—usually pay dividends too. Over time, this can really add up.

Building a robust portfolio doesn’t just mean chasing the next big thing. It’s about smart, long-term investment strategies. You want a mix of fast-moving growth stocks and steady, dividend-paying value stocks. This way, you get the best of both worlds. You’re ready for the market’s ups and downs. Plus, you can enjoy some extra cash from dividends while you’re at it. That’s how you ride the market waves to wealth.

In this post, we dived into growth and value stocks, showing what sets them apart and how they perform in different market conditions. We discussed the characteristics that define growth stocks and the indicators that identify value stocks. Plus, we looked at their past performance and why market cap matters when choosing stocks. We also explored strategies for mixing tech and stable blue-chip investments and how financial ratios and PE analysis can guide us. Finally, we covered ways to build a strong portfolio that can weather the ups and downs of the market, focusing on diversification and passive income.

What’s clear is that both growth and value stocks have a role in a smart investor’s portfolio. By understanding when and where each type fits, you can make better choices. Keep these tips in mind, and you’ll be on your way to a well-rounded investment strategy. Stay informed, stay flexible, and keep an eye on the market to make the most of your stock selections. Happy investing!

Q&A :

What are the main differences between growth stocks and value stocks?

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks usually don’t pay dividends as the companies prefer to reinvest any earnings back into the business for further growth. On the other hand, value stocks are shares of companies that are considered to be undervalued in price and have the potential for substantial price appreciation. Value companies often pay regular dividends to shareholders.

How do I identify growth stocks and value stocks in the market?

Identifying growth stocks often involves looking for companies with strong potential for revenue and earnings expansion, which might be due to unique products, services, or market domination. They generally have high price-to-earnings ratios and high growth rates. For value stocks, one would look for companies trading below the value that the financial metrics suggest. These might have lower price-to-earnings ratios, solid dividends, and are often established companies that are temporarily out of favor.

Are growth stocks or value stocks a better investment strategy?

The better investment strategy between growth and value stocks depends on individual financial goals, risk tolerance, and investment horizon. Growth stocks might appeal to investors looking for higher returns and who are willing to accept more risk and volatility. Value stocks might be more suited to conservative investors who are looking for steady performance and those who appreciate dividend income. Historically, both strategies have had periods of outperformance.

Can you give examples of growth and value stocks?

Examples of growth stocks include many companies in the technology sector like Amazon and Tesla, which are continuously expanding and innovating. On the flip side, value stocks often come from more traditional industries and might include companies like Johnson & Johnson or Procter & Gamble, which tend to have long-standing business models and steady revenues.

How do market conditions affect growth stocks versus value stocks?

Market conditions can significantly affect the performance of growth and value stocks. During booming economic times, growth stocks typically perform well as investors are optimistic about the future and willing to invest in companies with high expectations of earnings growth. Meanwhile, in economic downturns, value stocks may become more popular as they are considered safer investments with lower valuations and stable dividends. Furthermore, changes in interest rates and inflation can disproportionately impact these two categories of stocks.