Central bank interest rates and stock market trends are no strangers to each other. As someone who has seen the ups and downs of markets, I’m here to offer insights. Get ready to grasp how a change in interest rates by the central bank can send ripples through the stock market. We’ll dive into the nitty-gritty, from the impact of monetary policy on equities to decoding economic indicators. Don’t let the jargon scare you; I’ll break it down with simple mechanics and point out what to watch out for. Whether interest rates soar or dip, you’ll learn to navigate the waves. Let’s unveil the mysteries and steer you through the investment storm with poise.

Understanding Central Bank Interest Rates and Equity Markets

The Mechanics of Monetary Policy Impact on Equities

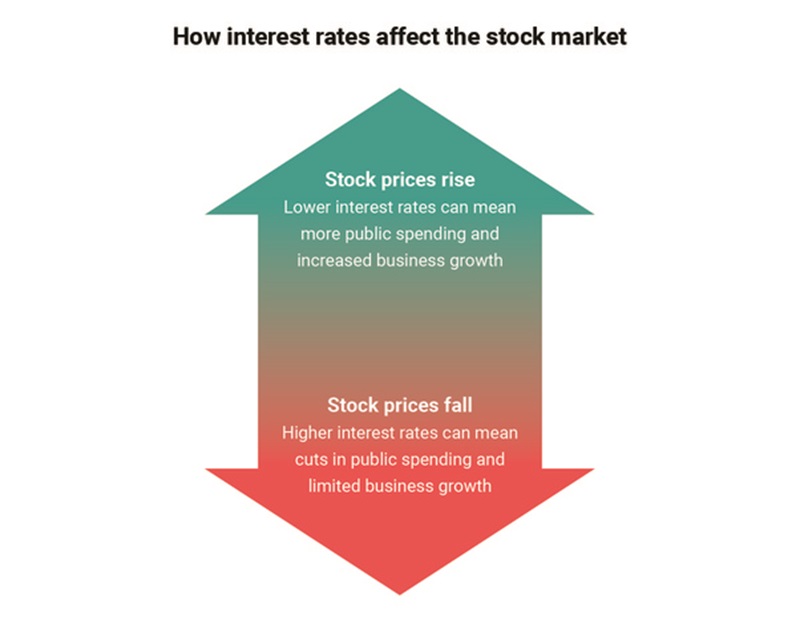

When central banks move interest rates, they rock the boat for stocks. Think of it like this: a bank decides it costs more to borrow money. Businesses may then say, “Let’s hold off on spending.” They’ll pull back on buying new gear or hiring. Now, investors watch this and think, “Hmm, this company won’t grow as much.” So, they might sell their stocks. When lots of investors sell, stock prices can drop. That’s how high rates can make stocks dip.

Low rates can do the opposite. They make borrowing cheap. Companies might say, “Let’s spend and grow!” They buy more, hire more, and maybe even make more cash. Investors like hearing that. They might buy more stocks, and when they do, prices can rise. It shows us that rates and stocks often move like a see-saw. One goes up, the other might fall, and vice versa.

Now, here’s something to think about: high rates fight inflation, but they can also slow down the job market. It’s a tricky balance for the central bank. They’ve got to get it just right, or else things can get messy in the stock market.

Federal Reserve Rate Decisions and Market Sentiment

Every so often, the Federal Reserve, also known as the Fed, will decide if they’re going to change interest rates. This is huge for our pocketbooks. If they hike rates, people and businesses don’t get loans as easily. They might spend less, and companies might earn less. So, the stock market might take a hit because people get nervous and sell their shares.

But if the Fed cuts rates, well, that can be like a party for the markets. Cheaper loans can lead to more cash floating around. Businesses might grow more, and investors might see dollar signs in their eyes. They start buying up stocks, hoping they’ll get more bang for their buck.

It’s kind of like weather for the stock market. A rate cut could mean sunny days, and a hike is like a storm’s ahead. Investors watch the Fed like a hawk, and even a hint of what they’ll do next can send stocks swinging. So, if you’re putting money in stocks, keep an ear to the ground for what the Fed’s saying. It can make or break your investment.

Remember, the stock market’s got a lot on its mind, but interest rates are like the market’s heartbeat. A quick change and everybody feels it. When you’re planning where to put your money, think about what the central banks are up to. They’ve got a big say in whether your stocks will soar or stumble.

The Indicator Lens: Economic Signs for Investors

How Economic Indicators Influence Market Performance

Let’s take a dive into market signs. First, why do we care about numbers like job reports or housing starts? These are like vital signs for our economy’s health. They can hint at what might happen next in the stock market. Think of them as the pulse and temperature of our financial wellness.

So, how do interest rates affect markets? They are like the volume control on your music player, but for the economy. When rates rise, it can mean less money for people to spend. That can slow businesses down. When rates drop, it’s like having more cash to splash. This can speed things up. But that speed can come with higher prices on stuff we buy.

Assessing Equity Valuations in Light of Quantitative Easing or Tightening

Now, let’s get into some big words: quantitative easing and tightening. These are fancy terms the big banks use. Imagine a balloon. When a central bank, like the Federal Reserve, uses quantitative easing, they are blowing air into our money balloon. This can make stock prices go up. Why? Because there’s more money around town, making it easier for people to invest in stocks.

On the flip side, when they tighten up – think less air, or even some air being let out – it does the opposite. Companies might find it harder to borrow money and grow their business. Less growth can mean stock prices might fall. But it’s not just stocks. This stuff matters for your whole game plan. We’re talking bonds, savings, even that new bike you’ve been eyeing.

Buckle up, friends. Monetary policy isn’t just for folks in tall buildings. It’s also for you and me, the ones on the ground aiming to guess where our kite will fly in this big sky of stocks and cash. When rates change, we’ve got to be ready. We take a hard look at the street signs along our way – jobs, home sales, how much stuff costs – and plan our next move.

And these signs, they aren’t just numbers. They’re clues. Like how detectives find their guy, investors feel the market’s beat. By watching these signs, we stay sharp and ready. Remember, with every central bank shout-out, whether about inflating or tightening, your money’s journey can take a new path. Keep your eyes open, watch those signals, and you’ll be ready for the ride.

To stay smart, think of all this as building your money’s muscles. Pull out your magnifying glass, read between the lines, and you’ll see the story they tell. We play not just to win today, but to set ourselves up solid for tomorrow – all by understanding the secret language of rates and markets. Keep your ears perked, and let’s ride this wave smarter, not harder.

Navigating Market Volatility Amid Interest Rate Fluctuations

Strategies for Adapting to Interest Rate Hikes and Bullish Trends

When central banks hike rates, markets often feel the heat. Stocks may drop as borrowing costs rise. But with smart moves, investors can ride the wave. Here’s how:

Remember, firms with big debt may struggle when rates go up. Short-term dips can happen, but quality companies tend to bounce back. So, review your stocks. Ask, “Do they have solid foundations?” If yes, they might just weather the storm.

Now, when markets turn bullish, it’s a different ball game. Rate cuts often spark this. Businesses spend more; investors get excited. This can lead to high stock prices. But beware, the thrill can push prices too high, too fast. Stay grounded and check why a stock climbs.

Bond Yields vs. Stock Prices: Balancing Portfolios in Variable Rate Environments

Bonds and stocks often dance a tricky tango; when one rises, the other may fall. This is key in rate shifts. Central bank rates affect bond yields directly. But stocks follow a trickier path, shaped by rate impacts on profits and spending.

So, what’s a smart move? Balance is key. If rates rise, bonds might shine, offering higher yields. This can protect your cash when stocks dip. On the flip side, if rates fall, stocks might soar as cheaper loans fuel business growth.

Always keep an eye out for how bonds and stocks complement each other in your mix. This balance can help curb the bumps when central bank rates swing.

Proactive Investing During Central Bank Policy Shifts

Interpreting Central Bank Communications for Advanced Market Forecasting

When central banks talk, smart investors listen. They hint at future money moves. Money gets pricier when rates rise, so loans cost more, and spending slows. Stocks often dip as company costs climb. But if rates drop, money’s cheap, spending jumps, and stocks can soar.

Truth is, rate hints sway stocks before changes even happen. Let’s say the Federal Reserve hints at a rate hike. Investors might sell stocks, thinking costs will rise and profits may drop. But if a cut’s hinted at, they might buy, expecting a business boost. You see, it’s not just the rate change; it’s the chatter around it that shakes the stock market.

So, I keep a close eye on central bank speaks. I look for words like “hawkish” – meaning rates might climb, or “dovish” – hinting at rate drops. It’s a bit like a game of hints and clues. Get it right, and you can prep your investments early.

Portfolio Rebalancing Techniques in Response to Interest Rate Predictions

Now, how do we brace for these market shakes? We rejig our portfolios – that’s investor talk for moving our money around to safer spots. If rates are rising, I might nudge more cash into bonds. They’re like a cozy blanket when market chills hit. But if rates are on a downhill slide, I scoot more into stocks, especially ones that could win from cheaper loans and more spending.

Some stocks are sturdy, even when rates go up. They’re like big trees that stand tall in a storm – think stuff folks always need, like food or power. Others, like tech, can wobble when loans cost more because their success often rides on borrowing for big ideas.

Every time the Fed or other central banks talk rate changes, it’s our cue to double-check our money mix. We can’t stop the market’s wild rides, but we can buckle up and ride it out smarter. That’s how we do more than just survive; we thrive through the market’s ups and downs.

Remember, pals, riding the interest rate seesaw needs a sharp eye and a quick hand. You’ve gotta watch those central bank clues like a hawk and tweak your cash stash just right. It’s part playbook, part crystal ball. If you play it cool and play it smart, your wallet will thank you when the dust settles. Keep learning, stay nimble, and let the central banks’ roadmap guide your investment journey!

In this post, we broke down how central bank rates affect stocks and your wallet. We explored the role of the Fed and how its decisions stir market moods. Then, we switched gears to show you how to read economic signs for smarter investing. When rates shift, stocks and bonds can dance to different tunes. But no sweat! We’ve got smart moves to make. You learned how to adjust your portfolio, whether rates go up or down. Balance is key when you’re investing in such times. Staying on top of bank policies can really boost your forecasting game. Remember, the right tweaks at the right time can keep your money growing strong. Keep an eye on the market, stay informed, and keep your investment goals on track. Let’s make those smart moves and win.

Q&A :

How do Central Bank interest rates affect the stock market?

Central bank interest rates can influence the stock market significantly. When the central bank raises interest rates, borrowing costs increase, which can dampen consumer spending and business investments. This can lead to decreased corporate profits and lower stock prices. Conversely, lower interest rates tend to encourage borrowing and spending, potentially boosting company earnings and elevating stock market valuations.

What happens to stocks when the central bank adjusts interest rates?

When the central bank adjusts interest rates, it can lead to immediate reactions in the stock market. An interest rate hike often results in a decline in stock prices as investors anticipate slower economic growth and reduced profitability. On the other hand, a rate cut can cause stocks to rise, as cheaper borrowing costs may stimulate economic activity and increase earnings potential.

Why do investors monitor central bank interest rate decisions?

Investors monitor central bank interest rate decisions closely because these decisions impact economic conditions, inflation rates, and currency values—all of which can have a significant effect on investment returns. Interest rate changes can alter the attractiveness of various asset classes, leading to portfolio rebalancing and shifts in market sentiment.

How can changes in Central Bank interest rates offer investment opportunities?

Changes in Central Bank interest rates can create investment opportunities by affecting the valuation of assets. For instance, rate cuts might make bonds less attractive and push investors towards stocks, especially dividend-paying ones. Conversely, rate hikes could make fixed-income investments more appealing. Investors can capitalize on these shifts by adjusting their asset allocation in anticipation of interest rate moves.

Can Central Bank interest rate trends be used to predict stock market performance?

While Central Bank interest rate trends provide important signals, predicting stock market performance based on these trends alone is challenging. Multiple factors influence the stock market, including economic data, corporate earnings, geopolitical events, and more. However, investors often look at interest rate trends as one of the components in their overall market analysis and investment strategy.