Impact of Competition: Does It Fuel Digital Economy Innovation?

Every buzz in the tech world sparks a question: how does the impact of competition on innovation in the digital economy shape our future? Imagine a race where each runner’s speed boosts the others’. That’s the tightrope we’re walking in the digital age. I dive into this complex tango, dissecting every step to reveal if fierce rivals push the envelope or if they stomp on the very creativity they need to thrive. Let’s strip it down to brass tacks – when tech giants and startups stare each other down, do we see a surge in breakthroughs, or does the shadow of dominance dim the bright lights of innovation? Join me as I unpack the layers, explore case studies, and analyze how the match-up of competition and invention writes the rulebook for tomorrow’s digital giants.

The Symbiosis between Market Dynamics and Digital Innovation

Unpacking the Relationship: Market Dynamics vs. Innovation Pace

Market rules shape how fast new stuff pops up. They are like big, invisible hands. Some rules help make new things come fast. Other rules can slow them down. Think of a race. Sprinters are the new ideas. The track is the market with its rules. A clean track without hurdles means sprinters can zoom. But add hurdles, and they might trip. It’s the same with making new stuff.

Let’s talk about digital economy innovation. It’s about creating new ways and tools to trade, work, and live. We see it in how we use our phones for so many things. Good competition means companies try to outdo each other. This can push them to innovate. But, if one company gets too big, it can turn into a bully. Then others may struggle to keep up or even join in.

Tech startups feel this a lot. They are young and full of ideas. They sometimes create huge changes fast. They are the sprinters in our track race. Silicon Valley trends show this. It’s where many sprinters train to be the best. They get support, money, and advice. This place shows how important it is to have a good track, without too many hurdles.

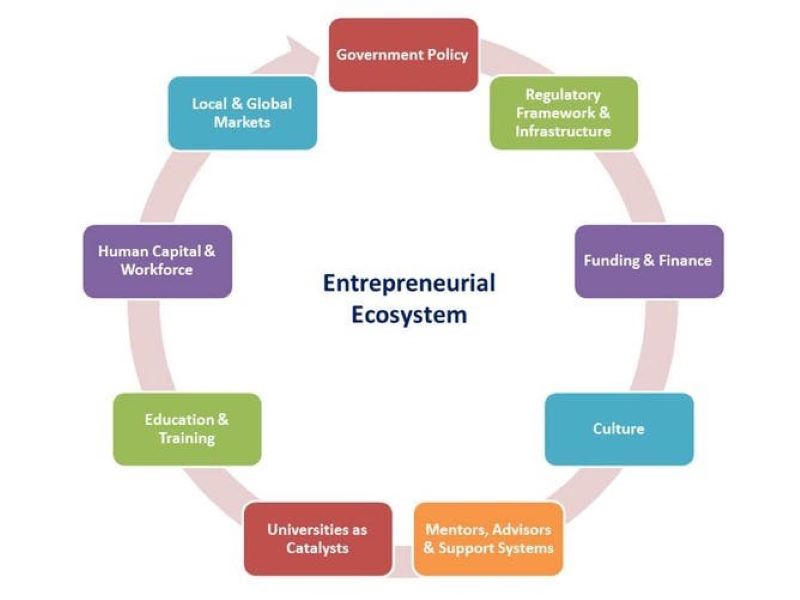

Venture capital can help a lot. These are like coaches for our sprinters. They give money and help to make ideas grow. But they also want to win. So, they choose who they think can run the fastest. They influence the innovation ecosystem. It’s a community where creating new things can thrive.

Some things make it hard to make new stuff. We call these “innovation barriers”. They can be bad rules or things that block the way. For example, if a few big companies hold all the good stuff, it’s tough for others. These big ones are ‘tech giants’. Sometimes, they dominate too much.

But remember, it’s not just about who comes first. We also need to share ideas, like passing a baton in a relay race. That’s called collaborative innovation. It can lead to even bigger wins in the long run.

Now, think about antitrust regulations. These are like rules that stop the big bully from hogging the track. They make sure the race is fair so that everyone can try their best.

Case Studies: How Market Shifts Have Propelled or Hindered Innovation

You see, every time the market changes, it’s a chance. A chance for new ideas to grow or die. Take fintech growth. It’s about using tech in finance. It’s grown lots because the market let it. People wanted easier ways to handle money. And the young companies saw this. They ran to the front fast.

But it’s not always like this. Look at digital transformation. It’s a big shift to digital in all parts of life. Some companies saw the track change and sped up. Others didn’t and fell behind.

Market dynamics are key to innovation speed. They can be a pal or a foe. They either clear the track or clutter it with hurdles. It’s a dance between what we need and what we can make. And it’s this dance that keeps the digital economy bouncing.

The Silicon Valley Blueprint: Fostering Competitive Tech Ecosystems

Analyzing Silicon Valley’s Approach to Nurturing Tech Startups

In Silicon Valley, the birthplace of big tech dreams, competition is fierce. Here, tech startups shoot for the stars. They are backed by a belief that anything is possible. We see disruptive technology take shape daily. This is due to a mix of bright minds, daring ideas, and bags of cash from eager investors.

The air in Silicon Valley buzzes with ideas on digital transformation. Startups know that to survive, they need a fresh trick up their sleeve. They push the envelope on emerging technologies. Keeping ahead of the innovation race is vital. It’s not just about having a good idea. It’s about making it real and doing it fast.

Startups live by ‘innovate or die.’ Down the street, another team just might crack the code on the next big thing. Tech giants keep an eye out for these fresh players. Sometimes they become mentors. Other times, they buy them out.

Entrepreneurial innovation thrives on this. It’s like a wild garden of ideas where the best ones bloom. Startups change market dynamics. They break old rules and set new trends. They draw in venture capital, betting big on a future payoff. All this energy makes Silicon Valley a magnet for those dreaming to disrupt.

Venture Capital’s Role in Shaping Innovation Ecosystems

Venture capital sits at the heart of the innovation ecosystem. It turns ideas into action. It’s not about charity. It’s about finding the gold in a sea of stones. VCs scout for the brightest ideas. Then, they pour in resources to make them grow. They play a huge role. They decide who gets the fuel to zoom ahead.

Imagine having a rough sketch. It could become a masterpiece. But you need colors and brushes. That’s what venture capital gives to a tech startup. They’re not just buying a slice of the company. They’re saying, “We believe in you. Now, go make magic.”

In this game, the stakes are high. VCs become part-time fortune-tellers. They must guess which startup will break through next. A wrong call can cost millions. The right one can change the world.

Some say too much money kills the startup spirit. Giants throw cash, and little fish lose their way trying to please them. Yet, without venture capital, many ideas would stay dreams. It’s a delicate dance. All must keep in step to keep innovation alive.

This cut-throat world shapes what we use every day. The device you’re reading this on, the apps you use, the digital services you can’t live without – many started here. Each faced tons of rivals. They won by playing smarter and faster.

The battle for the future of the digital economy rages on. Startups come and go. VCs hunt for the next unicorn. They push for faster, better, and bolder. This push is what powers Silicon Valley. It’s why disruptive technology keeps coming out of this small corner of the world. It’s a cycle that spins faster by the day. And we all watch, waiting to see where it goes next.

The Double-Edged Sword of Big Tech: Stimulation and Domination

How Big Tech Companies Influence Startup Culture and Knowledge Sharing

Tech giants often set the stage. They hire top talent and push the tech boundary. They show startups what’s possible. Startups want to be like them. New companies aim to match that success. They chase new ideas and dream big. Sometimes, they do it with help from big tech firms. Yes, large tech helps them too. They share tools and knowledge. It drives digital economy innovation to new heights.

Yet, it’s not all positive. Big tech can also limit small tech startups impact. They can take the best ideas and talents. They have more money and resources. This can make it hard for startups to compete. Startups may struggle to keep up. Market dynamics can also sway in the favor of big tech. If a startup does well, a big company might buy it. This can be good or bad. It depends on how you look at it.

Competition can be tough but it’s also a spark for new ideas. When startups have to fight, they think outside the box. They have to if they want to stay in the game. This leads to creative solutions. And sometimes, to big changes in our digital lives.

Competition helps. It keeps everyone on their toes. Big tech giants must keep moving too. They can’t just sit still. New startups are always coming. They bring fresh ideas and challenge the old ways. It’s important this stays this way. We need competition for innovation to grow.

Navigating Antitrust Regulations: Preserving Competition and Innovation

Rules are key in keeping the digital markets competitive. Antitrust regulations make sure of that. These rules stop one company from controlling everything. They make sure new ideas can win. But how do they do that? They look out for unfair moves. They check if small companies can get into the market. It’s all about balance. They want everyone to have a fair chance.

But these rules can be tricky. Too much control can slow things down. Companies might not want to risk new ideas. Too little, well, one big player could take over. Keeping a good balance is hard, but crucial. The right rules can keep the innovation ecosystem alive and kicking.

Silicon Valley trends show us that startups can reshape industries. They just need a fair starting line. Venture capital influence helps too. They bet on new, risky ideas. They put their money where most won’t. This pushes the startup culture forward.

So, good rules make for great races. They let the little guy in the door. And when that door is open, amazing things can happen. The big tech challenge is part of the race. It’s not always easy. But, when done right, it can lead to great leaps in how we live and work.

Emergent Trends in Disruptive Technologies and Their Market Impact

Artificial Intelligence and IoT: Pioneering the Future of the Digital Economy

Just think, your fridge orders milk for you before it runs out. This is no dream. It’s real, and it’s here thanks to the Internet of Things (IoT) and Artificial Intelligence (AI). These are two stars in today’s digital economy. They work together like peanut butter and jelly. AI learns from data and makes smart decisions. IoT connects everyday things to the internet. So, they can talk to each other, and to us.

AI and IoT are changing how businesses work and compete. They help them save time and money. Companies use AI to understand what customers like. They create new gadgets that change our lives. Smartwatches track our health. AI personal assistants, like Siri, make our day easier. They are part of a digital world that keeps growing.

Collaborative Platforms and Network Effects: A New Paradigm for Innovation Strategy

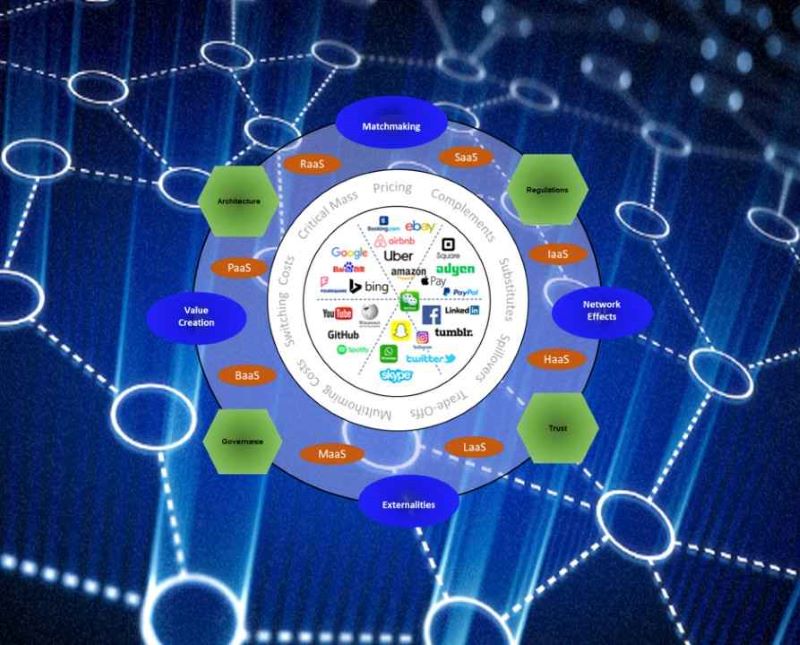

Now let’s chat about something cool called network effects. Here’s a simple way to think about it: a phone is no good if you’re the only one who has one. But if everyone has a phone, we all can chat, text, or send pictures. That’s a network effect. Each new user makes the network more valuable.

In the techie world, platforms like Facebook have nailed this. More users mean more folks to talk to. It also means more ads, which makes Facebook money. This also helps new ideas spread super fast. One smart person shares something new. Then tons more think of ways to make it better or different.

Tech startups love this. They use platforms to share ideas and build on them. This helps them make new things faster than before. A lot of big business now started this way. They grew big by thinking outside the box and working together.

These trends also help us all be more creative. They make it easier to throw around ideas. Then we can test them out to see what works best. This is what I like to call “collaborative innovation.” It’s not just big companies doing their own thing. It’s a mix of different people and businesses teaming up.

We all love new gadgets and gizmos. And we love them more if they make our lives better and easier. That’s why tech companies keep pushing to come up with the next big thing. They know if they don’t, someone else will.

Are we spinning faster towards the future? You bet! IoT and AI, network effects, and everyone sharing ideas—it’s all revving up innovation. It’s an exciting ride, and I can’t wait to see where we zip next. This is innovation at the speed of a click, a tweet, or an eureka! It’s always buzzing, always changing, and it never hits the brakes.

In this post, we’ve seen how market forces and digital breakthroughs depend on each other. From the fast dance between market change and new tech, to real-world stories of shifts sparking innovation. We’ve learned from Silicon Valley how a ripe tech landscape creates wins for startups. Money plays a big part here, giving smart ideas the push they need.

Yet, Big Tech’s grip can both lift and crush the startup scene. They’ve got smarts and power, but we’ve got to keep the playing field level. And with AI and the Internet of Things at the fore, we’re stepping into a bold digital era. New ways to connect and create are changing the game.

So, my final say? Keep an eye on these forces. They shape our tech world, for better or worse. It’s a thrilling ride, and we all have a role in how the future unfolds. Let’s be smart, stay open, and drive tomorrow’s innovation forward. Together, we can make sure the tech we dream up today builds a brighter, smarter tomorrow.

Q&A :

How does competition influence technological innovation in the digital economy?

Competition in the digital economy serves as a catalyst for technological innovation. Companies are driven to develop new products, services, and processes to gain a competitive advantage. This pressure often results in the acceleration of innovative activities and the fostering of a dynamic business environment that continuously pushes the boundaries of technology.

What are the risks and rewards of competition for digital startups?

For digital startups, competition can be a double-edged sword. On one hand, it can encourage startups to innovate and differentiate their offerings. On the other hand, intense competition may pose risks such as market saturation, difficulty in gaining customer loyalty, and the potential for rapid obsolescence of their products. Startups must carefully navigate the competitive landscape to leverage opportunities for innovation while mitigating risks.

Can a lack of competition stifle innovation in the digital economy?

A lack of competition can indeed stifle innovation in the digital economy by reducing the incentives for businesses to innovate. When companies face little or no competition, they may become complacent and less inclined to invest in research and development. This can lead to a stagnant market where progress slows and innovation diminishes over time.

How does market structure affect innovation strategies in the digital economy?

The structure of a market can significantly influence a company’s approach to innovation. In monopolistic or oligopolistic markets, few firms often dominate, which might either lead to reduced innovation due to lack of competitive pressure or increased innovation through the exploitation of large resources for research and development. In contrast, a highly competitive market structure typically forces firms to adopt more aggressive innovation strategies to survive and thrive.

What role does government regulation play in balancing competition and innovation in the digital economy?

Government regulation plays a critical role in maintaining a healthy balance between competition and innovation. Regulations can prevent monopolies, protect intellectual property rights, and ensure fair competition, which in turn can encourage companies to innovate. However, overly restrictive regulations may hamper innovation by creating barriers to entry and limiting the free flow of ideas and technologies. It’s vital for regulators to find a balance that promotes a competitive, yet innovative digital economy environment.