How digital platforms stifle competition is not just buzzwords tossed around in tech circle debates—it’s real, and it’s shaping our market’s future. Think about it: when was the last time you saw a new online store overthrow giants like Amazon? The truth is, for new players dreaming of digital success, the game seems rigged. The big names own the playing field, the ball, and even the referee, making it harder than ever for start-ups to score. I’ve seen it firsthand: solid products never reaching customers, innovation getting swallowed whole, and market variety shrinking. Ready to dive into this struggle and see how the net giants may be choking out the little guys? Stay with me, as we pull back the curtain on this hulking issue.

The Mechanics of Market Control: Tech Giants and Monopoly Power

Understanding Monopoly Power in the Digital Economy

Tech giants have grown huge, holding more market sway than we can easily see. Their power spreads wide in the digital world. Today, monopoly power is not just about high prices. It’s about how tech firms control markets and limit choice. The monopoly power nowadays controls what we see online and where we can buy things.

The Role of Antitrust Laws in Curbing Tech Giants’ Market Domination

Antitrust laws should stop one business from owning all the market. But these laws must change to keep up with tech giants’ tricks. Today, they face new challenges from digital markets growing fast.

To really grasp the strength big tech holds over our daily lives, let’s dive deeper. Think of monopoly power as a giant game board. Tech giants are like players who own lots of spaces. When we land on their space, we pay, and our choices are slim. Online shopping? Amazon’s your main bet. Need information? Google leads the way. Socializing online? Hello, Facebook. Here, each giant’s rules matter more than ever.

Monopoly power in the digital economy shows up in sneaky moves. Like a search engine steering you to its shopping site. Or an app store favoring its own apps. This control drowns out new voices and ideas. Companies with fresh visions can’t compete when big firms have locked down the game. It’s not just shops or apps – it’s news, opinions, what you see and share. This chokehold hurts everyone trying to find a spot in the digital world.

This is where antitrust laws should come into play. These rules should keep any one player from ruling the game. They were made a long time ago, when big businesses sold oil or steel. But now? Our game has changed. Big tech sells ideas, gathers our data, and makes new spaces online that we all live in.

We count on antitrust laws to tackle tech giants’ market dominance. But it’s a tough match. These laws must be sharp to hit the mark against giant companies online. They were not made for a time when a single app store could cut out so many others. Tech giants weave complex web – one where they can set the rules and tilt the board.

Market dominance in tech is like a dragon, hoarding treasure. But here, that treasure is our data, choices, and chances to grow new businesses. Amazon competitive practices, for instance, come under fire. They make or break small sellers on their site. Google search monopoly influences what we find. Facebook can squeeze out other ways to connect.

Apple app store restrictions block smaller apps from shining. All this builds up barriers to entry in the digital market. New businesses can hardly start when the door is held by just a few.

Data control and competition link tightly in tech. Those with the most data can push aside others. This power lets them use platform power to stay on top. It’s like having a superpower in our online world.

Digital monopoly impacts can stretch far. They reach into how we talk, shop, and even think. Anti-competitive strategies in tech are not just a problem for now. They are a big worry for our future in the digital world.

So, there’s a massive push for change. Rethink antitrust laws for today’s digital race. We need clear rules for fair play. We need to make sure no one holds all the cards. This is about keeping the game open, fair, and ready for the next player with big dreams.

Entry Barriers and Market Tightening: The Plight of Newcomers

How Barriers to Entry Cement Big Tech’s Market Position

Think of a big sandbox. Now, imagine big kids with the best toys guard the sandbox. Small kids can’t easily join in. That’s like what new companies face in today’s digital market. The big tech firms, giants like Google or Amazon, act like these big kids.

Big tech has lots of money. They pay to make it tough for new kids to play. This means the big keep getting bigger. Why does this matter? Well, with fewer new companies, we miss out on cool new ideas. We get the same old stuff. That’s no fun, right?

Ever heard of “network effects”? That’s when more people using something makes it better. Like how more pals on a gaming app make it cooler. Big tech uses this to stay on top. Once they’re huge, it’s hard for others to catch up.

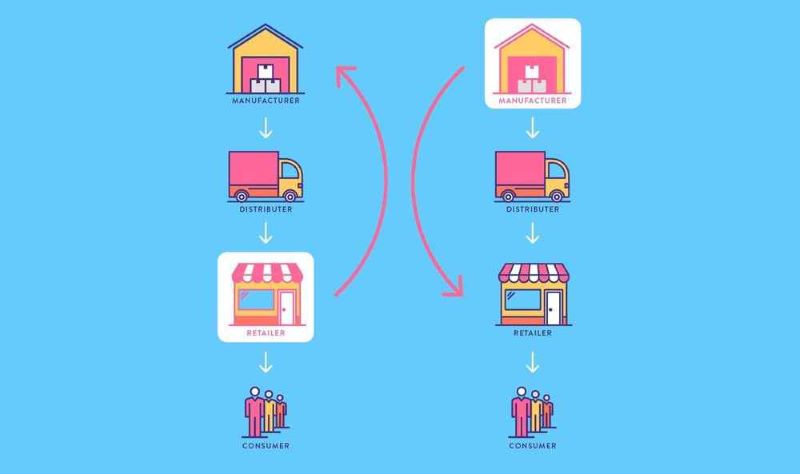

Effects of Vertical Integration on Startup Innovation and Growth

Now, let’s chat about “vertical integration.” That sounds fancy, but it’s simple. It’s like owning the candy shop, the candy-making, and the sugar all at once. Big tech companies do this, too. They own everything along the way in making their products.

This is a big deal for small startups. Why? Because then, the big tech companies control the tools they need. Imagine trying to make lemonade but someone else owns all the lemons. It’s tough, right?

Vertical integration can help big companies, sure. But it can hurt the little guys trying to grow. Startups need fair chances to turn their ideas into cool products. When big companies have such control, they can set rules that make it hard for others.

Big tech firms tell the new companies, “Play by our rules or you can’t play at all.” Those rules can be strict. They might even stop you from using other services. It’s like saying “You can only build sandcastles with our buckets and spades.” For small businesses, this cuts choices and chances to shine.

Now, think about the new guys wanting to sell apps or products. The big companies own the stores. They pick who gets to sell there. If they say no, your app might never be seen. That’s how Apple app store policies can control what we find on our phones.

All this can smother new ideas. And those new ideas are the seeds of cool, never-before-seen stuff. We lose out on that when newcomers can’t get past these giants.

My beef with digital monopolies? They’re not just bad for other businesses—they’re rough for you too. You get less choice. You may not find that awesome, life-changing app because it couldn’t fight through these tough rules.

And let’s not forget, without competition, prices might go up. Your wallet feels that. Big tech uses its power to keep prices in their favor, like making sure they’re the cheapest by charging smaller folks more to rise.

We need fair play, friends. Without it, we’re stuck with fewer choices, less cool stuff, and higher prices. That’s why we talk about things like monopoly power. Because in the grand game of business, everyone should have a chance to roll the dice.

The Invisible Hand Behind the Screen: Algorithms and Market Impact

The Influence of Search and Social Media Algorithms on Competition

Picture this: when you search online, it’s like asking a huge crowd. But what if only a few loud voices decide who talks? That’s what search algorithms do. They act like gatekeepers. Let’s say you want to buy a soccer ball. You type “buy soccer ball” into Google. Pages of choices pop up. But did you know? The top choices get there for a reason. It’s not random. It’s Google’s secret recipe, a search algorithm.

These algorithms can help or hurt businesses. How? Let’s say Google likes another company more. It will show their soccer balls before yours. Even with great soccer balls, you get fewer buyers. This is Google search monopoly at work. It affects who wins and who fades away.

Facebook does something alike. They control what you see or don’t in your news feed. This means they can decide which businesses show up more. This is Facebook unfair competition.

Predatory Pricing and Data Control Strategies of Online Platforms

These tech giants can also play a price game. They can set very low prices on purpose. This is called “predatory pricing”. How does it hurt competition? Small businesses often can’t match these low prices. They risk losing out or closing down. And get this: big companies like Amazon can afford to lose money for a while. Small ones? Not so much.

Now, think about all the info we share online. Big companies keep this data. It tells them what we like, what we buy, even where we go. With this, they have lots of power. They can use this data to get ahead. This is “data control”.

And apps? Apple has rules on who can put apps on iPhones. That’s Apple app store restrictions. It’s tough when one company controls such a big door to customers.

Still with me? Here’s the real kicker. All this links back to “monopoly power”. That means one or a few big names rule the market. They set rules that favor them. This crushes little companies. It can stop new ideas. It limits what we can choose from. It’s like a few big bullies running the playground. And this isn’t healthy for markets or for us.

What’s more, we’ve got more than just money at stake here. It’s about our options, right? We should have the power to choose from wide and varied products and services without a hidden hand tilting the scale. So, when we talk about “barriers to entry in digital market”, we’re saying these giants make it super hard for new names to even start playing the game.

And let me tell you, the battle isn’t just in online stores or apps. It’s in ads, it’s in what ideas get shared, and it’s in our choices, every single day. This is the impact of algorithms on the market. It’s big, it’s hidden, and it matters. Big time.

Forging a Fair Digital Marketplace: Regulatory Response and Challenges

Assessing the Effectiveness of Current Digital Market Competition Regulation

Let’s get real about digital market competition. We count on antitrust laws to keep things fair. They stop companies from choking out rivals. But are these laws tough enough for today’s tech world?

Think about the giants: Amazon, Google, Facebook, Apple. Their size makes it hard for new competition. They rule online shopping, searches, social media, and apps. Small businesses often can’t keep up.

Antitrust laws should prevent monopoly power. They’re meant to help innovation thrive. But tech giants hold so much control. They sway markets to their benefit. This can stifle new ideas and fair prices.

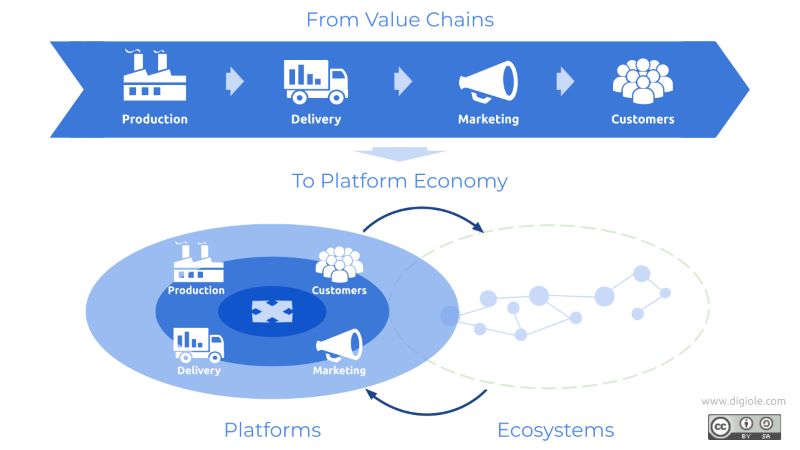

Digital monopoly impacts are huge. Network effects mean one top firm pulls more users. More users mean more data. More data means more power. It just keeps going.

New rules are needed. They need to consider tech giants’ market dominance. Old laws didn’t see digital giants coming. We need updates that reflect the new digital risks.

Tech giants are clever. They leverage platform power. They control data, weaken rivals, and keep growing. Take Amazon competitive practices, for example. Some say they hurt other sellers on their platform.

Google search monopoly? It’s real. Most of us use Google without thinking. Alternatives seem far off. This limits consumer choice. And it can hurt other businesses.

Apple’s app store restrictions? They force many app makers to follow strict rules. This can block smaller players from the game. Facebook and unfair competition? There’s been talk. The way they handle ads and news raises flags.

None of this is simple. We watch as big companies buy up smaller ones. It’s often called anticompetitive mergers and acquisitions. These deals can squash future competition.

But it’s tricky. Some deals seem okay at first. Then we see the effects. Eccomerce platform dominance or social media tactics can start small. Then, poof! They own the market.

Enforcing antitrust legislation is not easy. These tech firms are worldwide. They have deep pockets. They can delay or fight off legal challenges. This makes for real regulatory challenges for digital markets.

Bottom line: laws need to catch up. They must tackle today’s tech world head on. Only then can we see fair play and creativity soar.

The Debate Over Platform Economy’s Anticompetitive Mergers and Acquisitions

Big fish eating small fish. That’s often how it goes in the tech world. And it’s a hot topic right now.

Think about it. When a giant gobbles up a smaller company, what happens? Sometimes, it’s good. It can bring us new services. But there’s a flip side. It can also wipe out competition.

This often leads to gatekeeper platforms. These are like bosses of the digital world. They control what we see and buy online. This squeezes out smaller companies and new ideas.

People are talking. They worry about tech firms becoming too powerful. When everyone shops, searches, and socialises in one spot, who wins? The giants.

So, what can we do? We’ve got to look carefully at these mergers. Can they harm market variety? Could they give too much power to a few? These are the big questions.

We rely on regulators to watch over these deals. But they face tough choices. Stop a merger? Allow it? It’s a balance between growth and fairness.

In the end, it’s all about keeping the digital market vibrant. We want to shout out for the little guy, nurture breakthroughs, and protect our choices. It’s not just about today’s market. It’s about ensuring a dynamic, innovative tomorrow.

In this post, we’ve uncovered how big tech’s grip tightens around our digital economy. From how monopoly power works, to the way antitrust laws aim to control it, we’ve gone deep. We’ve also seen the huge walls new companies face when they try to enter the market. These giants use their power to keep control and make it hard for small players to thrive.

We took a close look at how algorithms can shape what we buy or see online. Not just that, but how they can crush or boost a business. And let’s not forget how these big companies can play with prices or use our data to stay on top.

In the end, we’re left with big questions about our digital market’s health. Is it fair? Can it be better? The rules we have now aren’t perfect – that’s clear – but change isn’t easy. The debate is hot on how to fix this, without hurting what makes our digital world so vibrant. It’s a tough call, but one thing’s sure—we need a fair place for all in the digital marketplace.

Q&A :

How do digital platforms affect competitive markets?

Digital platforms can influence competitive markets in a myriad of ways, ranging from setting the standard for user expectations to limiting market entry through network effects and data control. Large platforms with significant user bases can create high barriers to entry for new competitors, potentially leading to reduced competition and innovation.

What strategies do digital platforms use to stifle competition?

Digital platforms may employ several strategies to stifle competition, including exclusive agreements, preferential treatment of their products or services, and the utilization of massive datasets to thwart smaller competitors. Additionally, platforms can change algorithms in ways that disadvantage competitors, buy out potential rivals, or integrate vertically to control more of the supply chain.

Can digital platforms lead to monopolistic behavior?

Yes, digital platforms can sometimes lead to monopolistic behavior. Platforms with dominant market positions might engage in practices that abuse their market power, such as predatory pricing or requiring restrictive contracts with clients and suppliers. Such actions can reinforce their dominance, deter new entrants, and harm consumer choice and innovation.

What are the regulatory challenges in addressing competition in digital markets?

Regulatory challenges in digital markets include the difficulty of defining the markets themselves due to the rapid pace of technological change and the global nature of digital platforms. Antitrust laws may also be outdated or ill-suited for the unique aspects of digital markets. There’s also the challenge of enforcing regulations fairly and effectively without stifling innovation.

How can competition policy adapt to the digital economy?

Competition policy can adapt to the digital economy by updating antitrust legislation to reflect the realities of the digital age. This may include considering data control and network effects when assessing market power, as well as taking a more proactive approach to reviewing mergers and acquisitions. Regulators may also need to work closely with technology experts to fully understand the dynamics of digital markets.