Biometric authentication for digital payments is changing how we secure our money moves. No more panic to remember pins or passwords. With just a fingerprint or a glance, you’re in. It sounds simple, yet it’s a powerhouse at keeping bad actors out of your digital wallet. Our dive into biometrics doesn’t skip a beat: we’re checking out what’s hot now, what’s on your phone, and how it keeps your cash safe. Plus, we’re peeking at the future where paying by “you” gets even smarter. Ready to see how your unique self is becoming your best password? Let’s get to it!

Understanding the Biometric Landscape in Digital Payments

Current State of Biometric Authentication Methods

Right now, paying with just a fingerprint or a face scan is real. Biometric authentication in digital payments is growing fast. This tech checks who you are by what you are. For example, it scans your fingerprint or your face before a payment goes through. Because each person is unique, these methods work well to keep payments secure.

We’re seeing more phones and tablets that can read parts of your body like your iris or voice. They use this info to make sure it’s really you when you buy something. This way, only you can use your device to pay. This keeps your money safer than ever before.

Places that take biometric payments are also on the rise. Many stores now have point-of-sale systems that read your biometrics. This makes paying for stuff super easy and secure. Just a quick scan and you’re good to go. No need to pull out cash or cards.

Types of Biometric Identifiers Used in Digital Transactions

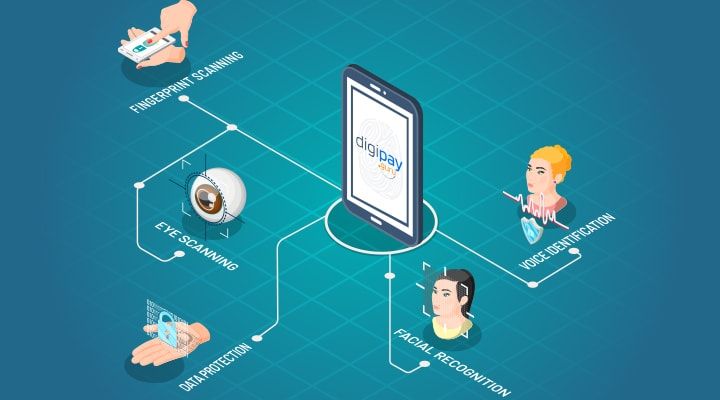

There are many cool ways biometrics can confirm your identity. Fingerprint sensors are common and are found in lots of smartphones. Just place your finger on the phone, and like magic, it knows it’s you. Fingerprint payment technology is super popular because it’s easy to use.

Facial recognition transactions are a hit too. Cameras look at your face to match it with the one they have saved. It’s quick and works without touching anything.

Voice payment systems are getting better. They listen to how you talk to confirm your identity. Now, just saying a phrase can let you pay. No need for cash or cards, your voice is your wallet.

Even your eyes can help you pay. Iris scanning payment is newer but also very secure. It looks at the special patterns in your eyes that nobody else has.

Vein pattern recognition is wild. It uses the unique veins in your palm as your ID. And it’s getting attention as a new and secure way to pay.

With these methods, digital wallet security becomes stronger. No one has the same body details as you, so fraud is much harder. Biometric verification methods are really changing how we use and protect our money.

Every day, more people use touchless payment options. This keeps things fast and germ-free. Your hand or face can pay for your coffee now, no need to swipe or insert a card.

Biometric data protection is key in all this. Companies must keep your info safe, or people won’t trust these systems. We want to pay with our face or finger, but we also want that info to stay safe. This is the heart of secure payment authentication.

Mobile biometric payments are everywhere now, letting you pay from your phone easily. And they’re growing because people enjoy how quick and hassle-free they are. We’re looking forward to more ways to pay that are just as simple and safe. Biometric payment processing is here to stay, and it’s getting even better every day.

The Integration of Biometrics in Mobile Payment Platforms

Advancements in Mobile Biometric Payment Systems

Mobile phones are getting smarter. They now keep your money safe using your body’s unique traits. This magic is called biometric payment technology. It quickly confirms it’s really you paying. You’ve seen it in action when you unlock your phone with a glance or a touch. Now, this tech is changing how we buy things.

No need to type passwords or sign names. Just use your fingerprint, face, voice, or even an eye scan to pay up. It’s fast, easy, and super secure. Fingerprint payment technology is the most common right now. You touch your phone and – zap – payment done! But there’s more coming.

Facial recognition steps in when hands are full. You look at your phone, it winks back and the payment goes through. Fancy, right? Voice payment systems are also on the rise. You just say a magic word and your payment is sorted. Talk about convenience!

Ensuring User Identity Verification Through Mobile Devices

When you use your phone to pay, it checks to make sure it’s you. This is user identification technology at work. It protects your money by checking your unique biometric features. Think of it as a superhero guarding your wallet in your phone. It’s quick and keeps the bad guys out.

Companies are all about making sure biometric payment security is top-notch. This means they work hard to keep your details safe – like your fingerprint or your smile. No more worries about someone pretending to be you and spending your cash. Biometric verification methods are on guard.

Imagine going to the store and just grabbing what you need. At checkout, no cards, no cash hassle. You use a biometric-enabled POS system. Maybe you place your finger on a scanner or the camera checks your face. And then, you’re done. It’s like living in the future!

What’s really exciting is seeing all this get better every year. We’re talking about digital wallet security getting stronger and payment stuff happening in a blink. It’s about trust. Trust that your phone knows you, protects you, and makes buying stuff fun.

Mobile biometric payments are not just cool. They’re important for keeping your hard-earned money safe, now and in the future. And this is just the beginning. As we go, things will get even safer, smarter, and snappier. I can’t wait to see where this goes. And I bet you can’t either.

Security Measures and Data Protection in Biometric Payment Systems

Safeguarding Biometric Data During Transactions

Keeping your info safe is top-notch when you pay with a tap or your face. Picture this: you get a cup of joe. You pay with a fingerprint. Easy, right? But hey, where does your print go? Right into a secure spot. Firms work hard to protect this data. They don’t play around with this. It’s like they put your fingerprint in a vault no one else can open. Not even them!

Now, let’s dive into how this magic happens. We’ve got these neat tools called fingerprint payment technology. You bet they are smart. They take your print and turn it into code. It’s like speaking in riddles. Hard to crack! This code goes through a secure channel to get checked. All clear? You’ve paid! And your print? It stays a secret.

Here’s another cool part. We’re not just talking thumbs. We’ve got voice payment systems and even face scans. All of them, super secure. Take your voice, for example. It’s like your music. Unique! You say, “Pay” and boom, it’s done. It checks if the song is truly yours and bingo, no wallet needed.

But wait! It’s not just about keeping things under lock and key. We also need to make sure everything is playing fair. That’s where biometric payment security comes in. They set the rules. Make sure no funny business happens. They look out for you.

Regulatory and Ethical Considerations for Biometric Use

Now, let’s talk rules. With great power comes great… you know the rest. Using parts of you – your face, finger, voice – to pay is mighty powerful. So, we got laws to keep things straight. These laws watch over your precious data. They say “Here’s what’s cool and what’s not.”

And let’s chat about the right thing to do. Ethics, my friend, is big here. Let’s say you’re cool to use your grin to buy a toy. That’s one thing. But, what if someone else decides to peek at your smile and use it to sell you stuff? Not so cool, right? That’s where ethics come in. They make sure no one steps over the line. Keep your smile to yourself, they say.

Oh, and we can’t forget about your say in it all. It’s all about choice. You pick how you want to pay. Finger, face, voice? You call the shots.

In short, biometric payment systems are like superheroes of payment. They make it fast, easy, safe, AND fair. From mobile biometric payments to biometric-enabled POS systems, they got it all. And they’re getting better every day. Plus, they stick to the rules and keep your data yours.

That’s the scoop on keeping your biometric data snug as a bug and doing it by the book. Super safe and super fair!

Future Outlook and Consumer Adoption of Biometric Payments

Emerging Biometric Technologies in Financial Transactions

When we pay, we want it fast, safe, and easy. Biometric technology is stepping up to help. Today, we press our fingers on a screen or show our face to a camera. But there’s more coming. Soon, we might just wave our hand or speak to pay.

Fingerprint payment technology is everywhere now. It’s easy to use. Just touch a sensor and you’ve paid. No need to pull out cash or a card. It’s quick and secure. No one else has your unique print. This makes fingerprint sensor transactions a top choice for many.

Facial recognition transactions are also growing. You may have seen this at stores or on your phone. Just look at a screen, and software checks your face to confirm it’s really you. It’s like a selfie that keeps your money safe.

But there’s even more coming our way. Things like voice payment systems and iris scanning payment tech are in the works. Banks and stores are also looking at vein pattern recognition. It sounds like science fiction, but it’s real, and it’s happening.

For example, imagine speaking your order at a drive-thru. A voiceprint payment authentication system checks it’s you. It then pays for your meal without you lifting a finger. It’s that easy.

And it’s not just about paying. It’s about the whole experience. Simple, smooth, and fast. That’s what users want. Biometric checkout experiences are going to make that happen. They will change how we think about buying things.

User Experience and Future Trends in Biometric Payment Solutions

People like stuff that’s easy to use. They also want to feel secure. That’s where biometrics shine. They offer both comfort and confidence in payment security. More shops and banks now use biometrics. This helps stop fraud and speeds things up at checkout.

One thing that’s getting attention is the digital wallet security. Digital wallets live in our phones. They hold our money just like a regular wallet. Biometrics keep them locked tight. Only your face or your fingerprint can open them up.

Contactless payment systems are becoming a must-have. No one wants to touch keypads anymore. So, we tap our phones or cards instead. But biometrics could make it even smoother. Imagine walking up, getting recognized, and just walking away. Paid.

Mobile biometric payments are also changing the way we bank. With your phone, you can check your balance or send money using your face or finger. Secure payment authentication means you can trust it’s safe.

Let’s talk about the data. Biometric data protection is super important. Banks and shops must keep your facial scan or fingerprint safe. If they don’t, that’s bad for everyone. But the good news is that they’re working on it. They’re making even safer ways to keep this info locked down.

User identification technology is only growing smarter. And with that, we can look forward to more secure, quick, and cool ways to pay. Say goodbye to swiping cards. A nod or a word might be all you need soon. Biometric payment processing isn’t just the future. It’s now, and it’s getting better every day.

In this post, we dove into the growing world of biometric payments. We began by exploring the current tech that makes your unique traits key to buying stuff with ease. Then, we looked at how smartphones are getting smarter with biometrics, making it super simple and secure to pay on the go. We didn’t stop there; we dug into how keeping your biometric info safe is top priority in today’s digital marketplace. And to wrap up, we peeked at exciting new tech that could change how we buy things in the future, making it all about you and your unique identity.

My final thought? It’s clear biometrics are here to stay in our shopping lives. They make buying fast, easy, and super secure. As these cool features get even better, we’ll wonder how we ever lived without them. Stay safe and get ready for a smoother, more personal buying journey!

Q&A :

What is biometric authentication in digital payments?

Biometric authentication for digital payments refers to using unique biological characteristics, such as fingerprints, facial recognition, voice patterns, and iris scans, to verify a user’s identity before proceeding with a financial transaction. This method enhances security by ensuring that only the authorized user can make the payment, reducing the risk of fraud.

How does biometric authentication improve security for online transactions?

By leveraging biometric data, which is nearly impossible to replicate or steal without the user’s presence, biometric authentication adds an extra layer of security to online transactions. It eliminates the risks associated with traditional authentication methods like passwords or PINs, which can be guessed, stolen, or phished, thereby significantly minimizing the chance of unauthorized access to financial accounts.

Are there any downsides to using biometric authentication for digital payments?

While biometric authentication provides robust security and convenience, there are downsides to consider. These can include concerns about privacy, as biometric data is highly personal; the potential for false negatives or positives in identification; and the need for specialized hardware that may not be accessible to all users. Additionally, in the event of a data breach, biometric information cannot be changed like a password or credit card number.

Can biometric authentication completely replace passwords in digital payments?

Biometric authentication has the potential to replace passwords in many digital payment scenarios, offering a more secure and convenient user experience. However, the complete replacement of passwords may not be practical for all users and situations. Multi-factor authentication, which combines biometrics with passwords or other verification methods, is often recommended to achieve an optimal balance between security and accessibility.

How do I set up biometric authentication for my digital payment apps?

Setting up biometric authentication for digital payment apps usually involves accessing the security settings within the app and enabling the biometric authentication feature. Users may be required to register their biometric data, such as a fingerprint or facial scan, which is then used for future authentication. The exact steps may vary depending on the app and the device’s capabilities. It is advised to follow the specific instructions provided by the payment app and ensure that your device’s operating system is up to date to support the functionality.