On the night of Tuesday, December 3, 2024, South Korea witnessed its first declaration of martial law in 44 years, which sent shockwaves through the financial markets, particularly in the cryptocurrency sector. The controversial decision by President Yoon Suk Yeol caused a dramatic drop in Bitcoin (BTC) and other cryptocurrencies, triggering a wave of panic selling on major exchanges in South Korea. This article will analyze in detail the event of martial law and its impact on the cryptocurrency market, especially concerning Bitcoin, XRP, and investors in the industry.

Introduction to martial law in South Korea

On December 3, 2024, South Korea experienced a pivotal moment when President Yoon Suk Yeol declared martial law for the first time in 44 years. This marked a significant turning point in the country’s political history, causing strong reactions throughout society and the economy. Under martial law, military authorities replace civilian governance for a specified period, granting the military special powers while restricting citizens’ freedoms.

This event unfolded amid increasing internal political tensions. President Yoon accused domestic factions of collaborating with North Korea and anti-government organizations, leading to the imposition of martial law to safeguard democratic order and national stability. The decision not only caused widespread panic among the public but also had a profound impact on the economy, especially on the financial markets.

Martial law in South Korea is not merely the imposition of military control; it involves extraordinary powers, such as suspending civil legal processes, restricting freedom of speech and assembly, and increasing the influence of state agencies and the military in political and social matters. These measures created an atmosphere of instability, causing concerns among investors and financial markets about the potential effects on the economy.

It is important to note that South Korea’s National Assembly holds the authority to request the lifting of martial law, but in this case, most members of the National Assembly disagreed with the president’s decision. Despite this, martial law continued to be enforced for a short period, further intensifying the uncertainty in the financial community.

The impact of martial law on the Cryptocurrency market

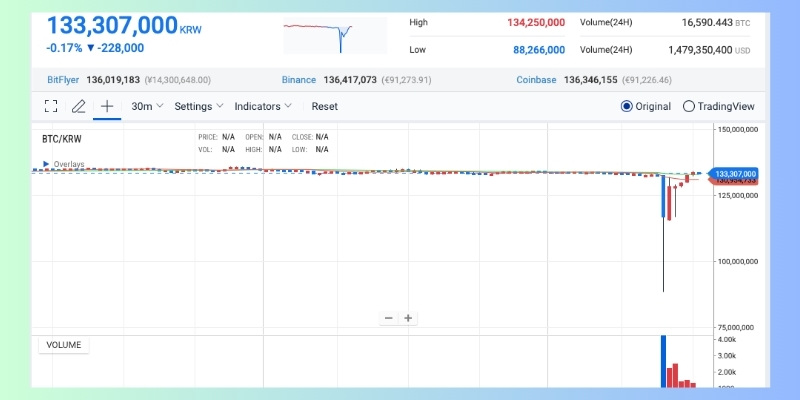

Immediately following the announcement of martial law, South Korea’s cryptocurrency market reacted strongly. Bitcoin, the largest cryptocurrency by market capitalization, experienced a severe decline. On Upbit, South Korea’s largest cryptocurrency exchange, the price of Bitcoin dropped significantly from 132 million KRW (approximately $92,000 USD) to a low of 88.26 million KRW (about $62,000 USD). A decrease of over 30% in less than a day led to widespread panic selling, causing a sharp drop in the value of Bitcoin and other cryptocurrencies.

XRP, a popular cryptocurrency, was also affected by this event. Its price plummeted by 60%, from 4,000 KRW to 1,623 KRW (about $1.23 USD). This decline clearly reflected the instability in South Korea’s financial markets, leading cryptocurrency investors to worry not only about price volatility but also about the influence of political decisions on the business environment.

A notable factor in this situation is the “Kimchi Premium.” Typically, cryptocurrency prices in South Korea are higher than on international exchanges due to liquidity issues and strong local demand. However, in this case, the Kimchi Premium became a negative factor when South Korean exchanges experienced traffic overloads and could not sync cryptocurrency prices with global markets. As a result, the value of Bitcoin and other cryptocurrencies dropped sharply, both domestically and on international exchanges.

Psychological factors also played a crucial role in the market volatility. The imposition of martial law in a major country like South Korea naturally created panic among investors. Concerns about political instability and government interference in financial activities caused a capital outflow, particularly from cryptocurrencies, which are highly sensitive to political and economic factors.

Assessing market recovery after martial law

Despite the sharp decline in value, the cryptocurrency market began to recover soon after martial law was lifted. Within just three hours of the South Korean National Assembly voting to repeal martial law, Bitcoin’s value rebounded significantly. On Upbit, the price of Bitcoin recovered to 133.2 million KRW, nearly reaching its pre-decline levels.

This recovery indicates that, despite the sharp fluctuations, the cryptocurrency market in South Korea maintained its stability once negative factors were cleared. Investors quickly returned to the market, with some even viewing the drop as an opportunity to buy at lower prices. The return of investors to Bitcoin and other cryptocurrencies spurred a strong upward movement within a short period.

A key factor in this recovery was the political stability restored after the martial law was repealed. With the removal of military control and the restoration of civil liberties, investor sentiment improved. This also demonstrated a shift in how investors are dealing with political factors in the financial environment. The cryptocurrency market proved that it can rebound quickly when political stability is restored and major concerns are alleviated.

Furthermore, the recovery was driven by macroeconomic factors from the global market. International exchanges such as Binance, ByBit, and OKX saw a rebound in Bitcoin and XRP prices, providing positive momentum for the global market. This shows that, although the martial law event in South Korea significantly impacted the market, the global cryptocurrency market remained stable due to increasing international investor interest.

The imposition of martial law in South Korea is a clear example of how political events can strongly affect financial markets, particularly the cryptocurrency sector. While it caused a significant drop in the value of Bitcoin and other cryptocurrencies, the quick recovery demonstrated that the cryptocurrency market can maintain its stability once external factors are clarified and concerns are addressed.

For investors, the key takeaway is the importance of closely monitoring political events and their effects on the economy and financial markets. Maintaining an investment mindset and being ready to adjust strategies is crucial in a volatile environment like today’s. As political factors stabilize, the cryptocurrency market will have the opportunity to recover and continue its growth in the future.

Stay updated with Forex Market Solutions for the latest news from the market.